- DAX outlook blighted by struggling Eurozone economy

- Focus turns to FOMC rate decision

- DAX technical analysis: Path of least resistance still to the downside

Sentiment has been somewhat firmer in the last couple of days with global indices staging a decent recovery. But at the start of today’s session, caution was the name of the game. European indices and US futures were trading a touch lower as investors awaited the Federal Reserve’s rate decision. Crude oil was also bouncing back after two days of losses, suggesting investors remain cautious over the situation in the Middle East. With concerns over the health of the eurozone economy remaining high, this argues against a major recovery for European indices like the DAX. So, instead, will we see the return of the selling?

Why are stocks struggling?

In short, because of a problematic macro environment. Eurozone data has been consistently very poor throughout much of this year, highlighting a challenging macro backdrop with stagflation and high interest rates holding back the developed economies, most notably the Eurozone. Whether it has been lagging indicators like GDP or forward-looking pointers such as the PMI data, the trend has been the same. This has discouraged excessive risk-taking by investors, the sort when global interest rates were at record lows up until a couple of years ago. The recent flare up of geopolitical risks is further damaging investors’ risk appetite. So, I wouldn’t be surprised if markets resumed lower, as currently there are not many things to cheer investors up. Stock prices will need to weaken to make investing in some of the over-stretched stocks viable again, especially when you consider the fact that the bond markets are providing a decent alternative yield right now.

DAX outlook blighted by struggling Eurozone economy

This week’s publication of eurozone data has once again disappointed. The single currency bloc contracted in Q3 by 0.1% when a small expansion was expected. What’s more, German retail sales also disappointed expectations with a surprise fall of 0.8% in September, confounding expectations for a rise of 0.5% on the month. And while there was good news on the inflation front with headline CPI slowing down more than expected to 2.9% in October, core CPI was in line at a still-high of 4.2% annual pace.

The week before, we saw the Eurozone services PMI fall deeper into the correction territory of 47.8, while the manufacturing PMI was down to a lowly 43.0. The PMI data are forward-looking, and they point to another drop in Eurozone output. With Q3 GDP already in the negative, we could get another quarter of negative growth in Q4 to put the Eurozone into an official recession.

So, the fact that we are continuing to see signs of weakness for Eurozone economy, this bodes ill for the leading indices such as the German DAX index.

Focus turns to FOMC rate decision

The market is not expecting the Fed to hike rates today, so the decision itself should not move the markets. Following the release of some more forecast-beating data this week, the probability of a final hike in the next meeting in December has increased to around 26% from around 20% last week. The Fed will likely keep the door to one more rate hike open, given the resilience of the US economy and the potential for inflation to remain high for longer.

The run of forecasting-beating US data has continued this week. Yesterday, the Conference Board’s consumer confidence index, two measures of house prices and employment cost Index all came in ahead of expectations. Last week saw the UoM’s consumer sentiment, pending and new home sales, GDP and both manufacturing and services PMIs all top expectations. The week before it was retail sales, industrial production and jobless claims data that had beaten expectations. So, the US economy is showing continued resilience in the face of high interest rates, putting the Fed in a slightly difficult position as to whether it should tighten its belt even further, or just keep rates at these current levels for a longer-than-expected period of time. A growing number of analysts and economists seem to agree with the latter approach. Let’s see if this is something that the Fed alludes to at this meeting, and how this will impact Wall Street shares and European index futures. One reason why the Fed is unlikely to raise rates again is the recent rise in long-term bond yields, which effectively is equivalent to a couple of additional rate hikes.

DAX technical analysis

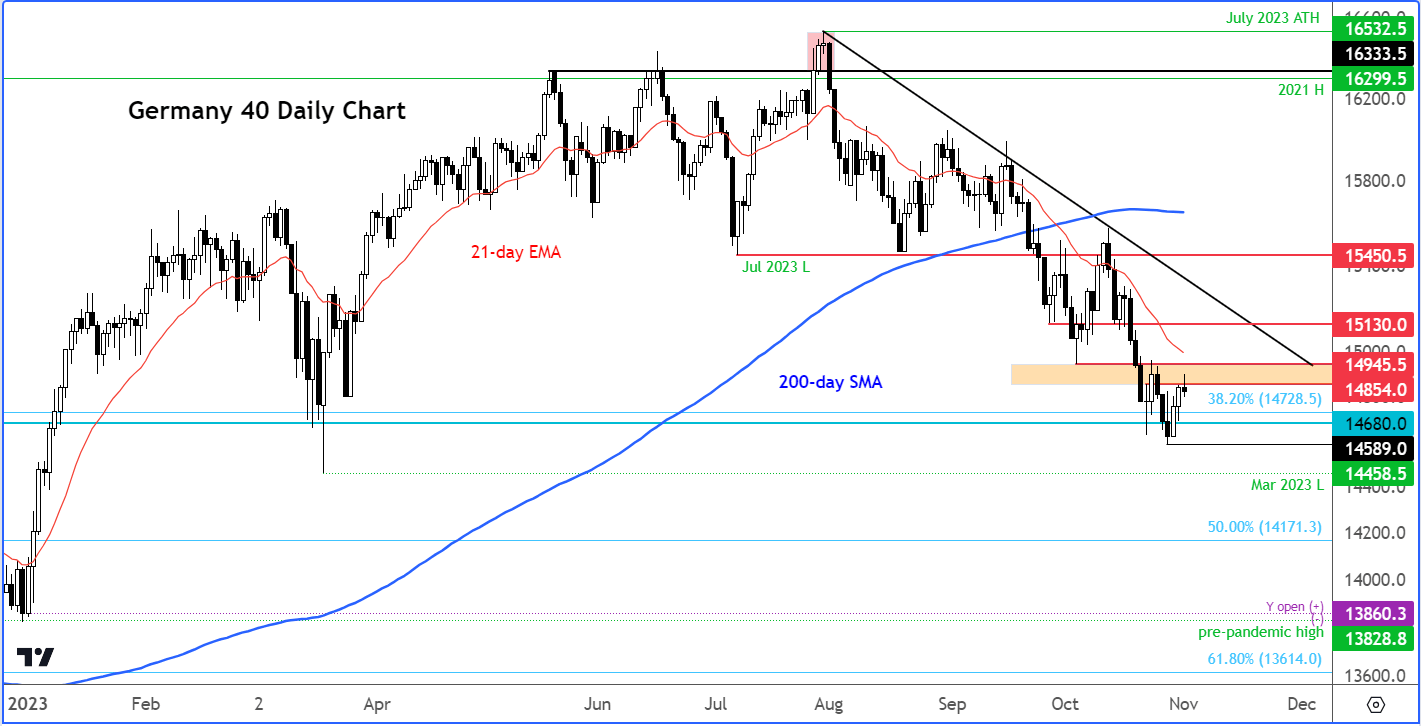

Source: TradingView.com

The DAX has now twice tested and bounced from a major long-term support zone around 14680-14730. This is where the index had found strong resistance in the past – first in June 2022, followed by December – before we broke above here in January and the subsequent retest in March held after a brief deviation below it. Meanwhile, the 38.2% Fibonacci retracement level of the entire rally from October 2022 also comes into play around here.

On Friday, it looked like the bears had won the battle here, as the index closed below this support zone. But at the start of this week, we have seen global indices stage a sharp rally across the board, until today’s hesitation.

The recent consolidation around current levels means the index is now no longer extremely oversold. This therefore increases the risks of trend continuation to the downside. The recovery so far this week has not been driven by anything fundamental, which makes me hesitant to believe it will hold. Unless subsequent price action tells us otherwise, the path of least resistance is still to the downside, I believe.

In fact, the DAX has now entered a key resistance range between 14854 to 14945, and it has reacted from here. This area was formerly support before turning into resistance last week. If the bulls fail to reclaim this zone, then watch out below.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R