Already under pressure from weakness in Eurozone data, weakness in China and ongoing dollar strength, the EUR/USD took another tumble just before mid-day in London. The single currency’s additional weakness came on the back of a CNN report citing sources that Donald Trump is considering a national economic emergency declaration to allow for new tariff program. The dollar is going to remain in sharp focus with key data including non-farm payrolls to come this week. Ahead of the NFP report, the EUR/USD forecast remains bearish.

Signs of weakness persist for Eurozone and China

The EUR/USD is being pressured from all sides: weakness in Eurozone and China economies are continuing to weigh on the euro, while the dollar finds support from rising US bond yields and strength in data. More on the latter below but concentrating on the euro-side of the equation, today we saw German factory orders suffered their steepest decline in three months, while French consumer confidence unexpectedly dropped.

German factory orders fell 5.4% month-on-month compared to -0.3% expected, while retail sales slipped 0.6% m/m when a 0.5% increase was expected.

Adding to the euro’s woes, China’s bleak economic outlook has sparked a surge in demand for Chinese bonds, causing their yields and yuan to drop. A weaker yuan reduces the buying power of the world’s second largest economy. This is not great given that China is a large exports destination for Eurozone goods, especially in the luxury sector.

Indeed, traders are increasingly turning pessimistic on China, driving yields to record lows amid fears of a deflationary spiral in the world’s second-largest economy. The 10-year Chinese bonds now yield an unprecedented 3 percentage points less than comparable US Treasury bonds. At these levels, they are significantly below those seen during the pandemic and the 2008 global financial crisis.

Tariff headlines udnermine EUR/USD forecast

The latest news about tariffs, and support for the dollar, comes after the greenback sold off on Monday, driven by reports suggesting that Trump’s aides may be contemplating a more lenient approach to tariffs. However, while Trump did say that he predicts he’ll get along with China’s Xi, he quickly issued a denial regarding a softer stance on tariffs. Given his tough rhetoric so far, it’s hard to envision him adopting a more conciliatory tone when he takes office later this month. With tariffs becoming the buzz word again, the dollar is going to remain more headline-driven, making active risk management even more important for traders.

US data maintains strength

As Europe struggles, the US economy continues to outperform. Both the ISM Services PMI and JOLTS job openings exceeded expectations yesterday, underscoring robust economic momentum at the world’s largest economy. JOLT job openings rose to 8.098 million in November compared to 7.730m expected and 7.839m in the previous month. This was the highest job openings since June 2024, pointing to continued strength in the labour market. What’s more, the dominant services sector saw growth expand at a faster pace as the ISM Services PMI climbed to 54.1 vs. 53.5 expected, up from 52.1 last month.

Today’s ADP payrolls data is unlikely to cause a major shift in the market, so the focus will remain on rising yields and tariff talks, before the focus turns to the official jobs report on Friday. Yesterday’s 10-year Treasury auction yielded its highest rate since 2007, with investors now eyeing 5% yields as a benchmark. Meanwhile, swap traders have pushed their expectations for a first Federal Reserve rate cut this year to July from June. We will need to see a major turnaround in data to bring those expectations forward again.

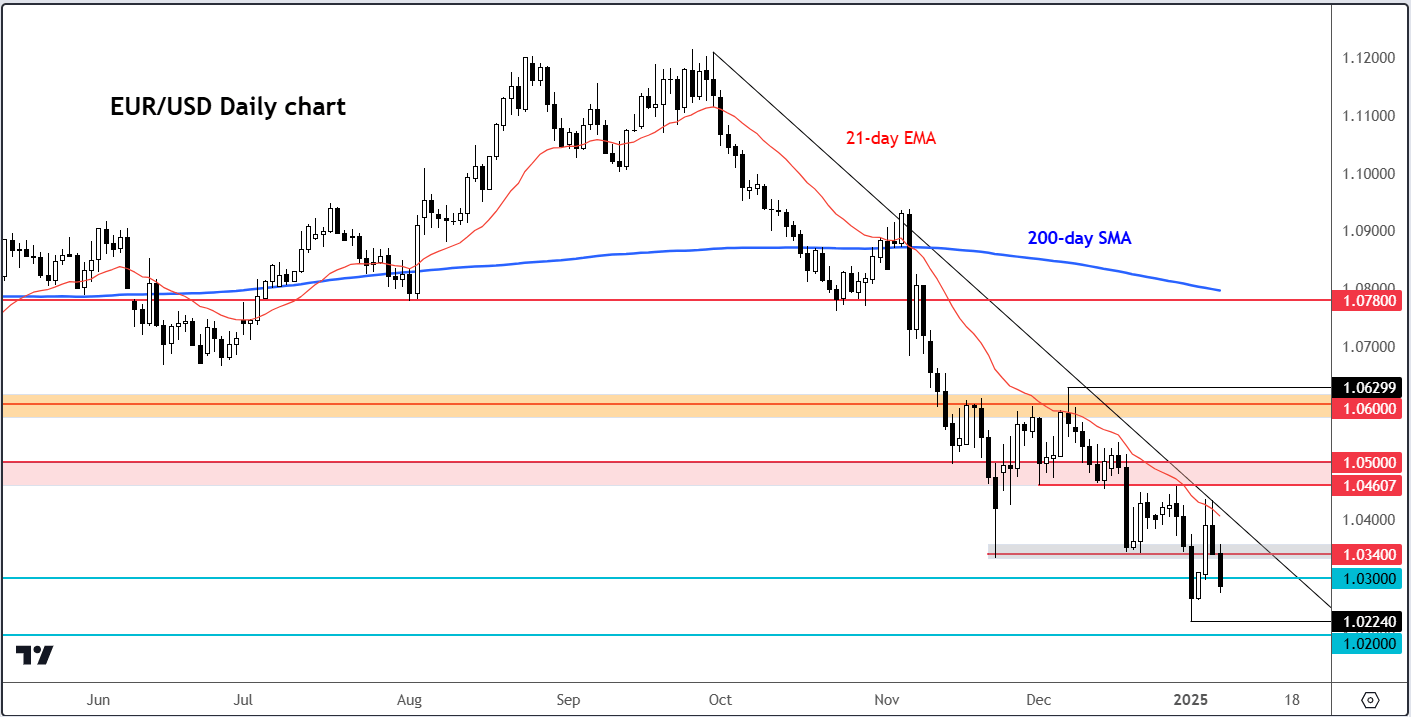

EUR/USD technical analysis

Source: TradingView.com

The EUR/USD remains rooted in a bearish trend, as characterised by a downward-sloping trend line connecting the recent highs, as well as both the 21- and 200-day moving averages pointing lower and being above market. Key support levels continue to break down. Unless resistance in the 1.0460-1.0500 range is reclaimed, the path of least resistance remains to the downside. The next bearish targets are liquidity below last week’s low at 1.0224, followed by the 1.0200 handle and then the next round handle at 1.0100.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R