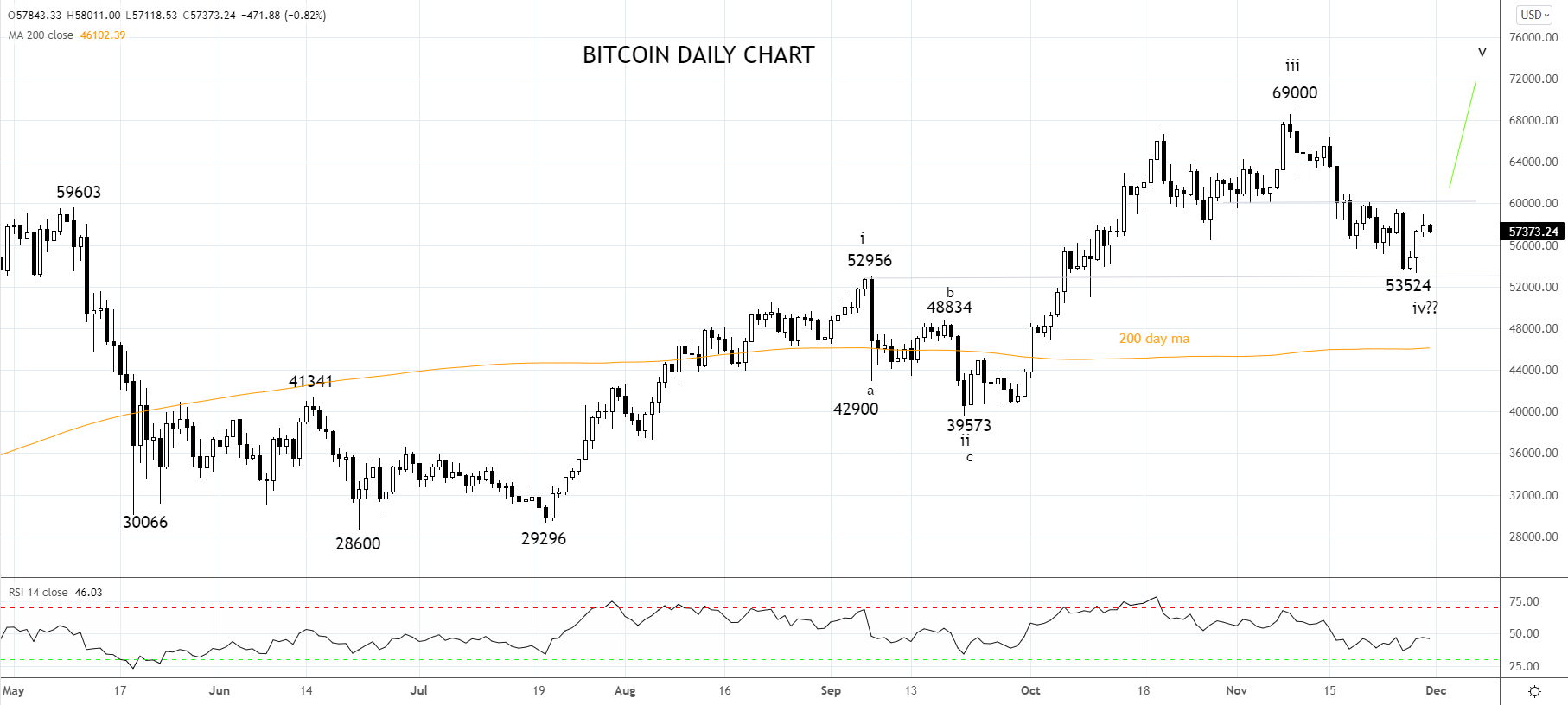

At Friday’s low, Bitcoin had fallen over 20% in just three weeks from an all-time high at $69,000 as events conspired to trigger a round of profit-taking after a stunning 75% surge higher from September lows.

The triggers for the profit taking, the signing into law the $1.2 trillion bipartisan Infrastructure Bill that includes tax reporting provisions that apply to cryptocurrencies. Expectations of reduced central bank liquidity/faster tapering, as well as an erosion of Bitcoin's role as an inflation hedge as energy-led inflation expectations, fell with the price of crude oil.

However, as cooler heads have begun to prevail in equity markets, the price of cryptocurrencies have started to recover, reassured by the knowledge that longer-term buyers remain committed. In a filing on Monday, Michael Saylors, MicroStrategy, announced it had bought another 7002 bitcoins between October and November, adding to the 114,000 already owned.

