Global equity markets have rebounded slightly in the first half of this week after a shocking start to the year sent the major indices tumbling. The rebound is in part due to the sellers taking profit on their positions, a technical rebound in crude oil prices from around the psychologically-important $30 handle and the stronger-than-expected Chinese trade figures that were released overnight which also gave the black stuff a further boost and helped to lift copper prices. Miners and energy stocks find themselves at the top half of the UK’s FTSE 100 index, as a result. But after the initial bounce, European stocks struggled to further extend this morning's rally as traders awaited direction from Wall Street. US index futures point to a higher open today. Understandably, sentiment remains fragile after US stocks had their worst start to a year. Not many people are willing to jump back into equities as they fear this could be a mere oversold bounce in a bear market. Bullish speculators are hopeful that the fourth quarter earnings and forward guidance will provide a positive outlook on US equities, a day before the major Wall Street banks start reporting their results.

Chinese data tops expectations

Overnight, the big news came from China once again. This time however, there was some good news as exports rose for the first time since June in yuan terms, up 2.3% in December from a year ago and fared much better than a fall of 4.1% expected. Imports also beat expectations as they ‘only’ fell 4% on a year-over-year basis compared to forecasts of a 7.9% drop. China’s trade figures in US dollar-denominated terms were also better-than-expected: exports fell 1.4% compared to forecasts of an 8% slump, while imports declined 7.6% versus 11.5% expected. China won’t be out of the headlines any time soon. Next week will see the release of the much-important GDP and industrial production figures, among other things. But for now at least, these trade figures have helped to calm investor worries slightly about a sharp slowdown in activity at the world’s second largest economy.

Crude oil to provide direction for stocks

Meanwhile, there’s little in the way of top-tier US economic data to provide direction in the afternoon, so equities may continue to find direction from technical buying and selling, and the direction of crude prices as the buyers desperately try to defend the $30 mark. As well as technical buying, crude prices have also found support from the American Petroleum Institute (API) data that was released last night. According to the API, US crude oil inventories fell by a sharp 3.9 million barrels last week, while stocks at the delivery hub of Cushing, Oklahoma, also fell slightly. Expectations were for an increase on both fronts. The official crude stocks data from US Energy Information Administration (EIA) will be released at 15:30 GMT (10:30 ET) today and so we will probably need to see a drop of 3.9 million barrels or more for oil to sustain its kick-back rally.

Dow Jones: a mere oversold bounce in a bearish trend?

