Asian Indices:

- Australia's ASX 200 index rose by 41.7 points (0.61%) and currently trades at 6,931.90

- Japan's Nikkei 225 index has risen by 499.28 points (1.64%) and currently trades at 31,026.16

- Hong Kong's Hang Seng index has risen by 130.35 points (0.76%) and currently trades at 17,326.19

- China's A50 Index has fallen by -72.69 points (-0.58%) and currently trades at 12,398.05

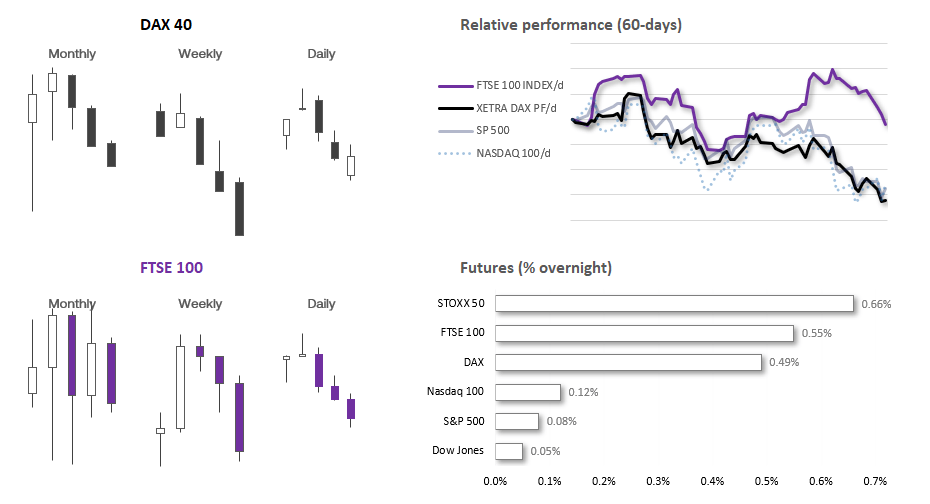

UK and Europe:

- UK's FTSE 100 futures are currently up 38.5 points (0.52%), the cash market is currently estimated to open at 7,450.95

- Euro STOXX 50 futures are currently up 26 points (0.63%), the cash market is currently estimated to open at 4,125.85

- Germany's DAX futures are currently up 78 points (0.51%), the cash market is currently estimated to open at 15,177.92

US Futures:

- DJI futures are currently up 13 points (0.04%)

- S&P 500 futures are currently up 2.25 points (0.05%)

- Nasdaq 100 futures are currently up 11.25 points (0.08%)

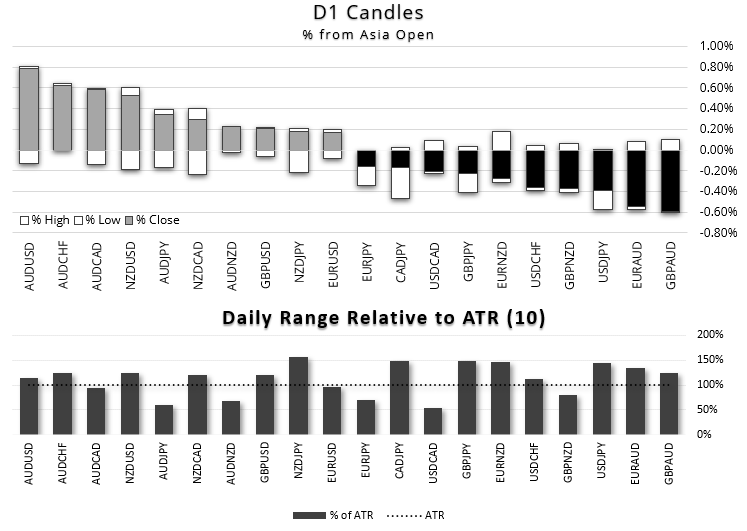

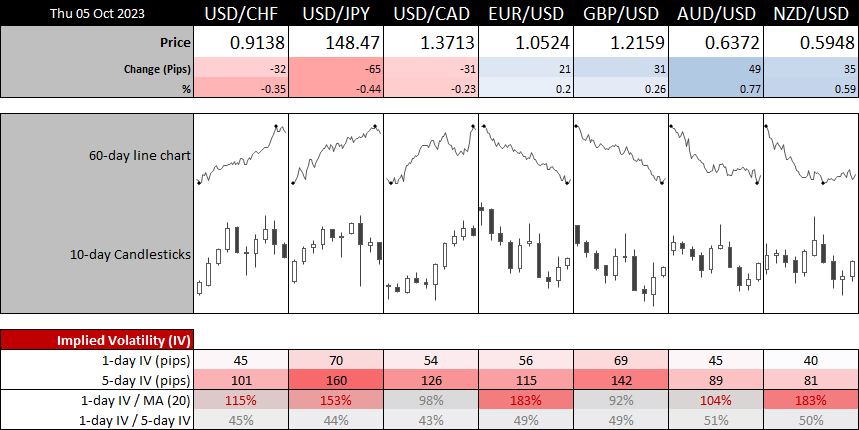

We saw some movement in yen pairs which prompted some to question whether the BOJ had once again intervened. If they had it was slightly underwhelming by historical standards, although worth noting the USD/JPY’s daily range was around 120% of its 10-day average in just a couple of hours. I suspect it’s more likely large funds are changing their risk tolerance given the negative sentiment around bond markets and upcoming data such as Friday’s NFP and next week’s US inflation report.

