On Monday, International Business Machines (IBM) is expected to report second quarter EPS of $2.12 compared to $3.17 a year ago on revenue of approximately $17.6B vs. $19.2B last year. IBM is an information technology company and on July 16th, the company announced a collaboration with Verizon Communications (VZ) to work together on 5G and edge computing innovations in an effort to help enable the future of the Fourth Industrial Revolution.

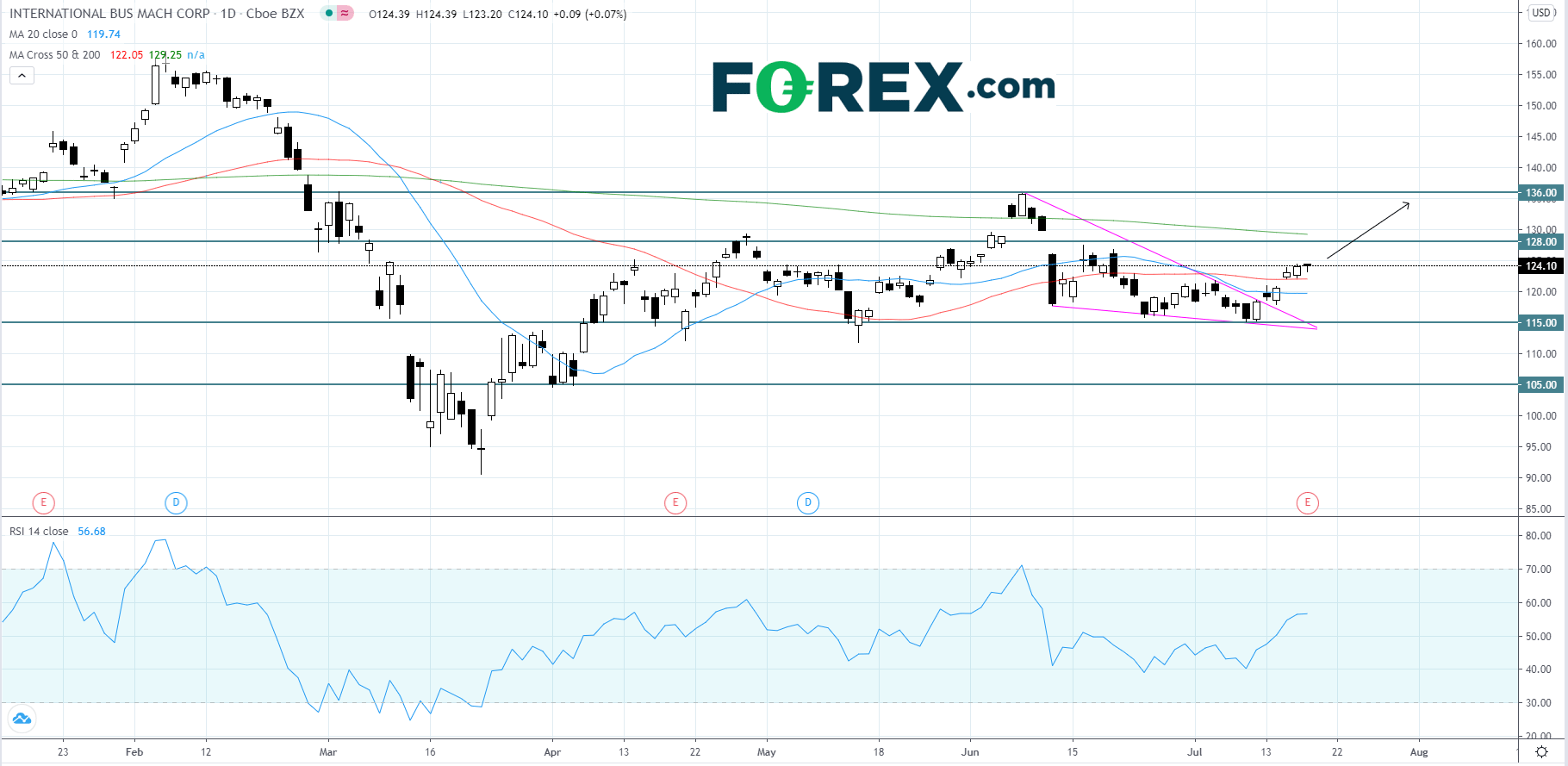

Technically speaking, on a daily chart, at the start of this week IBM's stock price broke to the upside of a short-term falling wedge pattern that began to form in early-June after price made its last peak at $136.00. A falling wedge is classified as a bullish pattern and the RSI is currently rising. Even though the moving averages are arranged in a bearish manner, price appears to be headed for the $128.00 resistance level. If price can reach that level it could bring in a new wave of buyers and push the price up towards its last peak at $136.00. The $115.00 level has been a strong support that has been holding up price since about April. Given the volatility in the current market, we could witness price chop around above the $115.00 level before seeing a break of the $128.00 level. However, if price falls below the $115.00 support, it is very likely that price will be pressured down towards the $105.00 level.

Technically speaking, on a daily chart, at the start of this week IBM's stock price broke to the upside of a short-term falling wedge pattern that began to form in early-June after price made its last peak at $136.00. A falling wedge is classified as a bullish pattern and the RSI is currently rising. Even though the moving averages are arranged in a bearish manner, price appears to be headed for the $128.00 resistance level. If price can reach that level it could bring in a new wave of buyers and push the price up towards its last peak at $136.00. The $115.00 level has been a strong support that has been holding up price since about April. Given the volatility in the current market, we could witness price chop around above the $115.00 level before seeing a break of the $128.00 level. However, if price falls below the $115.00 support, it is very likely that price will be pressured down towards the $105.00 level.

Source: GAIN Capital, TradingView

Latest market news

Today 10:55 AM

Yesterday 01:00 PM

Yesterday 08:00 AM