We have just seen the release of US CPI and markets went a little wild, with the dollar initially rallying then selling off somewhat. Not that I was expecting great volatility. Indeed, with the Fed’s focus turning more to employment than inflation, traders are also not paying much attention to CPI data these days. CPI had to be significantly weak or significantly strong for it to have moved the markets meaningfully. Indeed, it looks like they have reacted more to news that US initial jobless claims surged to a 13-month high last week. This shouldn’t materially turn the EUR/USD forecast bullish yet. Indeed, the euro faces several risks of its own, from a weak Eurozone economy, to rising oil prices to increased stagflation concerns, to mention but a few.

US CPI was a little high but does matter?

The headline September CPI print of +2.4% y/y was a little above expectation of +2.3% y/y, although still down from +2.5% the month before. The core CPI was also stronger at 3.3% vs. 3.2% expected and last. On a month over month basis, CPI rose 0.2% and core CPI 0.3%, beating estimates of 0.1% and 0.2% respectively. Traders should be expecting some volatility in the month-on-month data, but if a new trend emerges showing a renewed uptrend in prices then that could worry the Fed and support dollar more meaningfully. This puts the focus on oil prices and the middle east with reports of an imminent Israeli attack on Iran’s oil facilities doing the rounds. But oil prices will need to stay elevated for inflation to make a comeback. So, a lot will depend on what happens between Iran and Israel now and whether a ceasefire will eventually merge, or get into a protracted war, which will be in no one’s interests. Still, the inflation data and Middle East tensions underscore the Fed’s view of raising rates only slowly from here on.

Jobless claims surge to send US dollar lower

Part of the reason why the dollar didn’t show a significantly positive response was that traders are not too focused on inflation data anymore. Indeed, it looks like they have reacted more to news that US initial jobless claims surged to a 13-month high last week.

Jobless claims came in way higher than expected at 258K, compared to the estimate of 230K. That’s a noticeable jump from the prior week’s 225K, marking the highest since August 2023 and the biggest week-on-week jump since July 2021. Unsurprisingly, the four-week moving average also ticked up to 231K, slightly higher than the 224.25K forecast. On the continuing claims side, they also rose, hitting 1.861M versus the estimate of 1.830M, with last week's figure being revised down to 1.819M.

These rising claims suggest some softening in the labour market, though after a blowout nonfarm payrolls report last week, not many people are too sure about a softening labour market. Confusion is the name of the game, and more data is needed for many investors to form strong opinions about the direction of US jobs market and thus interest rates.

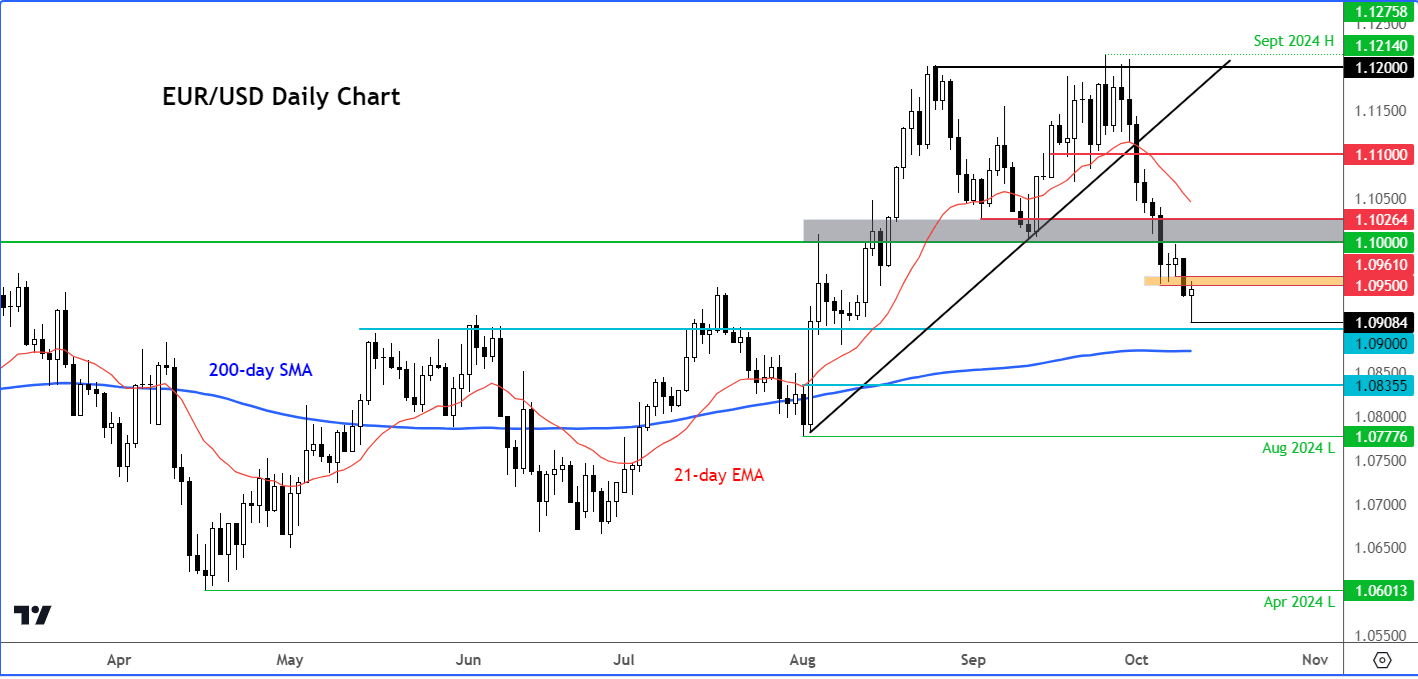

EUR/USD forecast: technical levels and factors to watch

Source: TradingView.com

The EUR/USD has turned positive, but it is now testing the former support area around 1.0950 to 1.0960, which could turn into resistance. If it doesn’t then we could see a revisit of a stronger resistance around 1.10 area.

Should the selling resume, a run down to take out liquidity that is resting below today’s low of 1.0908 could be on the cards. Below 1.0900 handle, the next downside target is at 1.0875 where the 200-day average comes into play.

All told, the EUR/USD forecast remains bearish despite recovering in the aftermath of today’s US data releases.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R