The Australian dollar was the strongest FX major during Thursday’s Asian session due to a combination of strong trade data and a slight bounce on risk markets the day prior. Australian exports rose 4% y/y and imports were flat at 0%, helping the trade surplus to rise to a 2-month high. AUD/USD rose around 0.8%, gold and oil tracked Asian indices slightly higher from their cycle lows.

Events in focus (GMT+1):

- 07:00 – German trade balance

- 08:30 – German S&P Global construction PMI

- 09:30 – UK construction PMI

- 10:45 – ECB Lane speaks

- 12:30 - US Challenger Job cuts

- 13:30 – US jobless claims, trade balance

- 13:30 – Canada trade balance

- 15:00 – Canada IVEY PMI

- 16:30 – FOMC Member Barkin Speaks

- 17:00 – FOMC Member Daly speaks

- 17:15 – Fed Vice Chair for Supervision Barr Speaks

US employment data remains key for sentiment, so it’s good to see jobless claims and job cuts fresh scheduled today, fresh on the back of yesterday’s weak ADP employment print. If we see the cracks widen with rising claims and job cuts, then it sets the stage for a weak nonfarm payroll report tomorrow. And whilst that would clearly be bad news for the economy, it could further stimmy the bond rout to send prices higher and yields lower. And provide another leg higher for risk assets today.

Take note that the 1-day implied volatility level for EUR/USD is 183% of its 20-day EMA, and that makes sense due to the importance of today’s employment figures, speeches from the Fed and ECB and data from Europe.

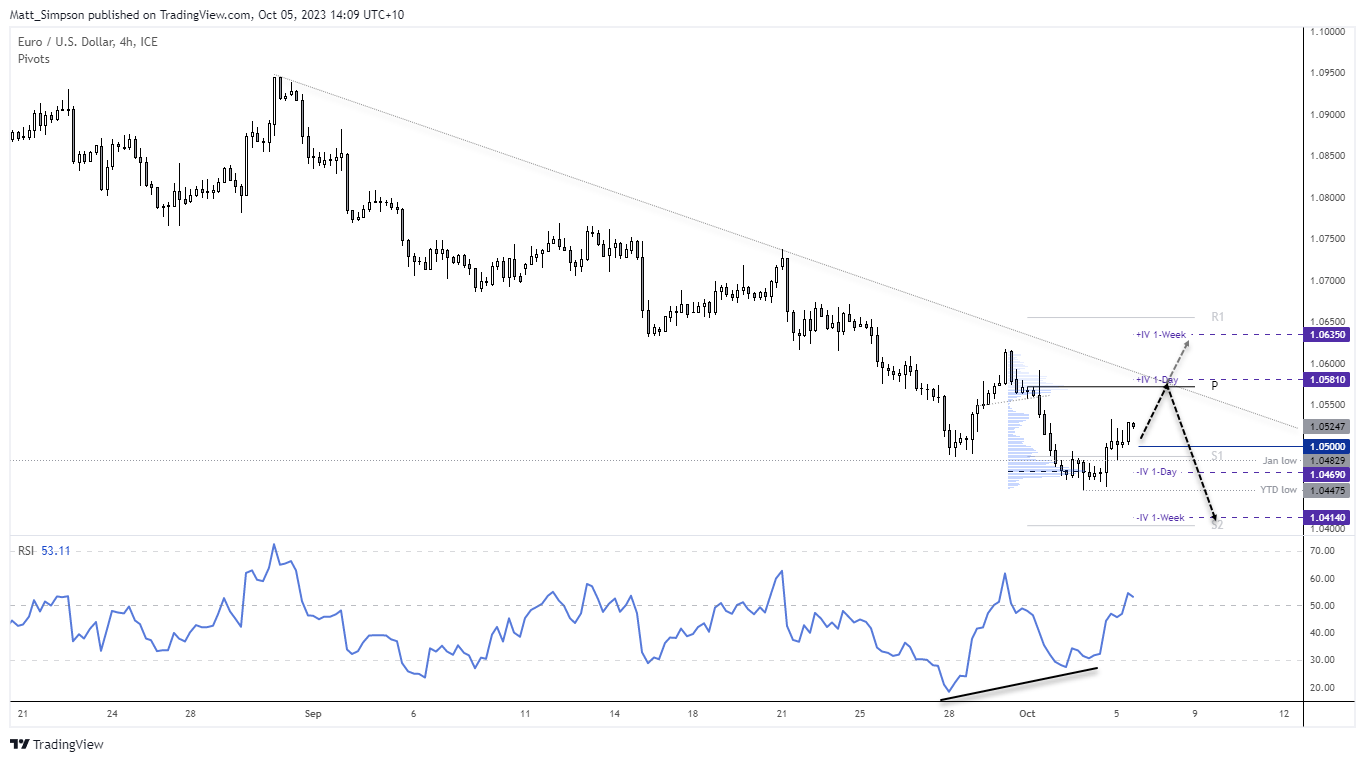

EUR/USD technical analysis (1-hour chart):

The weaker US dollar helped EUR/USD move higher in line with the near-term bias on Wednesday, although its pullback as higher than expected. And given bullish divergence on RSI (14) and the clues on the bond market that yields may pull back at least a little further, I suspect the euro may have some more upside potential up its sleeve.

From here I like dips towards the 1.0500 / Jan ow area, and for a move to the weekly pivot point / +IV 1-day level. At which point I’d reassess its potential to extend higher or form a swing high and revert to its established bearish trend.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge