- DJIA analysis: Stocks tumble on Middle East jitters

- What is driving the US dollar and risk sentiment?

- Has gold topped after reaching exhaustion levels?

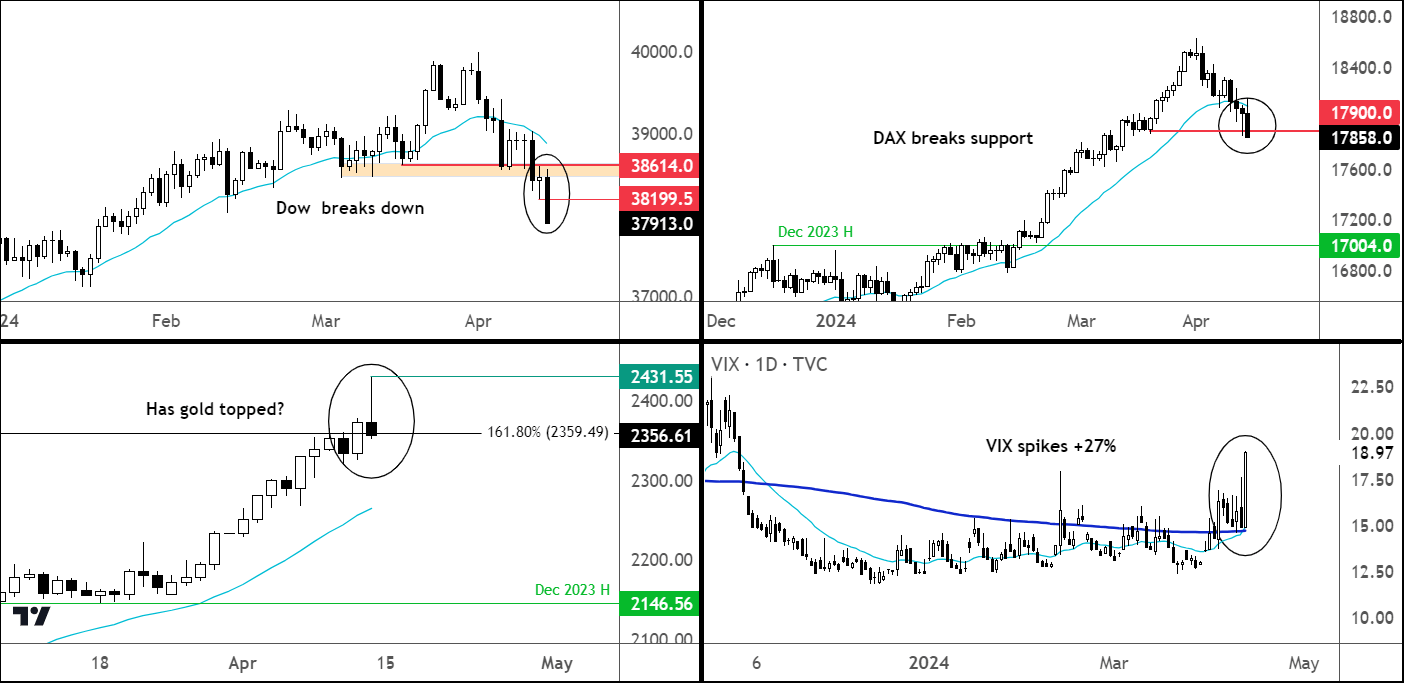

Friday was a risk off day in the markets, although traders just looking at the FTSE wouldn’t have known. The UK index hit a new record high as miners and energy stocks rallied sharply, tracking firmer metal and oil prices. The major US indices were more than 1% lower at the time of writing, with the Dow under-performing. Gold initially topped $2430, before giving back the entire 2.5% gains by late afternoon in London, as the US dollar extended its advance against all major currencies bar the perceived safe haven Japanese yen. The VIX spiked. Thanks largely to the US strength, the GBP/USD took a pounding as it sliced through the 1.25 handle to hit its lowest point since mid-November, ahead of key UK data in the week ahead.

DJIA analysis: What is driving risk sentiment?

Risk was off the menu on Friday on a news report that Israel was in for a direct attack by Iran on government targets. This could happen potentially as soon as Saturday, according to Bloomberg. Thus, investors were lighting up on risk exposure ahead of the weekend, fearing risk assets could gap lower should something happen at the weekend. The escalation in geopolitical tensions in the Middle East have also driven bullish activity in the oil options market.

As well as raised geopolitical risks and higher oil prices, the US dollar has also found support after strong inflation data and surprising resilience in data pushed back expectations of the Fed’s rate cuts. Consumer Prices in March rose to their highest annual pace since October with a print of 3.5% in mid-week. That was the fourth consecutive month when CPI overshot market expectations, as prices of many basic necessities rose sharply.

A few FOMC officials that have spoken since the CPI report, including, Bank of Boston President Susan Collins, have reiterated there is no urgency to cut interest rates in the near term. The reason is what we all know: elevated inflation and the resilience of the labour market. Bond market investors are now pricing in two rate cuts by the end of the year. This contrasts sharply with about six at the start of the year.

Has gold topped? What about the stock markets?

Source: TradingView.com

Judging by the bearish inverted hammer candle on gold, at least a temporary top looks to be in place now. Gold prices were extremely overbought, so a pullback of this sort was always on the cards.

Meanwhile the chart of the stock markets looks bearish, too. With major support levels broken, the likes of the DAX and Dow Jones suggest the bears are now in control of price action. Watch out below!

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R