DAX outlook: With the US out, it has understandably been a quiet day so far in Europe where major indices were trading mixed but holding onto their recent impressive gains. Some of the major European indices hit new record highs last week, including the high-flying German DAX index. Even the UK’s FTSE joined the run. However, despite a big rally, none of the Wall Street indices broke to new unchartered territories, while China’s markets remained out of favour. It was still a pretty impressive week for most major indices, all things considered. The week ahead promises to be an interesting one, and it could start with a bang – even if without the participation of Wall Street on Monday, where banks will be closed in observance of Martin Luther King Day. Donald Trump will start his second term as US President today.

European stocks surge to record highs

On Friday, major stock indices enjoyed a strong rally, fuelled by record highs in major European indices like Germany’s DAX and the UK’s FTSE 100. What was driving this optimism? Well, significant drop in global bond yields, thanks to weaker-than-expected inflation data out of both the US and UK, played a key role. Adding to the good news, surprisingly strong corporate earnings and stronger economic data from China also eased concerns about the health of the world’s second largest economy. What’s more, the ceasefire in Gaza also provided a boost to investor sentiment.

Trump’s Inauguration

But let’s not get too comfortable. With Donald Trump set to take office on Monday, volatility could make a dramatic return. Trump’s pledge to hit the ground running with bold and potentially disruptive policies could potentially shake up European markets in the weeks ahead. And with Trump’s administration likely to revisit trade tariffs, China’s exports could also come under pressure, potentially reigniting market volatility.

Global PMI Data Could Shape the DAX outlook

Friday, January 24, will bring PMI releases from across the globe, offering an early glimpse into economic health. For Europe, where concerns about growth have weighed on currencies like the euro and pound, the data will be closely watched.

Interestingly, weaker currencies have been a boon for European equities, as investors bet on looser monetary policies in 2024. So far, recession fears have been muted, allowing stocks to shrug off softer economic data. But the question remains: how long can this disconnect last?

If PMIs show any improvement, the euro might catch a break, easing some of the selling pressure it has faced. However, it would likely take exceptionally poor numbers to dampen the current enthusiasm in stock markets. For now, the bulls seem firmly in control.

DAX testing major resistance trend

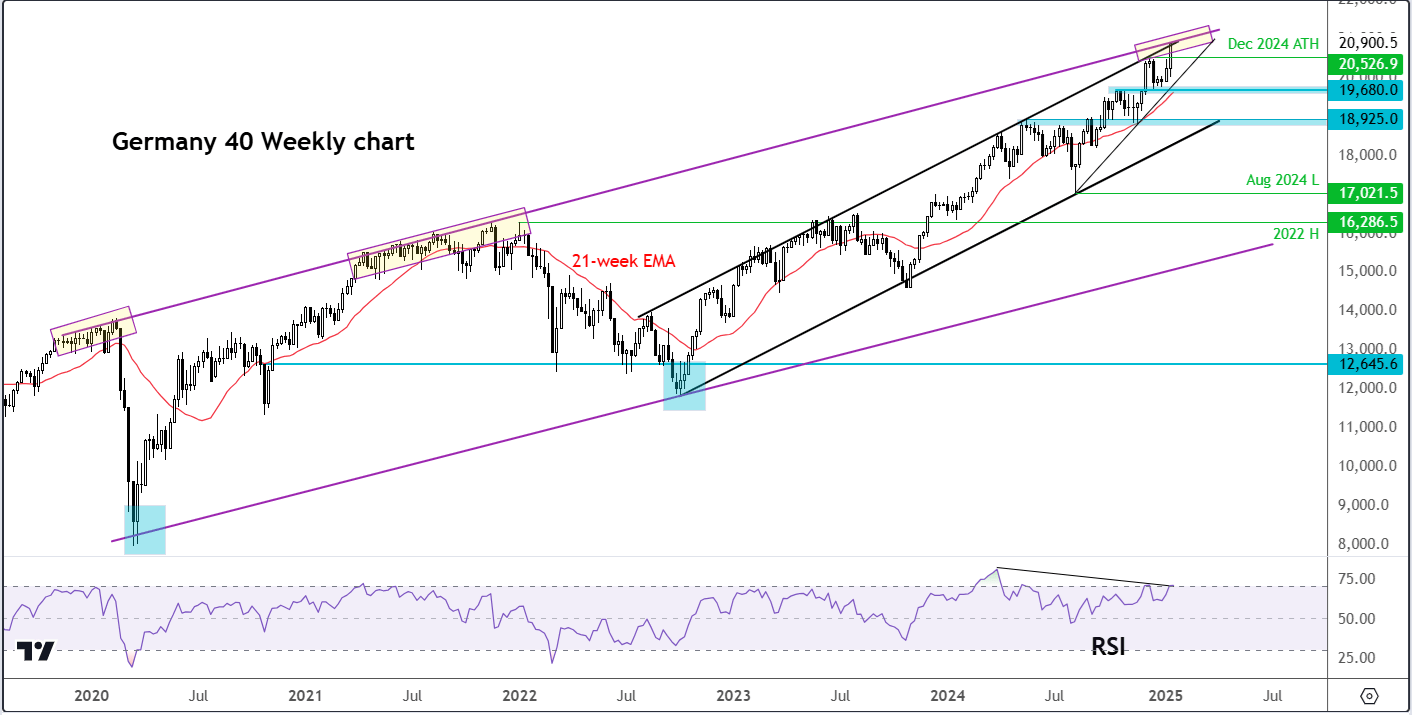

The DAX has reached a pivotal point, testing resistance at the upper boundary of its long-term bullish channel as well as a medium-term channel established back in 2022. This dual resistance, combined with negative divergence on the Relative Strength Index (RSI), hints that the rally’s momentum might soon lose steam.

Source: TradingView.com

Here’s the catch: while the DAX has hit new all-time highs, the RSI, which recently climbed above the overbought level of 70, is now making lower highs. This divergence between price and momentum is often a red flag for an impending correction. Yet, so far, the DAX has defied this signal.

For now, the uptrend is commanding the market, making it a buyer’s game until something fundamentally shifts. Traders will be closely watching for bearish price action or clear signs of a reversal. The December high, sitting just above the 20,500 level, is the key support to monitor. If this level holds, the bulls may have another shot at extending the rally. But if it breaks, it could mark the beginning of a much-needed correction.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R