US futures

Dow future -0.05% at 39315

S&P futures 0.07% at 5434

Nasdaq futures 0.25% at 20192

In Europe

FTSE 0.05% at 8242

Dax 0.77% at 18595

- NFP showed 206k jobs added, but downward revisions to previous months

- Unemployment rose to 4.1% from 4%

- Tesla extends gains, up 24% this week

- Oil is set for a fourth straight weekly gain

Stocks rise as the jobs market cools

U.S. stocks are heading higher after US non-farm payroll data points to a cooling labor market.

The NFP report showed that 206,000 jobs were added in June; this was slightly ahead of the 190,000 that was forecast. However, the previous two months also saw a combined downward revision of 111,000,

Meanwhile, the unemployment rate rose to 4.1% as more people entered the labor market, up from 4%. Average hourly earnings cooled to 0.3% month over month, down from 0.4%.

The data shows a sustained slowdown in hiring, combined with recent cooling in inflation, boosting bets that the Federal Reserve will lower interest rates as soon as September.

This is the last jobs report before the Federal Reserve meets later this month. Federal Reserve Jerome Powell had highlighted that unemployment was still low. Higher unemployment could prompt a more dovish tone from the chair of the Federal Reserve when he testifies before the Senate Banking Committee next week.

The market is now pricing in a 75% probability of a September rate cut, up from 56% at the start of the week.

Corporate news

Cryptocurrency-related stocks are set to open sharply lower after Bitcoin tumbled over 5% to its lowest level since February as defunct exchange Mt Gox prepares to repay its creditors. Coinbase and MicroStrategy are down 5%.

Macy's, the retailer, is expected to open over 6% higher after reports that an investor group has hiked its takeout offer. Arkhouse Management and Brigade Capital Management offer $24.80 per share, up from $24.

Tesla continues its impressive comeback, rising a further 2% after second-quarter vehicle deliveries beat analysts' estimates. Shares are up 24% for the week.

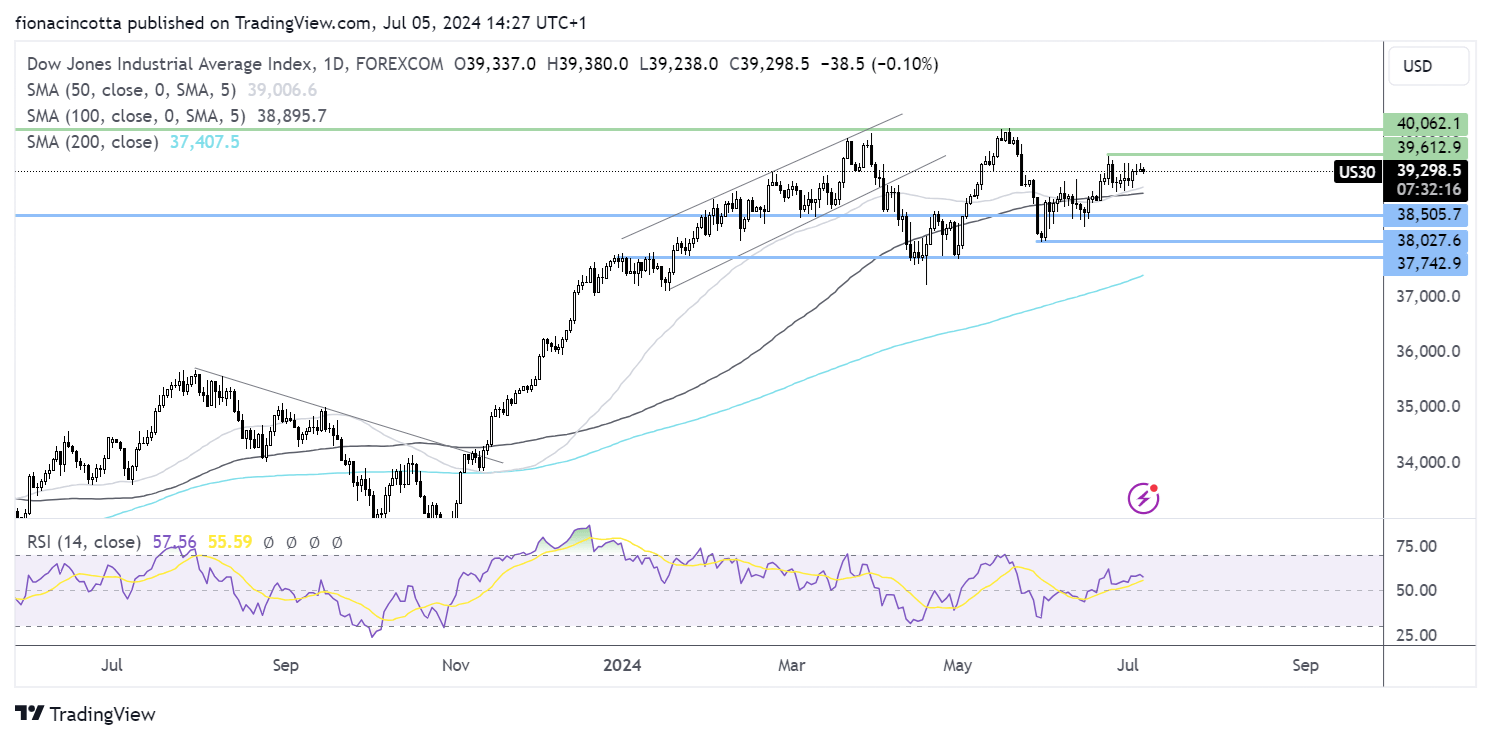

Dow Jones forecast – technical analysis.

The Dow Jones is grinding higher towards the 39,575 June high. A rise above here opens the door to 40k. The price has been guided higher by the 100 SMA, which has acted as a dynamic support at 38,900. Sellers need to break below here to bring 38500 into focus.

FX markets – USD falls, GBP/USD rises

The USD is falling after US NFP data raised expectations that the Federal Reserve could start to cut interest rates sooner rather than later.

EUR/USD is rising after a smaller-than-expected rise in retail sales of 0.1%. Sales were expected to increase just 0.2% after falling 0.2% in April. The data comes after the ECB meeting minutes yesterday showed that policymakers were divided over cutting rates due to sticky inflation and high wage growth.

GBP/USD is rising after the Labour market won a landslide victory in the UK elections, as expected. The pound is benefitting benefit from safe-haven flows amid expectations of increased stability, but the impact is likely to be limited. This is because no dramatic change to fiscal policy as expected, which could leave the Bank of England on track to cut interest rates in August. Should Bank of England policymakers, who are coming out of the blackout period, start preparing the market for a rate cut soon, this could put downward pressure on the pound.

Oil on track for a 4th weekly gain

Oil prices are edging lower on Friday but remain near their highest level since late April and are on track to book a fourth straight week of gains.

Oil prices have been helped higher across recent weeks an optimism surrounding strong summer driving fuel demand, some supply concerns and a weaker U.S. dollar.

US Energy Information Administration posted a 12.2 million barrel inventory draw last week compared to expectations of just a 700,000 barrel draw, adding to optimism surrounding demand.

Meanwhile, soft U.S. data this week has increased expectations that the Federal Reserve could cut interest rates sooner. A lower interest rate environment would be more beneficial for the oil markets and bring a weak U.S. dollar.

Elsewhere, reports are circulating that Russia's oil producer Roseneftand Lukoil will make sharp cuts to oil exports from a Black Sea port in July. This could lead to tighter supply, which would support the oil price.