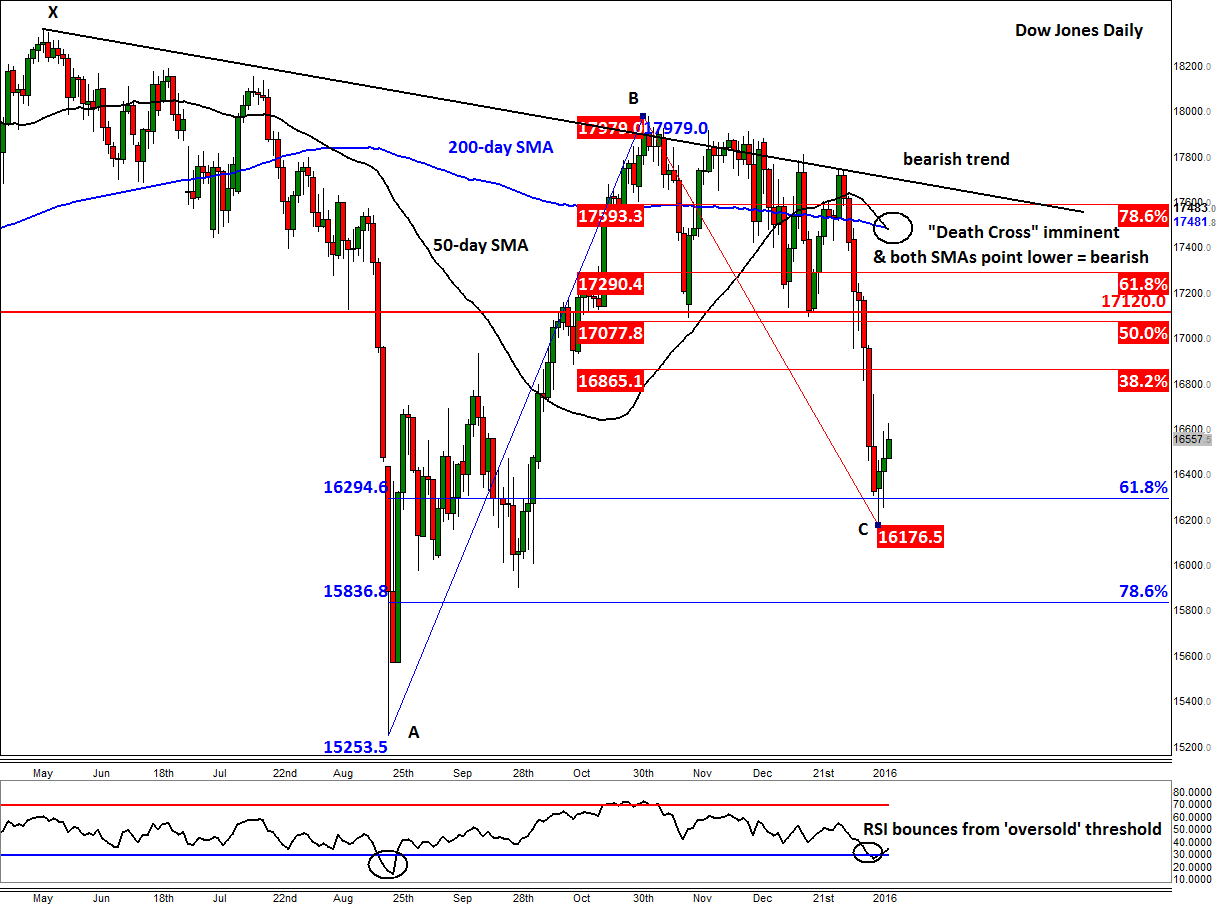

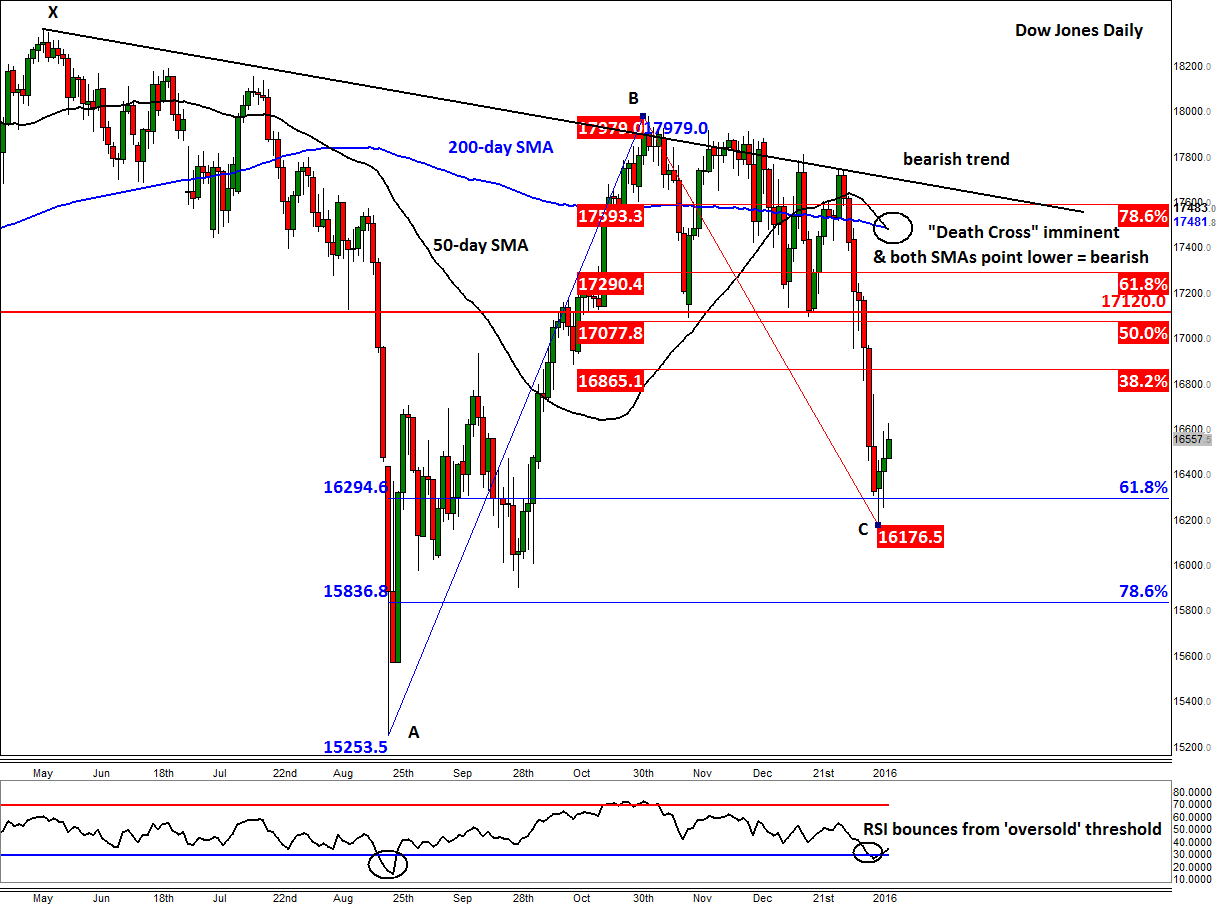

The stock market rebound makes perfect technical sense when you look at charts of the major indices. We have already seen, for example, a strong bounce in the German DAX index from around its long-term bullish trend line. Similarly, technical rebounds from key levels have come to our attention on several other indices, including the US small-cap Russell 2000. The Dow Jones meanwhile, in figure 1, below, has bounced off its 61.8% Fibonacci retracement level against the August low, around 16295. However, this doesn’t necessarily mean that the long-term bullish trend has resumed. It may have, but we don’t know that at this stage – not when lots of technical indicators point lower, which suggests this could simply be an oversold bounce in a bear market.

Indeed, the 50-day moving average is about to cross below the 200 to create a so-called "death crossover," which, as its name suggests, is a bearish development. Some trend-followers do not buy when the moving averages are in this order; rather, they sell into the rallies. As such, it is imperative to watch the key technical levels such as those shown on the chart, for if we get there we may see renewed selling pressure. How strong or otherwise the selling pressure may be around those levels will depend on the fundamentals and sentiment at the time. So, it could be that we will see a small pullback and then another push higher, or conversely a much larger downswing, which is what we are worried about. But if the selling resumes before we even get a sizeable pullback, then this would strongly suggest that a much-larger correction could be on the way. So proceed with extreme caution.

As per the chart, the key level of resistance is around 17120 which was previously support. Other resistance levels to watch closely include the Fibonacci retracement levels (of the BC swing) at 16865 (38.2%), 17075/80 (50%), 17290 (61.8%) and 17590/5 (78.6%) – the latter ties in with the bearish trend line, making it a strong level of resistance, should we get there. On the downside, a closing break below the 61.8% Fibonacci retracement of the previous bounce (i.e. the AB swing) would pave the way for the 78.6% Fibonacci level at 15835/45, the August low at 15250/5 and potentially much lower if the latter breaks.

Figure 1: