- Dollar analysis: Why did FX markets ignore CPI?

- Gold analysis: Metal rises on raised geopolitical risks

- Looking ahead to next week: Chinese GDP, US retail sales and UoM surveys

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week's edition, we will discuss the US dollar and gold, and look forward to the week ahead.

The big news so far today has been centred around geopolitical risks in the Middle East after military strikes by air and sea targeted 16 Houthi positions in Yemen overnight. The news sent crude oil up 2.5% and gold found haven flows to climb more than 1% to above $2050. The US dollar was finding a bit of support on haven demand after failing to hold onto its gains the day before, despite a stronger-than-expected inflation report. The focus will momentarily shift to PPI data, due for release at 13:30 GMT, which is the last important macro data of the week. But after the dollar's muted reaction to the CPI report, the dollar bulls will need a more robust performance to maintain their influence over FX markets, following a promising start to the year. In the event they don’t we could see gold start to climb toward $2075 key resistance level and potentially beyond.

Dollar analysis: Why did FX markets ignore CPI?

Throughout the week, investors had anxiously anticipated Thursday's CPI report to introduce much-needed volatility into the markets. The market had positioned itself for a positive surprise, but the December inflation report turned out to be slightly hotter than expected. This led to a rebound in the dollar, causing equity indices to dip immediately following the inflation report. However, by the end of the trading day, the markets had recovered, and the dollar, although off its lows, closed the session marginally lower against a basket of foreign currencies.

Yesterday’s performance of the dollar suggests investors may have been content to cash in on their long dollar positions. While they still anticipate rate cuts this year, the exact timing remains uncertain. The CME FedWatch tool maintains the likelihood of a March rate cut at around 70%. It is possible that investors are anticipating a decline in inflation, looking beyond the December report and arguing that economic weakness will exert downward pressure on prices in the coming months.

Nevertheless, the muted reaction is indeed surprising, but one that will definitely appease gold bulls – as it has, judging by its rise in the last couple of sessions.

Another factor contributing to the dollar's muted response could be investors perceiving foreign central banks as more hawkish than the Fed. For example, European Central Bank official Isabel Schnabel delivered a hawkish speech a couple of days ago. She basically countered recent dovish ECB commentary, stating that "it is too early to discuss rate cuts" and highlighted the need for additional data to confirm any disinflationary trends before considering a shift from a restrictive monetary policy. Despite the hotter US inflation report, the EUR/USD managed to remain well above the 1.09 handle but also failed to break the 1.10 barrier. A move beyond this range is expected to trigger subsequent technical buying/selling in the corresponding direction.

What are analysts expecting from PPI today?

Today’s inflation data is expected to show that PPI likely increased by 0.1% month-over-month in December, following a stagnant reading in November. Additionally, Core PPI is anticipated to rise by 0.2% for the month.

The PPI data will follow the release of CPI data the day before, revealing a 0.3% month-over-month increase, surpassing the expected 0.2% rise. This pushed the annual rate to 3.4% in December, up from 3.1% in November, surpassing the anticipated 3.2%. Core CPI registered a 3.9% annual increase, exceeding forecasts of a 3.8% rise. Notably, the job market also displayed positive signs, with jobless claims dropping to 202K from the previous week's 210K.

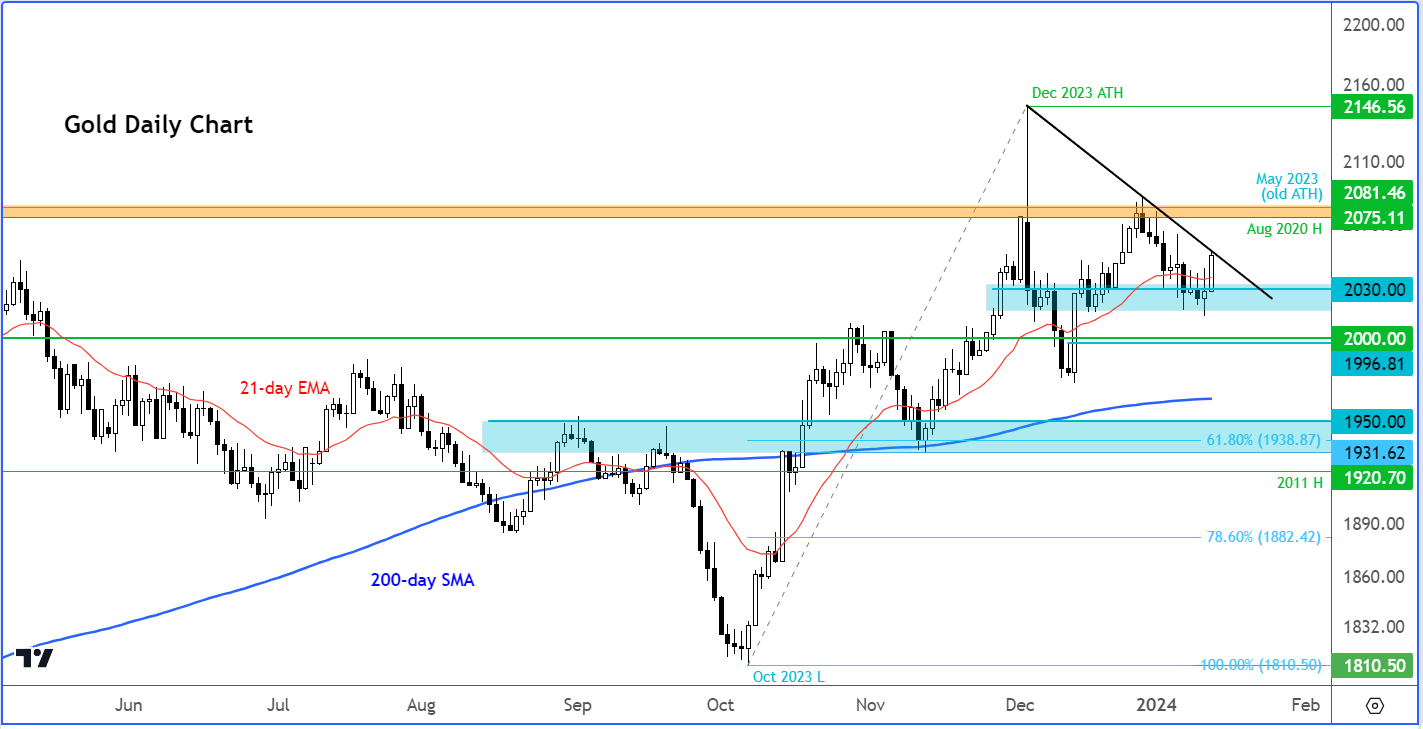

Gold analysis: technical levels to watch

Gold briefly dipped below short-term support at $2020-$2030 following the CPI data on Thursday, before closing the session in the positive. So, there was some evidence and a bullish signal to confirm that the metal has formed at least a short-term low. Consequently, we have seen some further upside follow-through today. The metal could further extend its gains and head towards $2075, the high from August 2020, which is going to remain a pivotal zone for XAUUSD. It has not been able to post a weekly close above this level in the past. Should it do so now, then the December 2023 high of $2146 will come into focus next.

However, if support around $2020 to $2030 breaks decisively then the next key level to watch is around $2000, the psychologically-important level, followed by the 200-day average and prior support some $50 lower.

