Dow Jones Forecast DJIA falls ahead of a busy week for data US Open 2024 9 3

US futures

Dow future 0.41% at 41328

S&P futures -0.62% at 5613

Nasdaq futures -0.75% at 19447

In Europe

FTSE -0.54% at 8312

Dax -0.47% at 18839

- US stocks fall after the Labour Day long weekend

- US ISM manufacturing PMIs is due

- USD extends is recovery from a 13 month low

- Oil falls on China demand concerns

Stocks falls after the extended weekend

U.S. stocks are heading for a lower open at the start of a busy week for economic data. Starting today with the ISM manufacturing PMIs there are plenty of reports across the week which could influence the extent to which the Federal Reserve will be cutting rates.

US stocks recovered from the early August sell off and ended the month higher, marking the fourth straight monthly gain after data pointed to a resilient economy.

The Dow Jones is at record highs and the S&P500 is within 1% of its ATH as the market enters September historically bearish month for the main indices

History suggests September is the worst month of the year for stock market performance generating an average monthly decline of 1.2% on the S&P 500 and a 1.1% drop on the Dow Jones.

Attention is on ISM manufacturing data which is due shortly and is expected to show that activity improved in August but remained below the 50 level separating expansion from contraction.

The main focus this week will be on the US labour market numbers with Friday’s nonfarm payroll. The jobs data will be under more scrutiny than usual after July's report pointed to a larger than expected slowdown and sparked global sell off in risk assets.

The Federal Reserve meeting is due later this month and the market is pricing in a 33% probability of a 50 basis point rate cut and a 67% probability of a 25 basis point cut.

Corporate news

Tesla is rising premarket after data yesterday showed EV maker booked the best month in China so far this year in August benefiting from stronger sales in smaller cities.

United States Steel is set to open over 5% lower after US Democratic presidential nominee Kamala Harris indicated that she would block Japan's Nippon Steel's proposed $14.9 billion takeover of the steel company.

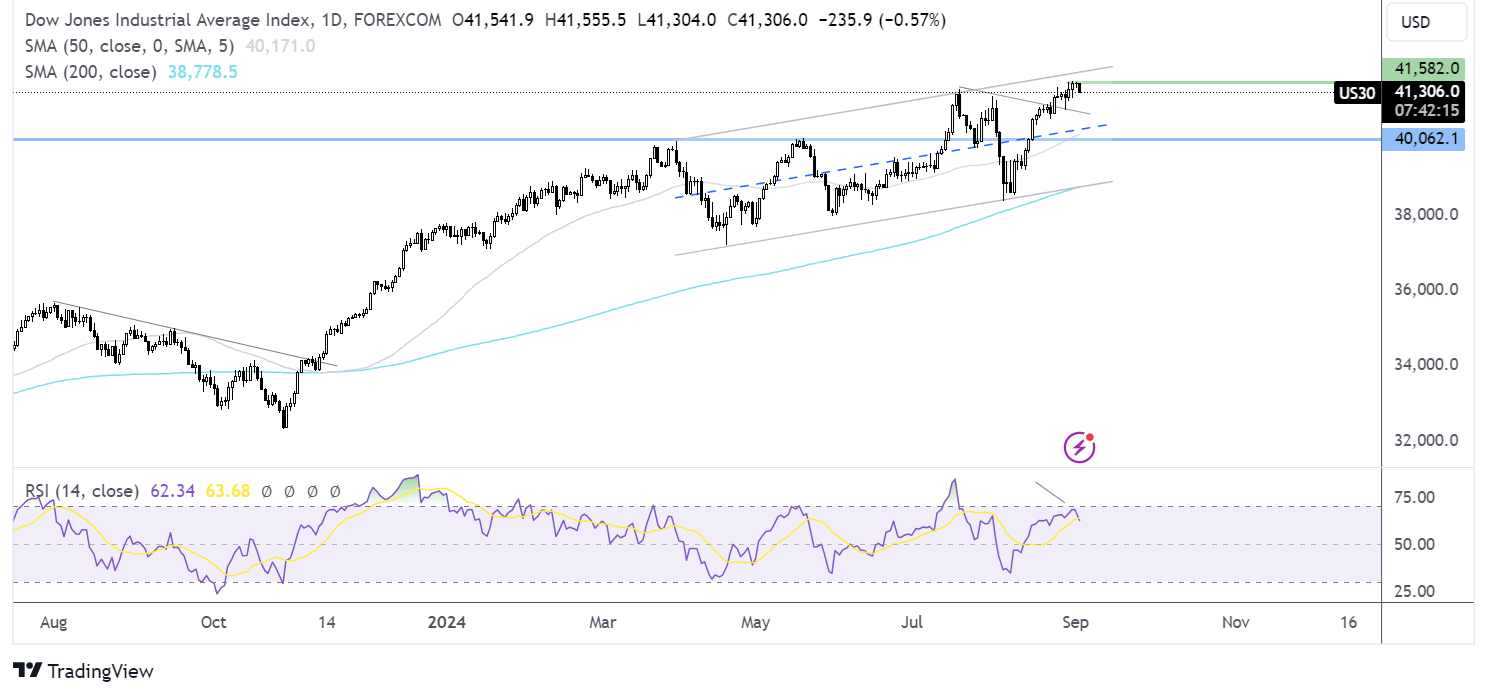

Dow Jones forecast – technical analysis.

The Dow Jones rose to a fresh all-time high of 41582 last week. The price hovers just below here but is still comfortably above the 41000 support level and the falling trendline support. Buyers, supported by the RSI above 50, will look to rise above 41582 to fresh all-time highs.

FX markets – USD rises, EUR/USD falls

The USD is rising as it extebds its recovery from a 13 moth low as the market reins in outsized Fed rate cut expectations and lowere recession fears.

EUR/USD is falling amid a quiet economic calendar in the eurozone leaving the USD driving the pair. Data on Friday confirmed that eurozone inflation cooled in line with forecasts and weak manufacturing PMI data yesterday supported the view that the ECB could cut rates in September.

GBP/USD is faling on a stronger U.S. dollar and despite signs of an improving consumer environment in the UK. British consumer spending rose in August by 1% according to the BRC raising optimism that consumers could help the economic recovery in H2 as confidence improves and real income grows.

Oil tumbles on China worries

Oil prices are heading lower as concerns over economic growth in China the world's largest oil importer overshadow the impact of halted production in Libya.

Weaker than expected Chinese manufacturing PMI data over the weekend fueled concerns about the Chinese economy's performance. Meanwhile, on Monday China reported that manufacturing new export orders fell for the first time in eight months and the prices of new homes rose in August at that weakest pace this year.

On the other side Libyan oil exports at major ports and oil production were halted on Monday amid a standoff between rival political factions and the central bank over oil revenue.

Finally OPEC+ is expected to go ahead with oil supply increases this month which is adding pressure to oil prices.