- DAX outlook: Tech-fuelled rally fades ahead of Apple event

- ZEW remains deep in the negative as Eurozone data fails to impress

- Focus turns to US CPI and ECB policy decision

- DAX technical analysis remain bearish

At the time of writing in mid-morning European trade, the German DAX was off its earlier lows, but still lower on the session in what has so far been a mixed day for European markets. But with the euro and pound weakening again, it is obvious investors continue to remain concerned over the growing threat of stagflation in Europe. High levels of inflation and low growth, combined with downbeat business and consumer sentiment, and not to mention rising borrowing costs, all make for a tough economic climate for investors to navigate through. Unsurprisingly, there’s not much appetite for taking on too much risk right now.

Tech-fuelled rally fades

So, it looks like Monday’s tech-fuelled rally on Wall Street and the 10% rise in Tesla shares failed to inspire a wider rally in global markets. Shares in China and Hong Kong fell overnight, causing European indices to trade mixed in the first half of Tuesday’s session. While Spain’s Ibex was up nearly 1.5%, the top shares indices in France and Germany were down by around half a percent each. US index futures were also a touch lower, hurt by a 10% slide in Oracle shares in pre-market following its results. With the US dollar also rebounding across the board, things could start to turn more volatile for equities again, especially if Apple fails to wow investors.

Tech stocks will be in focus after the big rally in Tesla on Monday being countered somewhat by a big fall in Oracle shares, ahead of Apple’s launch of the new iPhone 15 and Arm’s IPO. But apart from tech optimism, there’s not much to cling on to right now. So, there is a big risk that things could get worse before stock prices become attractive again in these tough economic times.

ZEW remains deep in the negative as Eurozone data fails to impress

Following last week’s mostly weaker-than-expected data, there was finally a bit of good news as German ZEW survey came in slightly better. But at -11.4, German institutional investors and analysts remain quite pessimistic, albeit less so than last month (-12.3). But the respondents of the survey rated the relative 6-month economic outlook for the Eurozone at -8.9 compared to -5.5 the month before, meaning that they turned even more pessimistic over the eurozone outlook.

The latest data comes after last week’s disappointments, when Eurozone GDP (+0.1% q/q vs. initial estimate of +0.3%) and retail sales (-0.2% m/m) failed to beat the estimate, while German industrial production (-0.8% m/m vs. -0.4% expected), factory orders (-11.7% m/m), manufacturing PMI (which fell to 39.1 in August, marking the second-lowest reading since May 2020) all also showed alarming signs.

Against a backdrop of weakening Eurozone and Chinese data, the DAX outlook doesn’t look too great right now.

DAX outlook: ECB policy decision looms

While the upcoming US inflation data will probably provide the same directional bias for all major indices, the German DAX and other European indices will be facing an additional test from Thursday’s ECB meeting, which could move the markets sharply. Investors have chosen not to sell European markets too aggressively yet, owing to speculation the ECB will stop hiking rates amid growth concerns. As mentioned above, data after data has disappointed with Eurozone GDP being revised lower last week and a number of German indicators all missing the mark. The probability of a final rate hike at this ECB meeting has fallen sharply. The key risk now is if the ECB hikes anyway, which should send the DAX lower. But if it holds rates, then this might provide a temporary relief.

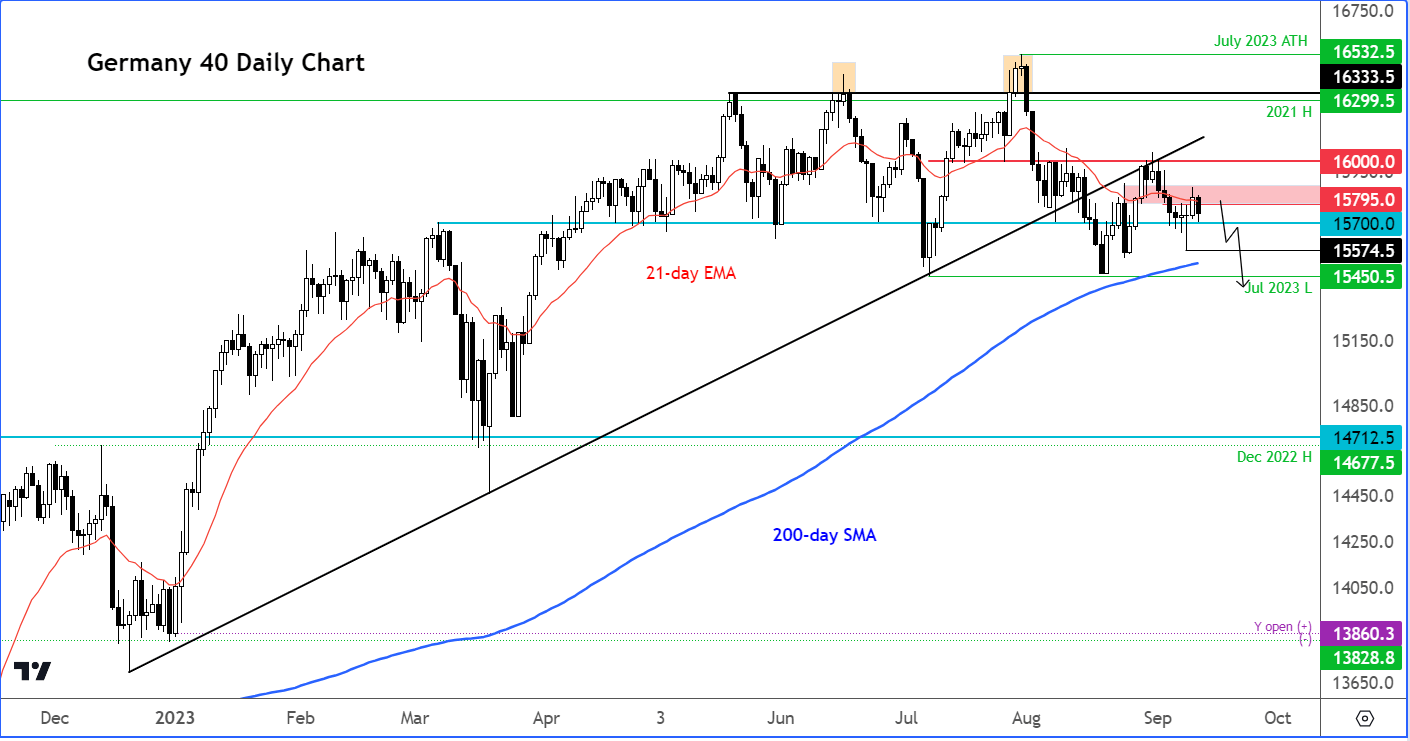

DAX outlook: Technical analysis

Ahead of this this week’s key events, the German DAX index has managed to cling onto some key short-term support levels, yet the upside has been capped with the backside of the broken trend line. The small lower highs point to further weakness for the German index. Short-term support comes in at 15700. A move below this level could pave the way for a drop towards last week’s low at 15575, followed by the July low at 15450. And if we break that level decisively, then we could be in for a volatile period in the markets.

Given that several short-term support levels have already broken down, patience is the key word if you are bullish on the German index. A clear move back above the key 16,000 resistance level is needed to tip the balance back in the bulls’ favour, although we would prefer a healthy correction before entertaining the long side again.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R