US futures

Dow future -0.10% at 38,666

S&P futures 0.37% at 5436

Nasdaq futures 0.73% at 19606

In Europe

FTSE -0.4% at 8220

Dax -1% at 18442

- Stocks mixed after PPI drops & jobless claims jump

- Tech sector drives record highs on S&P 500, Nasdaq100

- Broadcom rises, lifting chip stocks after earnings & revenue beat

- Oil slips on demand worries post-Fed

Stocks mixed, tech sector leads the risers

U.S. stocks are pointing to a mixed start after reaching record highs in the previous session. The market continues to digest the Federal Reserve's interest rate decision and the latest inflation data. Tech is leading the S&P500 and the Nasdaq higher, while the Dow Jones points lower.

The tech-heavy NASDAQ and the S&P 500 rose to fresh record highs for a third straight day yesterday after inflation cooled more than expected and despite the Federal Reserve limiting its rate cut projections to just one this year, down from three rate cuts forecast in March.

Yesterday's CPI showed inflation coming in cooler than expected on a monthly basis but remained unchanged annually at 3.4%, which is still considerably above the Fed’s 2% target. This, combined with the upward revision to the annual inflation forecast to 2.8%, drove the Fed to lower its rate cut projections.

Following yesterday’s events, the market upwardly revised its September rate cut expectations. The market is now pricing at a 56% probability that the Fed will cut interest rates in September, up from just 46% earlier in the week.

Today, data showed US PPI unexpectedly fell in May, dropping -0.2% MoM in May, down from 0.5% in April. Cooling PPI bodes well for additional cooling in CPI.

Jobless claims are also in focus after Friday’s stronger-than-forecast non-farm payroll report and support the view that the labor market is cooling. Jobless claims rose to 242k up from 229k, the highest level for months. This was also well ahead of the 225k forecast.

Corporate news

Tesla shares are set to open higher after Elon Mask said shareholders would likely approve his controversial $56 billion pay package and a resolution to move the EV maker's incorporation to taxes.

Broadcom is set to open 14% higher after the semiconductor firm upgraded its annual revenue forecast for its optimized chips. These chips benefit from solid demand around AI, and the upbeat report is lifting chip stocks and the tech-heavy Nasdaq.

GameStop is set to rise over 3% ahead of the annual shareholder meeting later in the session as the meme stocks' choppy trade continues.

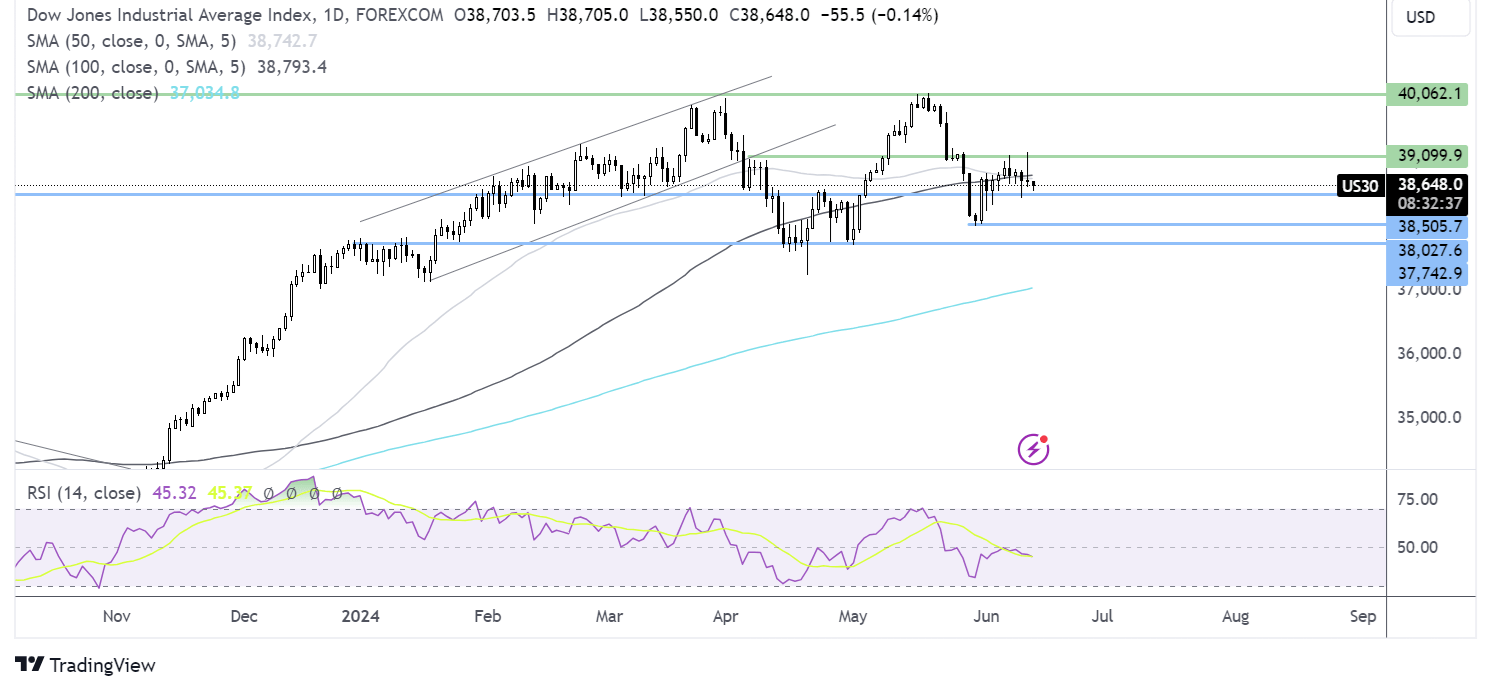

Wall Street forecast – technical analysis.

The Dow Jones continues to trade in a familiar range, caught between 38500 on the downside and 39,000 on the upside. The RSI is modestly favoring sellers, as is the move below the 100 SMA. Sellers will look to take out 38,500 support to bring 38,000 the May low into play. Meanwhile, buyers will need to take out 39,000 to extend gains back up towards 39,335 and 40,000.

FX markets – USD rises, EUR/USD falls

The USD is rising, recovering some of yesterday's steep losses following the cooler-than-expected CPI data after the Federal Reserve said that it would look to cut interest rates once this year.

EUR/USD is falling on USD strength, and after, German wholesale prices fell by more than expected. German wholesale prices were 0.1% MoM, down from 0.3% in April. The data bodes well for continued cooling in CPI. Political uncertainty continues to cap the euro.

GBP/USD is Inching lower after rising above 1.28 in the previous session as the market weighs up data released this week k to asses when the Bank of England may start to cut interest rates. Attention is also on the political parties' manifestos as the Labour Party unveils its policies today. Labour is widely expected to win the election and is considered the more GBP-friendly results in the election after Brexit and years of Tory infighting.

Oil slips on demand worries post-Fed

Oil prices are falling amid concerns over the demand outlook after the Federal Reserve indicated that it would keep interest rates high for longer.

High interest rates for longer will likely slow the economy and weaken oil demand. In the Fed's view, this is the price that needs to be paid in order to lower interest rates.

On the supply side, US crude oil stockpiles rose more than expected in the previous week. Data from the EIA showed that oil inventories rose by 3.7 million barrels to 459.7 million barrels, well ahead of expectations of a 1 million barrel draw.

Meanwhile, gasoline stocks rose by 2.6 million barrels compared to expectations of a 0.9 million barrel build.