Appetite for risk was jolted on Tuesday on reports Iran had fired over 100 ballistic missiles at Israel. This ups the ante on a war in the Middle East, which so far has mostly been fought via proxies.

US data was skewed to the downside on Tuesday, with ISM manufacturing and GDP now coming in softer than expected yet job openings surged at their fastest pace in a year. At 43.9, ISM manufacturing employment contracted at its second fastest pace since the pandemic, although new orders contracted at a slightly slower pace. The headline ISM was also lower than expected at 47.2 compared with 47.6 forecast.

- Crude oil prices spiked as much as 8.5% on the day before WTI settled the day 3.5% higher, closing above $70 for the first day in five.

- Wall Street indices were all lower with Nasdaq leading losses at -1.4% and the S&P 500 off by -0.9%.

- Safe-havens took inflow which saw gold erase Monday’s losses, although stopped shy of retesting the 2700 handle

- US bond yields were lower across the curve as investors sought the safety of bonds (bond prices move inversely to yields)

- AUD/JPY reached yesterday’s lower downside target of 98.50 after resistance was met around the 100 handle.

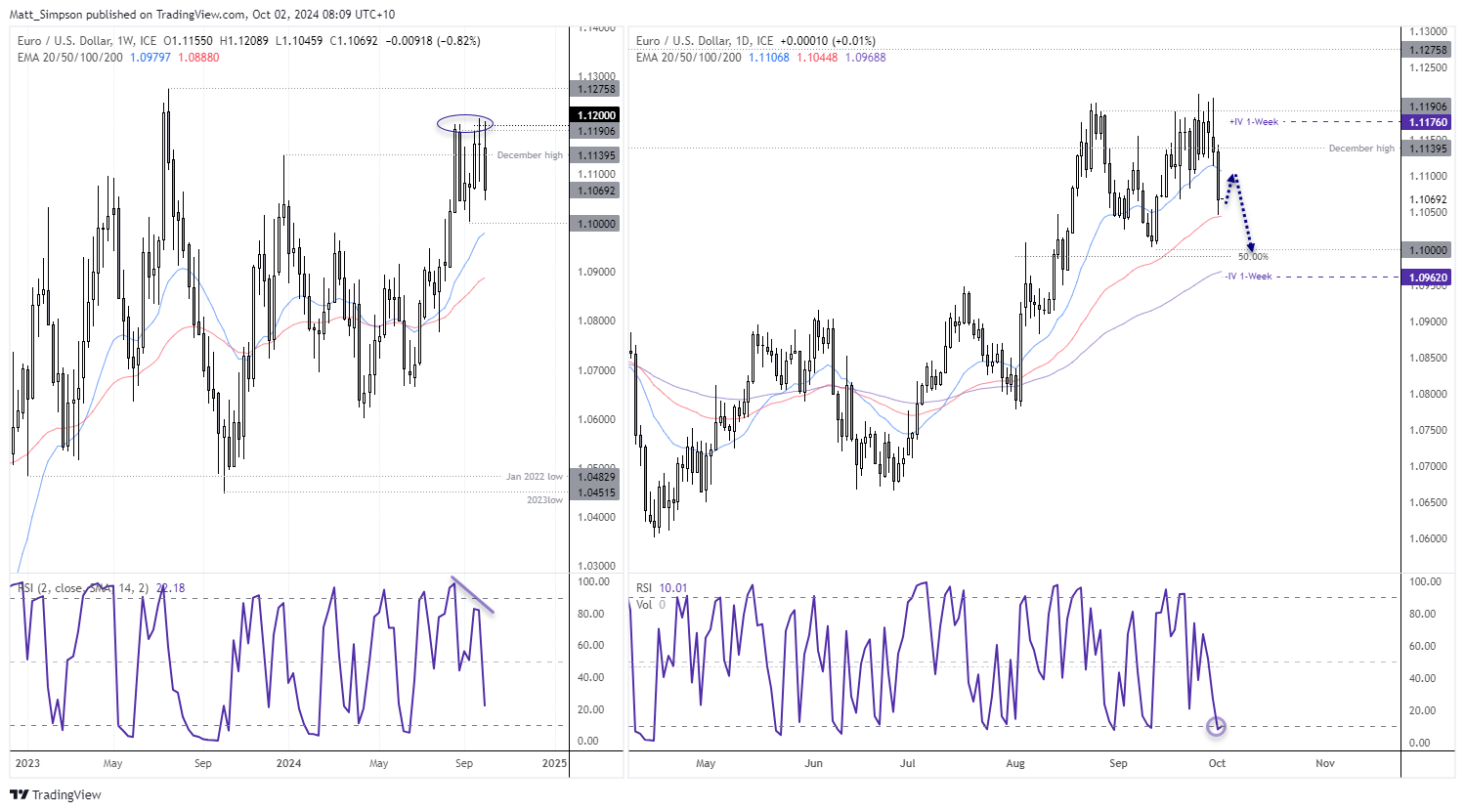

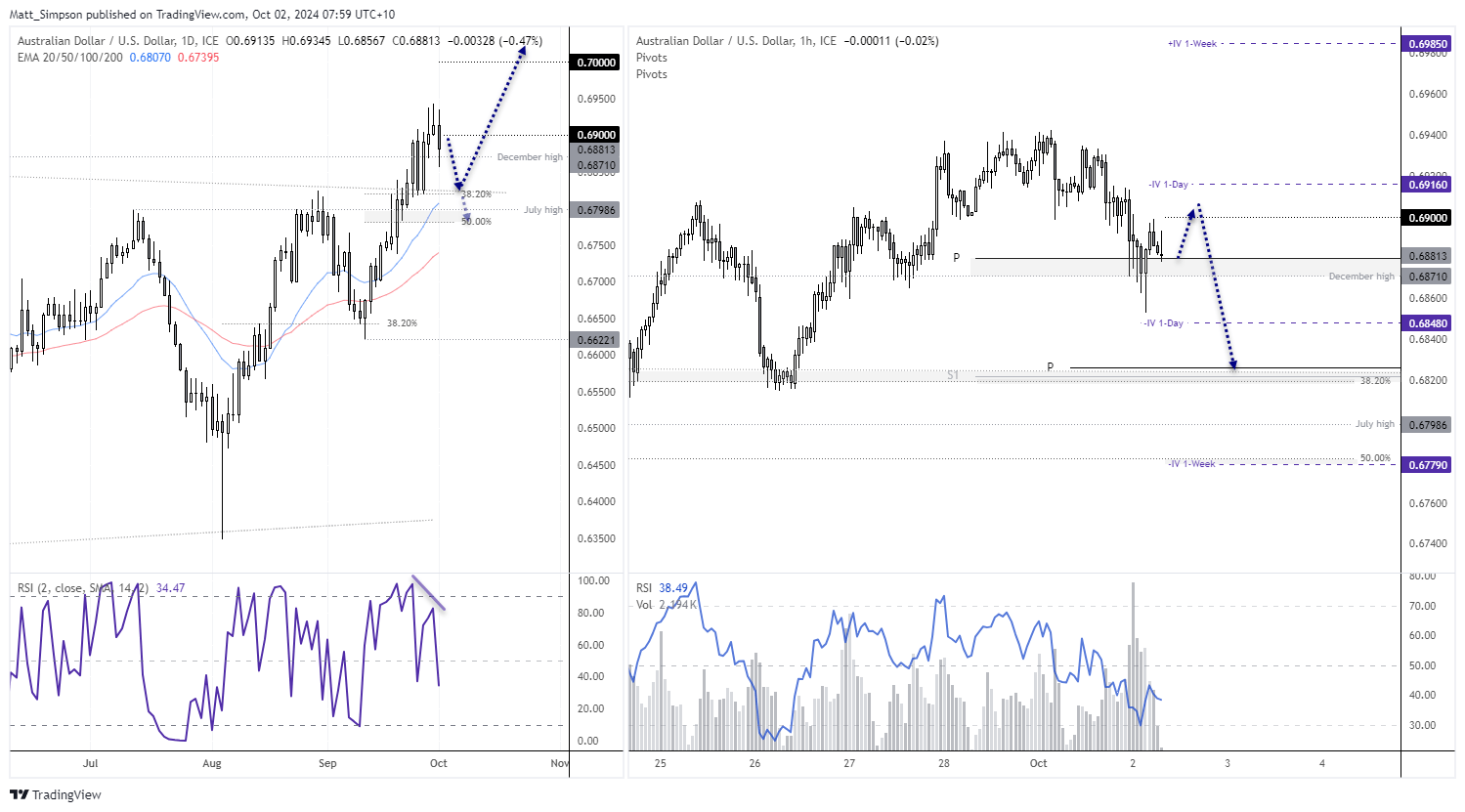

- EUR/USD closed below 1.11 at a 13-day low, NZD/USD was the weakest FX major and AUD/USD also mean reverted lower after two small shooting star days around 69c