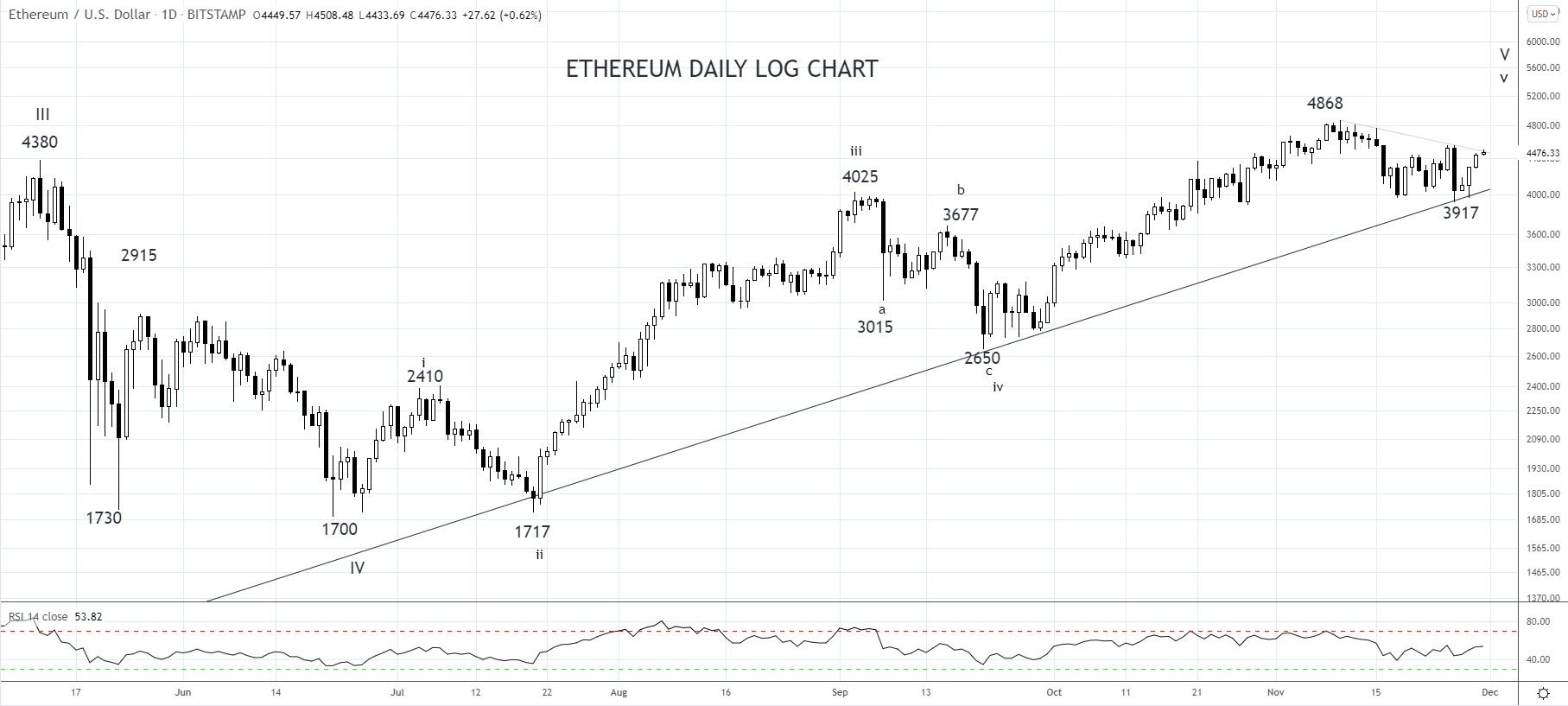

Encouragingly for the markets two leading cryptocurrencies, the declines in Bitcoin and Ethereum, have held critical support zones. Bitcoin traded to a low of $53,524, holding above the support at $53,000 coming from early September high. At the same time, Ethereum tested and held the uptrend support near $3900 (coming from the March 2020 $88.20 low) flagged on Sunday on Twitter here.

From here, should Bitcoin continue to hold above support at $53,000 and then post a daily close above short-term resistance at $60,000ish, it would indicate the correction from the $69,000 high is complete, and the uptrend has resumed.

Should Ethereum break and post a daily close above trendline resistance at $4500 (coming from the $4868 high) and then last week's highs near $4557, it would indicate the correction from the $4868 high is complete at last week's $3917 low, and the uptrend has resumed, targeting a move to $5200.

Source Tradingview. The figures stated areas of November 30th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.