Stock market snapshot as of [30/7/2019 6:11 PM]

- Some solid if not stellar European heavyweight earnings failed to offset a similarly sized raft of disappointment whilst the session on both sides of the Atlantic was garnished by Trump tweets downplaying the chances of a trade breakthrough

- Sentiment was damped further on The Continent by further data prints pointing to a slowing German economy; several German states reported monthly inflation that missed forecasts, though the Federal-level result for July beat. French growth was similarly lacklustre in the second quarter

- Germany’s DAX and related contracts are seeing their worst day since the end of May with the cash gauge down 2.2%

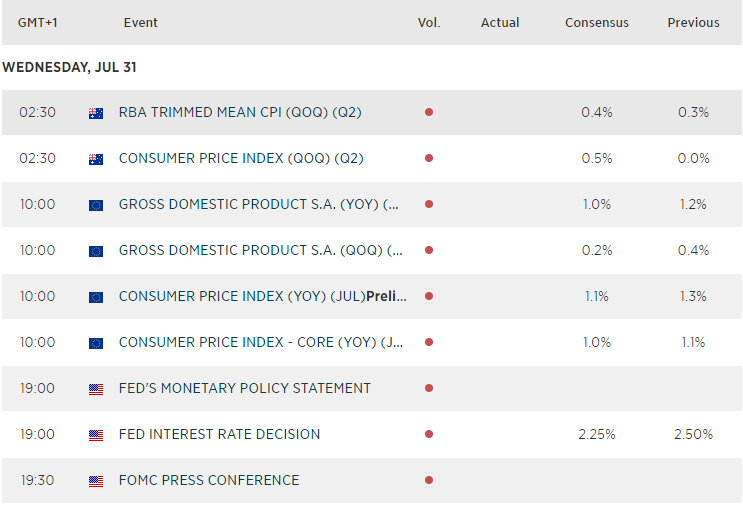

- The Fed’s preferred inflation series was also quite weak in June. With probability of a 25-basis point rate cut on Wednesday tracking around 100%, positive indications of a move back towards the central bank’s target is a silver-lining that’s already priced in

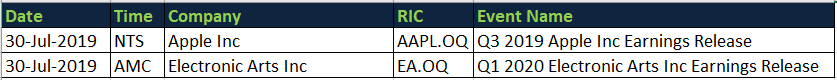

Corporate News

- Oil at least is a positive story—sort of—with key contracts on course for a seventh rising session in eight, underpinning the U.S. energy sector. The S&P 500’s Energy sub-index rose 0.4% a while ago on a combination of tensions over state-backed actions in the critical Strait of Ormuz and seasonal refinery shutdowns

- A raft of giant European—particularly German—groups also darkened the mood. Lufthansa weighed German markets most, losing 6%, as it remains at the epicentre of European travel sector woes; Chemicals group Bayer was down 3.7% after warning on crop product weakness whilst litigation drags on; Delivery Hero slid, though Britain’s Just Eat fell more, as the German online takeaway app said it wasn’t bidding for its rival after all; FTSE 100 consumer product maker Reckitt slumped 3.2% after missing estimates and reducing guidance; BP was a relative star, topping the UK benchmark with a solid if not spectacular set of earnings, earning the shares a 3% rise

Upcoming corporate highlights

Upcoming economic highlights

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM