US futures

Dow future -0.45% at 42013

S&P futures 0.38% at 5720

Nasdaq futures 0.45% at 19985

In Europe

FTSE -1% at 8219

Dax -0.05% at 19084

- Stocks struggle after hotter-than-forecast inflation

- Jobless claims rose to a yearly high

- Market prices in an 85% chance of a 25bps

- Oil rises after Hurricane Milton hits

Stocks fall as data heads in the wrong direction

U.S. stocks are heading lower as investors digest hotter-than-expected inflation and cooler-than-forecast labor market figures, raising some questions over the Goldilocks scenario that the US economy had been enjoying.

CPI was hotter than expected at 2.4% YoY in September, down from 2.5% but ahead of the 2.3% forecast. On a monthly basis, CPI rose 0.2% MoM ahead of the 0.1% forecast. Core inflation was also hotter than expected, rising to 3.3% YoY, up from 3.2%.

While CPI came in hotter than expected, it could have been much worse, still paving the way for a 25 basis point rate cut in the November meeting.

Meanwhile, jobless claims were also disappointing, rising to 258K, a yearly high, up from 225K and well ahead of estimates. However, it's worth keeping in mind that volatility will be seeping into the jobless claims data in the wake of hurricanes Helen and Milton. While some people are unable to work because of the storm's destruction, others might have difficulty applying or even delay applying for unemployment benefits.

Following the data, the market Is are still pricing in an 85% probability that the Fed will cut rates by 25 basis points at the coming meeting and a 15% probability that rates will be left on change.

Corporate news

Tesla rose 1.1% ahead of the EV manufacturer's Robitaxi day, an event that, according to Wedbush analysts, could mark a new chapter for growth around autonomous vehicles, and AI future.

Delta Airlines plummeted 6.2% after the airline revealed disappointing Q4 guidance, with revenue and earnings forecasts weaker than expected. Delta cited the US presidential election as an expectation of a temporary slowdown in travel spending.

Apple is set to open 0.5% lower after Jefferies said the latest data suggests that demand for iPhone 16 remains weak and points to a double-digit fall in iPhone volumes.

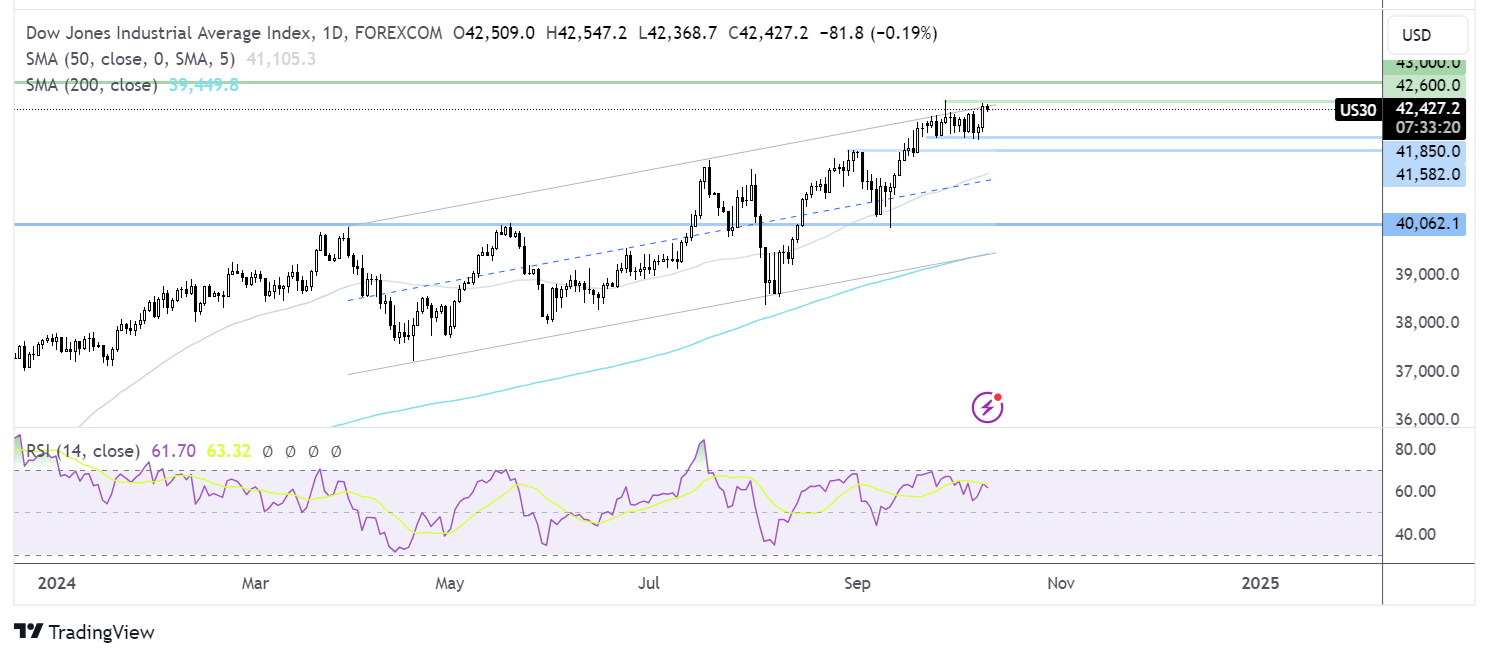

Dow Jones forecast – technical analysis.

The Dow Jones recovered from the 41800 low and rose back towards its record high just below 42,600. Bulls will look to rise above here to bring 43k into focus. Sellers will need to take out support at 41800 to spur a further pullback to 41500 the August high.

FX markets – USD falls, EUR/USD rises

USD is falling after hotter-than-expected inflation data, and cooling jobs data, painting a weaker outlook for the economy.

EUR/USD is rising after German retail sales came in stronger than expected. The minutes of the ECB meeting revealed a cautious stance regarding the outlook on monetary policy and that further cuts would depend on incoming data. A gradual and cautious approach to rate cuts remains appropriate.

GBP/USD is unchanged as investors digest the latest US inflation data and amid a quiet UK economic calendar. Even so, GBP/USD trades around monthly lows after comments from Bank of England governor Andrew Bailey at the start of the month that the central bank could be more aggressive with rate cuts.

Oil rises as Hurricane Milton hits Florida

Oil prices are rising due to renewed optimism surrounding China's stimulus and after the US storm in Florida spiked fuel demand.

In the US, the world's largest oil producer and consumer, Hurricane Milton made landfall in Florida, where around 25% of fuel stations had sold out of gasoline as households looked to evacuate.

Meanwhile, investors remain concerned over the situation in the Middle East, where a broadening out of the conference could disrupt supply.

On the demand side, news that the Chinese finance minister will speak at the weekend has raised optimism surrounding more stimulus announcements.

Even so, the US Energy Information Administration downgraded its demand forecast for next year owing to weakening economic activity in China and North America.