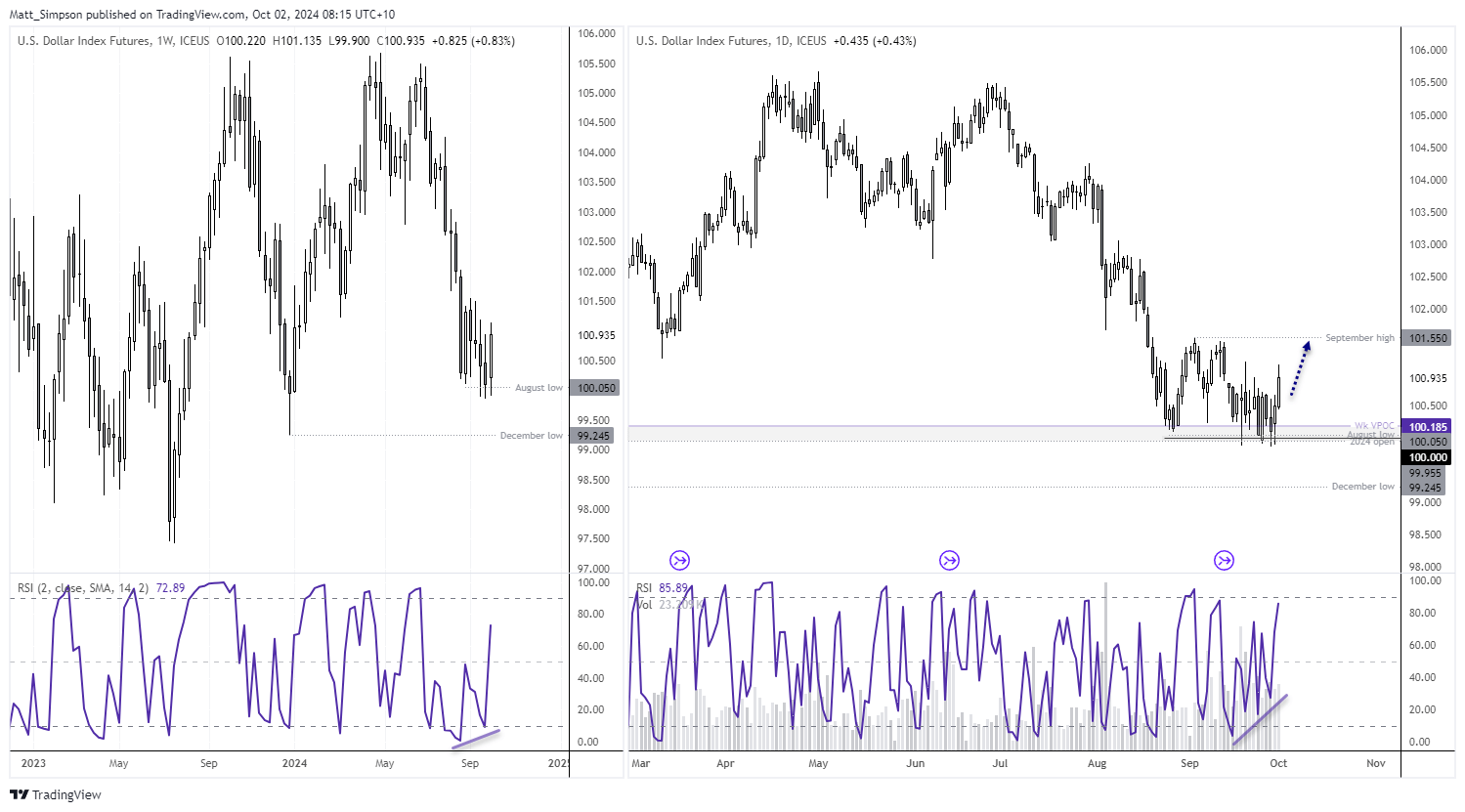

- The USD index rallied for a second day as the bounce I’ve been calling for a couple of weeks finally kicked into action. If US data improves this week then it could at least retest the September high.

Events in focus (AEDT):

- 09:00 – AU construction manufacturing index (AIG)

- 10:00 – SG manufacturing PMI

- 17:30 – ECBs De Guindos speaks

- 19:00 – Unemployment

- 19:30 – ECB’s Lane speaks

- 20:00 – OPEC meeting

- 22:15 – US ADP Nonfarm Payroll

- 23:00 – SNB quarterly bulletin

EUR/USD technical analysis:

At long last, we’re finally seeing EUR/USD mean revert lower after several weeks of failure to hold above 1.12. A bearish inside week formed five weeks ago around current levels, and price action on the daily chart has been very choppy while repeatedly struggling around 1.12. Bearish momentum saw prices accelerate away from 1.12 to the downside on Tuesday, and it looks like EUR/USD now wants to head for the range lows around 1.10, making EUR/USD a ‘fade the rally’ pair to my eyes.

AUD/USD technical analysis:

So far, so good. We have seen the anticipated false break of 69c marked with a second shooting star candle, and risk-off trade saw prices tumble back below 69c. The daily trend remains bullish above the 0.6622 low, so even a pullback to the July high (0.6798), near the 20-day EMA, keeps the trend well intact. I anticipate AUD/USD could head for 70c once the retracement completes and Q4 develops.

The low wicks on the 1-hour chart show demand around the daily lows, and with prices holding above the monthly pivot point perhaps we’ll see a minor bounce in today’s APAC session. However, I also suspect we could see an eventual move towards the support cluster around 0.6820 which includes the weekly pivot point, monthly S1 pivot and 38.2% Fibonacci level.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge