European indices sold off yesterday and were trading mixed this morning with indices in Spain and Italy a bit higher while those of the bigger economies lower. Chinese markets bounced back, and this helped to limit the losses. But overall sentiment remains cagey. European investors are waking up to the reality that Trump’s tariffs will impact European exports to the US. As the election dust continues to settle, European indices are feeling the impact of several factors: the threat of tariffs, the potential for a relatively tighter US monetary policy, and declining commodity prices. This week’s US inflation data may impact Wall Street but will likely have limited implications for European indices. But one factor that is certainly weight on sentiment on this side of the pond is political uncertainty in Germany. Against this backdrop, our DAX forecast is turning bearish in the short term, especially if the German index now breaks a key support area that it was testing at the time of writing.

Before discussing the macro factors further, let’s take a look at that area of support I mentioned in the opening paragraph and discuss its importance and implications.

Technical DAX forecast

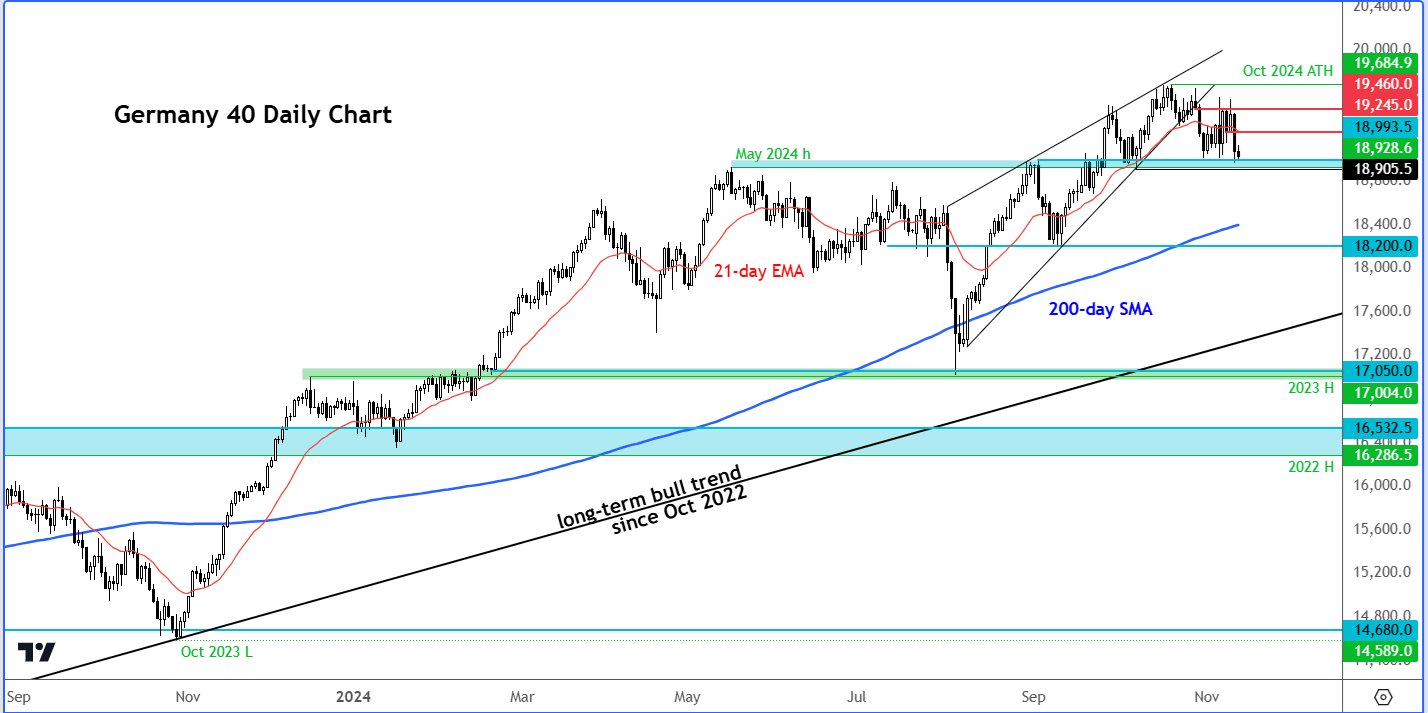

After Tuesday’s sharp drop, the DAX broke several short term support levels to erode the bulls’ control. At the time of writing, DAX was testing a key support area between 18,905 to 19,000. This area is shaded in light blue on the daily chart, below.

Source: TradingView.com

The above mentioned support area was a major resistance zone back in May and a few times in September, before we finally saw a breakout. This area has now been tested from above on at least a few occasions. So far, the bulls have held their ground.

But with a deteriorating sentiment, the support area here could give way in the coming days, possibly as soon as today. If this happens, it will confirm our bearish view, putting the DAX forecast on a downward trajectory in the short term outlook.

A breakdown could see the DAX potentially head down to the 200-day moving average which sits around 18,400 currently.

Meanwhile if support holds and we see yet another bounce here, then the index will still have to reclaim a few broken levels to maintain its long term upward trajectory. Among other levels to watch for resistance include 19245, which marks the low from Monday’s range.

Sentiment dented by political uncertainty in Germany

Yesterday’s release of German ZEW economic sentiment was weak. Hardly surprising when you consider what is currently happening in German politics. Anyway, it came in at 7.4 compared to 13.1 in October, and well below the expected figure. Deteriorating sentiment Germany could impact the Eurozone as a whole given the importance of the nation both as the economic powerhouse of the eurozone and also a major contributor of the NATO. With the US likely to withdraw its support for Ukraine under Trump, this could put the European economies — Germany in particular — in a weak spot to continue defending Ukraine.

German Chancellor Olaf Scholz will face a confidence vote on December 16, paving the way for an early general election in February.

China weakness also not helping the DAX forecast

The Eurozone’s already fragile economy faces potential new challenges, with US tariffs on its exports possibly reaching 10% to 20%. Additionally, US tariffs of up to 60% on Chinese goods could further strain the Eurozone in 2025. China, already grappling with a property crisis, continues to see its equity market struggle, despite several rounds of stimulus measures. Given China’s role as a major trade partner for Europe, particularly Germany, further economic weakening there would directly impact growth in the Eurozone. This week’s inflation data from China also highlights weak domestic demand, with producer prices dropping by 2.9% year-over-year. Against this backdrop, it is becoming increasingly difficult to maintain a bullish DAX forecast by investors.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R