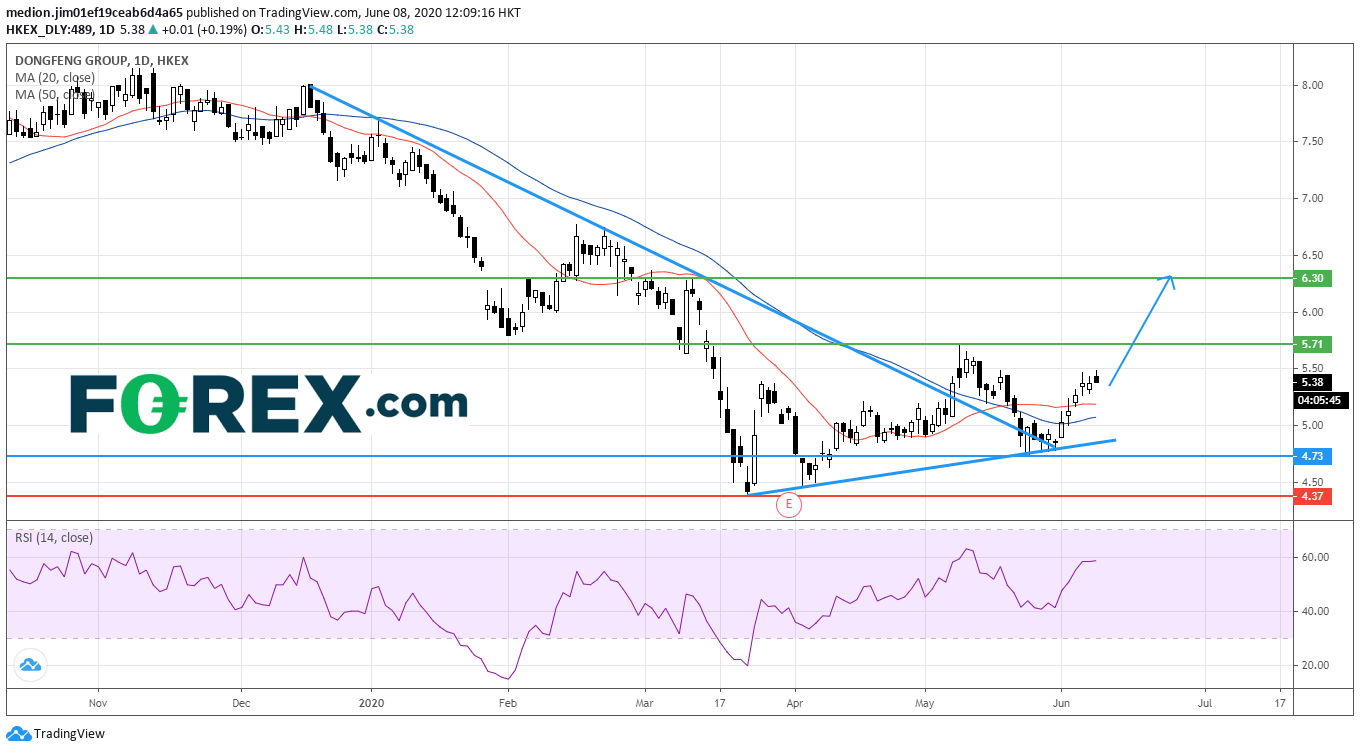

Dongfeng Motor (489), an automobile group, reported that vehicle production rose 12.5% on year to 265,536 units in May and sales were up 17.6% to 264,523 units.

From a technical point of view, the stock posted a rebound after hitting the former declining trend line drawn from December and the rising trend line drawn from March low. The 50-day moving average is reversing up, indicating that the trend is gradually turning to positive.

Bullish readers could set the support level at HK$4.73 (the previous low), while the resistance levels would be located at HK$5.71 (the previous high) and HK$6.30 (the high of March 12).

On the other hand, a break below HK$4.73 would erase the bullish outlook and trigger a return to the March low at HK$4.37.