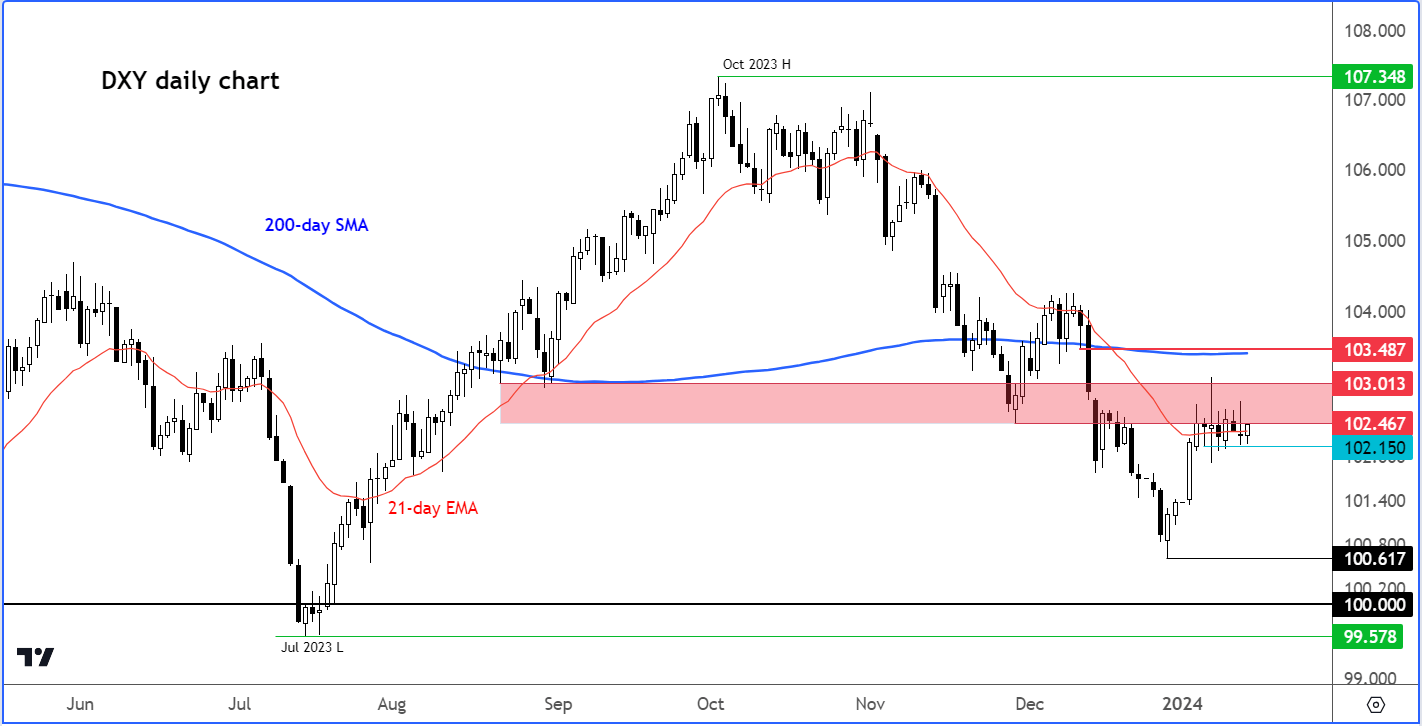

Dollar analysis: DXY technical levels to watch

Ahead of the PPI data, the Dollar Index was up a modest 0.1% after closing flat the day before, reflecting a subdued FX market response.

The bearish trend that started from October is being tested though, and the dollar sellers must step in around these levels if they want to maintain control.

Zooming out a little, the larger time frames show lower lows on the DXY ever since it peaked in October at 107.35ish. With that in mind, the important of that key resistance zone between the 102.45 to 103.00 area should not be underestimated. This is where the DXY was residing at the time of writing. This zone had acted as strong support on a couple of occasions back in August and again in November, before giving way on the back of the Fed’s last policy meeting in mid-December.

The 200-day average could be the next upside target in the event the dollar bulls regain control over this zone in the next couple of sessions.

But for as long as that 102.45 to 103.00 area holds as resistance, this should keep a bearish bias on the dollar alive.

So, watch today’s closing prices closely to determine the directional bias for the dollar heading into the week ahead.

Looking ahead to next week

In the week ahead, we will have important data from China to look forward to on Wednesday, followed by retail sales and consumer confidence data from the US. We will also have retail sales data from the UK and Canada, among other places. Let’s quickly run through the top 3 macro events for next week.

Chinese GDP, industrial production

Wednesday, January 17

02:00 GMT

The Chinese data dump on Wednesday will also include retail sales and will be eagerly anticipated by traders in the commodities space, as well as those trading the Aussie and Chinese indices and equities. Concerns over the health of the Chinese economy has driven the China A50 index to a 5-year low, after breaking down from a bearish flag pattern. The 7-year low is near 10,200 and it might get there should we see a big disappointment in data. However, with global indices in an uptrend outside of China, dip buyers will be lurking for any signs of recovery in the world’s second largest economy.

US retail sales

Wednesday, January 17

13:30 GMT

The retail sales data from the US and elsewhere will put retailers’ stocks into focus. On a macro level, the data may help the Fed decide whether to opt for an earlier rate cut or a later one. What the dollar traders will be looking for is a big beat or miss from expectations in order for it to move the markets. Gold investors will also be eying all these retail sales figures to gauge the health of the global consumer.

UoM Consumer Sentiment

Friday, January 19

15:00 GMT

As well as key retail sales figures, we will have the latest consumer confidence and inflation expectations data from the University of Michigan’s popular survey. Last time, consumer sentiment surged to 69.4 from 61.3, which beat even the most optimistic of forecasts. Let’s see if the December reading was just an outlier, or there’s actual sustainable momentum in consumer confidence at the start of this new year. A wide range of markets should be impacted by this release, including indices, gold and the dollar.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R