- EUR/USD analysis: Eurozone PMIs mixed as focus turns to US data

- Dollar weakness not fundamentally justified

- EUR/USD technical analysis: 1.0890-1.0900 is key resistance

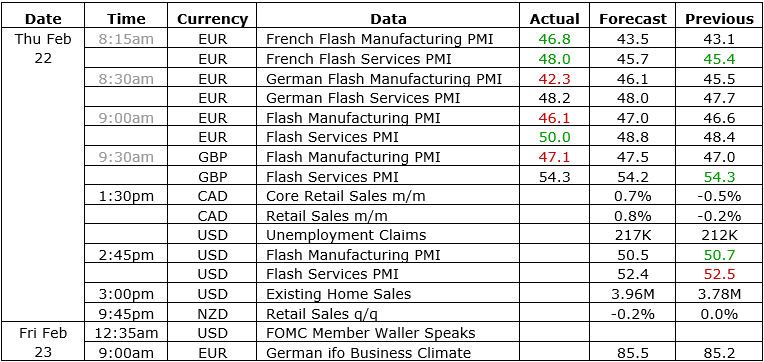

The EUR/USD rose along with most other FX majors in early European session on Thursday. They were all boosted by weakness in US dollar, thanks to further improvement in risk appetite. Commodity dollars outperformed overnight as the already-positive risk sentiment took another boost by Nvidia’s forecast-beating earnings and positive outlook that sent Nasdaq futures near new unchartered territories and lifted Asian markets. The greenback then fell further once European trading got underway, as the German DAX index hit a fresh record high. Consequently, the likes of the EUR/USD turned up the heat, boosted by stronger-than-expected PMI data from France. However, German PMI data that was released a bit later disappointed expectations, as manufacturing activity fell to 42.3 from 45.5, which helped to keep the EUR/USD under the 1.09 handle.

EUR/USD analysis: Eurozone PMIs mixed as focus turns to US data

As mentioned, the EUR/USD gains have largely been driven by weakness in the dollar, with Eurozone data being far from convincing. Today’s PMI data showed a bit of improvement in Eurozone services sector, but manufacturing remains a weak point. So, without a sharp deterioration in incoming US data, it is difficult to be bearish on the dollar and bullish on EUR/USD. Coming up later in the day, we will have US PMIs, jobless claims and existing home sales.

The above data will have to show weakness to justify the recent dollar selling, else a recovery could be on the cards. Still, it pays to choose the correct pair when trading the dollar regardless of whether you are a bull or bear. Those who are bearish the greenback will be better off looking at currencies where the interest rate is relatively high like the NZD or GBP, while the likes of CHF and more so the JPY, the stand-out funding currency with interest rates still in the negative in Japan, are the currencies to short against the dollar. At least that has been the case until now, anyway, with the JPY about 6% lower against the dollar year-to-date. I don’t envisage to see a big turnaround for the yen until the BoJ provides a strong signal that rates are about to come out of negative, or the Fed signals an imminent rate cut. Even those stronger performing currencies like the GBP and NZD will struggle to maintain recent gains without clear evidence that the US economy is headed for a downturn and require looser monetary policy.

EUR/USD analysis: Dollar weakness not fundamentally justified

The greenback has failed to find much further support despite last week’s above-forecast inflation prints, as both CPI and PPI beat expectations. Profit-taking could be a factor, given that the economic calendar has been relatively quieter this week. Those inflation gauges did cause bond yields to rise but FX markets have largely shrugged off the data. However, with the lack of any significant data or news to cause a big dent in the dollar rally this year, it is difficult to see how this week’s dollar weakness will last too long. With US 10-year bonds providing yields around 4.30%, this should keep the greenback support against those where yields are comparatively lower (like JPY), and those where economic data is not showing much strength (like EUR). Therefore, for the dollar to weaken sharply, we will need to see a noticeable deterioration in incoming US data. The release of the FOMC meeting minutes on Wednesday served as a reminder that the Fed is in no rush to cut rates, which was hardly surprising given the hawkish rhetoric we have heard from various officials from the central bank that have spoken lately. Still, the markets continue to price around 90 basis points of Fed easing this year.