Source: TradingView, GAIN Capital

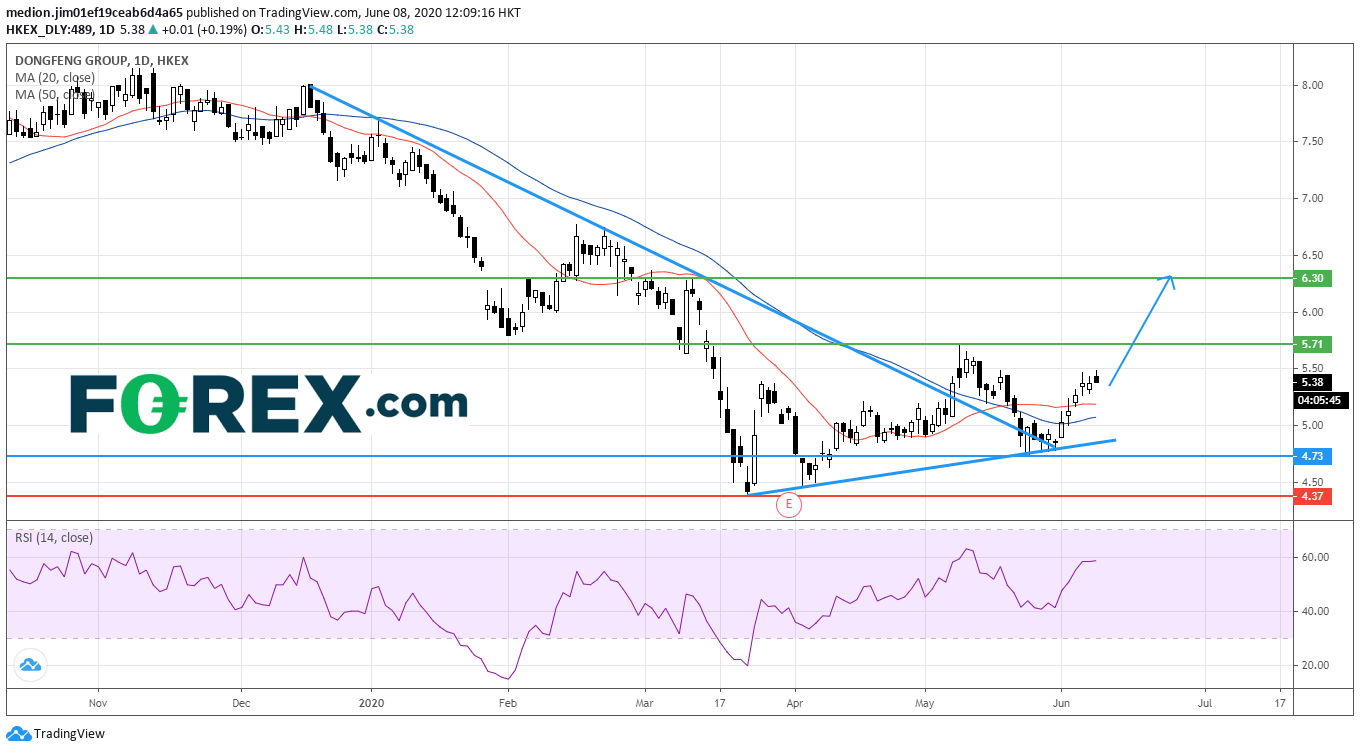

From a technical point of view, the stock posted a rebound after hitting the former declining trend line drawn from December and the rising trend line drawn from March low. The 50-day moving average is reversing up, indicating that the trend is gradually turning to positive.

Bullish readers could set the support level at HK$4.73 (the previous low), while the resistance levels would be located at HK$5.71 (the previous high) and HK$6.30 (the high of March 12).

On the other hand, a break below HK$4.73 would erase the bullish outlook and trigger a return to the March low at HK$4.37.

Source: TradingView, GAIN Capital

Latest market news

Today 12:56 PM

Today 09:27 AM