A 50 or 75 basis points hike?

The ECB raised interest rates by 50 basis points in the July meeting, the first rate hike in 11 years. The big question this month is not if the ECB will hike but whether it be by 50 or 75 basis points?

Expectations that the ECB would hike rates again were already well in place before last week’s data showed that inflation hit a record high and unemployment fell to a record low. Since then, we have heard from several ECB officials who support a front-loading approach to rate hikes to avoid a 1970’s inflation spiral.

There are strong arguments on both sides for a 50 or a 75-basis point hike.

The ECB is playing catch up as far as rate hikes are concerned, and a 75 basis point hike would send a clear message about getting on top of inflation. Furthermore, the window within which aggressive hiking can take place is narrowing as the region tumbles towards recession.

Following Putin’s cut-off of gas through the Nord Stream 1 pipeline, gas prices are expected to remain high, meaning that inflation still hasn’t peaked, and Christine Lagarde could be reluctant to say when it will peak. Double-digit inflation in Q4 is looking very likely.

Meanwhile, some ECB policymakers would prefer to hike by 50 basis points and to use this meeting to discuss a larger move in the future meetings – a more orderly approach.

There is also the fear that the larger interest rate hikes will mean a faster decline into a recession and the sooner the bank will need to stop hiking. Could a smaller for longer approach help cushion the hard blow to the eurozone economy?

Concerns over the weak Euro?

In the previous ECB meeting, policymakers highlighted concerns over the euro’s weakness. A move below parity since then will add to those concerns, particularly as a weaker euro brings inflationary pressures.

Where next for the EUR/USD?

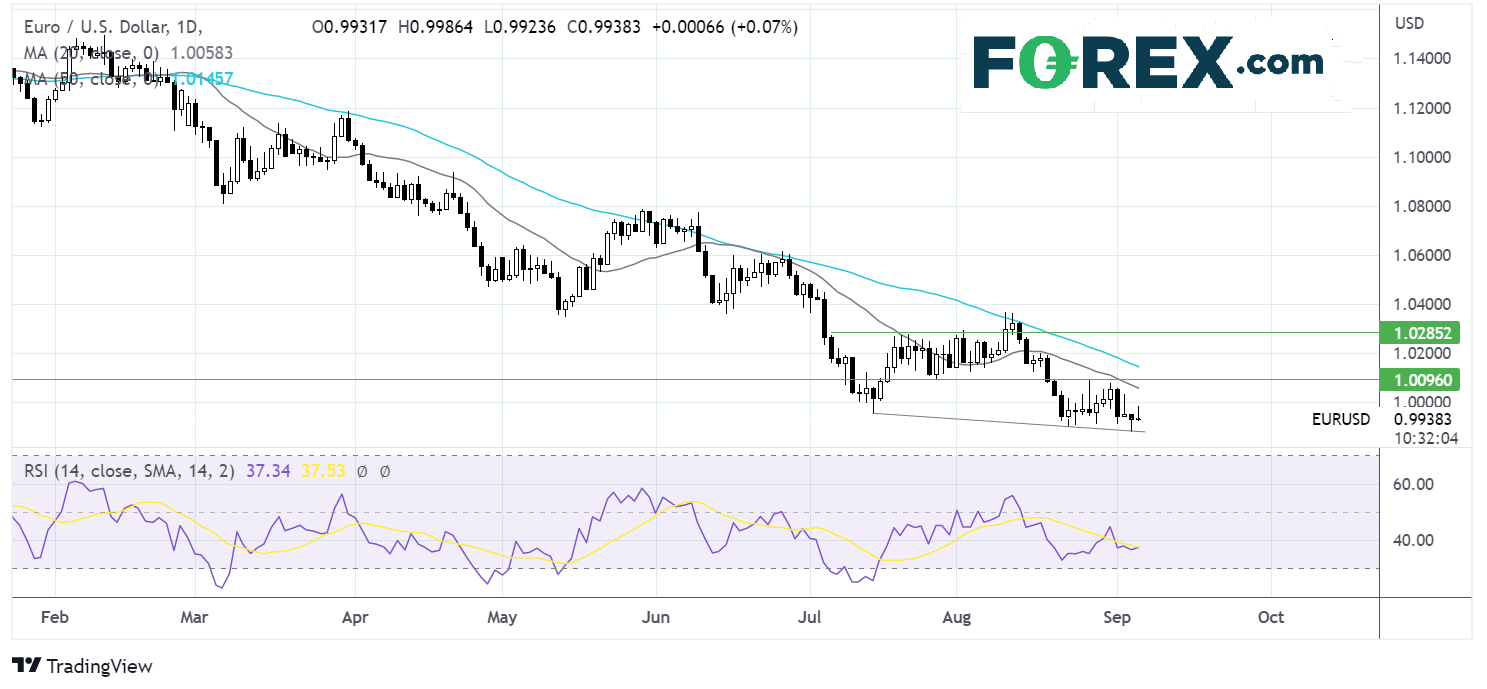

EUR/USD found support on the falling trendline support yesterday and has pushed higher, but the outlook remains bearish. The pair trades below its down trending 20 & 50 sma, and the RSI remains below 50 supporting further losses while it remains out of oversold territory.

To stage a recovery, buyers need to rise above 1.0100, last week’s high, to expose 1.0160, the 50 sma.

Meanwhile, sellers could look to test 0.9877, yesterday’s low, to extend the bearish trend towards 0.98.