EUR/USD technical analysis

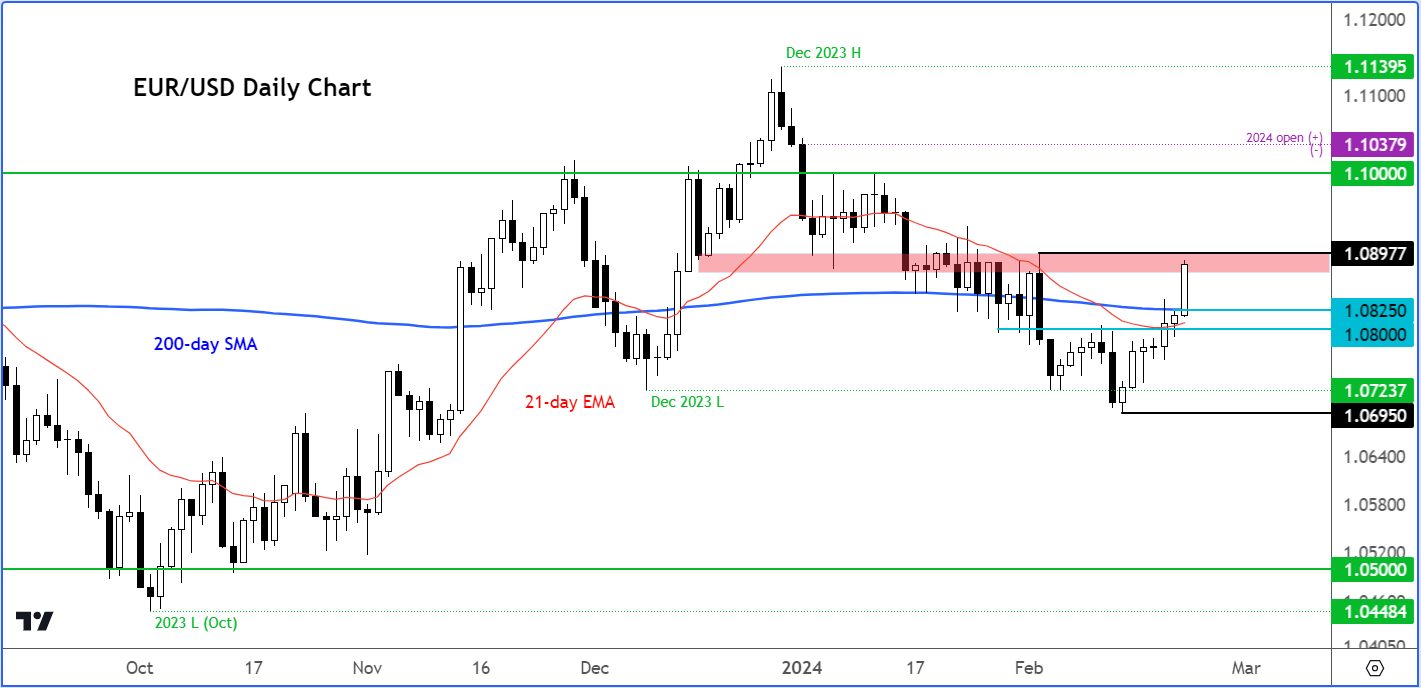

Source: TradingView.com

It is far too early to conclude the EUR/USD has ended its bearish trend, just on the back of a few days of gains and a move above the 200-day average. Yet, the bears will now need to see some confirmation and a lack of conviction from the bullish camp, before potentially looking for fresh trades.

The EUR/USD has reached levels last seen in early February, near 1.0890. The recovery began after the EUR/USD fell to take out liquidity that was resting below the December low at 1.0723. Once that target was hit, it went on to drop a little more, briefly dipping below 1.07 handle, before staging a recovery. From its weakest point, the EUR/USD has now bounced back around 190 pips or 1.8%, which is not that significant. If the EUR/USD bulls want to see higher level, they must now get past key resistance in the 1.0890-1.0900 area.

On the downside, the first area of support now comes in around 1.0800 to 10825. Here, old resistance meets both the 21- and 200-day moving averages. The bears would be looking for a move below this zone, ideally on a daily closing basis, to provide a fresh bearish signal on the EUR/USD. Should that happen, then liquidity below this month’s low at 1.0695 could be the next downside objective.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R