The dollar outlook remains bearish. The greenback continued to face mild pressure during the mid-morning European session, with AUD/USD (+0.5%) leading the charge after the release of robust labour market data from Australia overnight and a rebound in metals prices. Following a sharp decline on Tuesday, the dollar index (DXY) saw a more modest drop on Wednesday, driven by investor optimism over weaker inflation data. This trend has reinforced expectations that the Federal Reserve might initiate a rate-cutting cycle in September. While the ongoing disinflation process is a positive sign, investors are now questioning how the US economy will respond to these anticipated rate cuts and whether a hard landing can be avoided. Recent macroeconomic data points to a weakening US economy, and if that trend continues then it could spell trouble for the dollar in the months ahead. This puts today’s upcoming data in focus.

Optimism over rate cuts balanced by growth concerns

In light of July's US consumer inflation data, the dollar has softened, as you would expect, albeit mildly so fae. The limited movement in the dollar can be attributed to the fact that many investors had already positioned themselves for a weaker consumer inflation report, following softer producer price data released on Tuesday. Although the Consumer Price Index (CPI) met expectations, it wasn’t soft enough to prevent some profit-taking on these short dollar trades. Despite this, the disinflation trend continues, with CPI inflation dipping below 3.0% for the first time since March 2021. This subdued inflation data could pave the way for the first rate cut since 2020. The central question is whether the Fed will choose a 25 or 50 basis point cut in September, and at what pace they will proceed with further cuts.

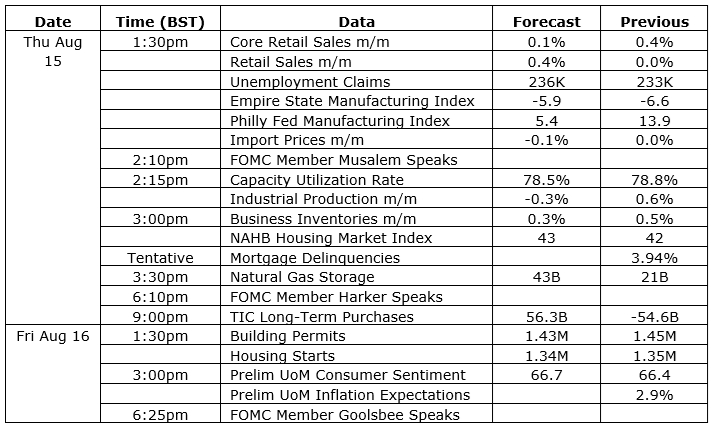

Key US data could shape dollar outlook further

With inflation data now in the rear-view, attention shifts to other critical areas of the US economy as we move towards the end of the week. Key reports, including July retail sales figures, the latest jobless claims, and manufacturing indices from New York and Philadelphia, are due for release today. These reports are expected to offer valuable insights into the labour market, consumer health, and the manufacturing sector. Should these data points also reveal weakness, it could further cement expectations for rate cuts, potentially leading to a drop in bond yields and negatively impacting the dollar outlook. This, in turn, could boost the appeal of major forex pairs, such as the AUD/USD, and increase the attractiveness of precious metals too.

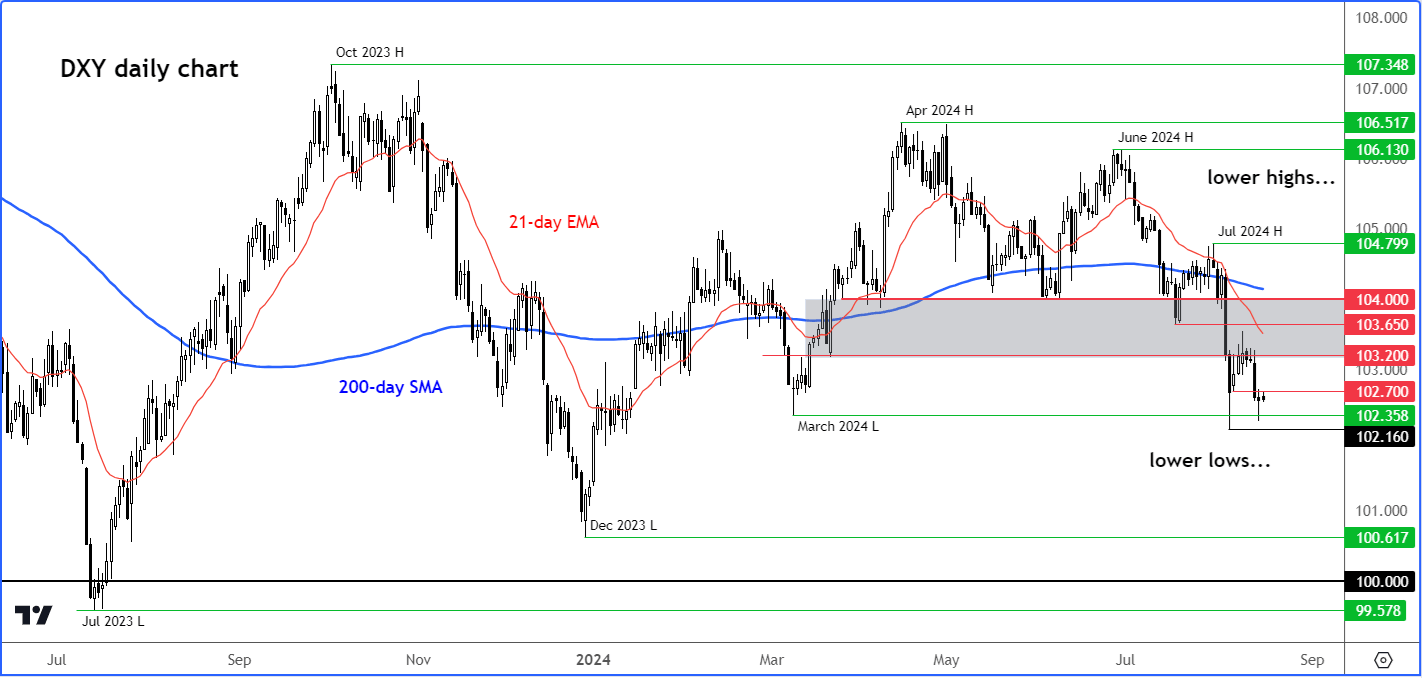

Dollar Index (DXY) technical analysis

Source: TradingView.com

After peaking in April at 106.51, the Dollar Index has now formed at least two distinct lower lows – one in June (106.16) and another in July (104.80). At the same time, we have seen several lower lows, including one a couple of weeks ago at 102.16.

That 102.16 low has not been taken out yet, but if we see further weakness in US data today, then a drop below that level could be on the way. Further downside targets include 102.00, followed by 101.00 and the December low at 100.61.

In terms of resistance, 102.70 is the first line of defence for the dollar bears, followed by 103.20 and 106.65.

The trend of lower lows and lower highs has caused the DXY to move below its key moving averages like the 200-day. Not only that, but the short-term 21-day exponential moving average has now crossed below the 200-day too. Both of these averages have negative slopes, confirming a bearish technical trend and a negative US dollar outlook.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R