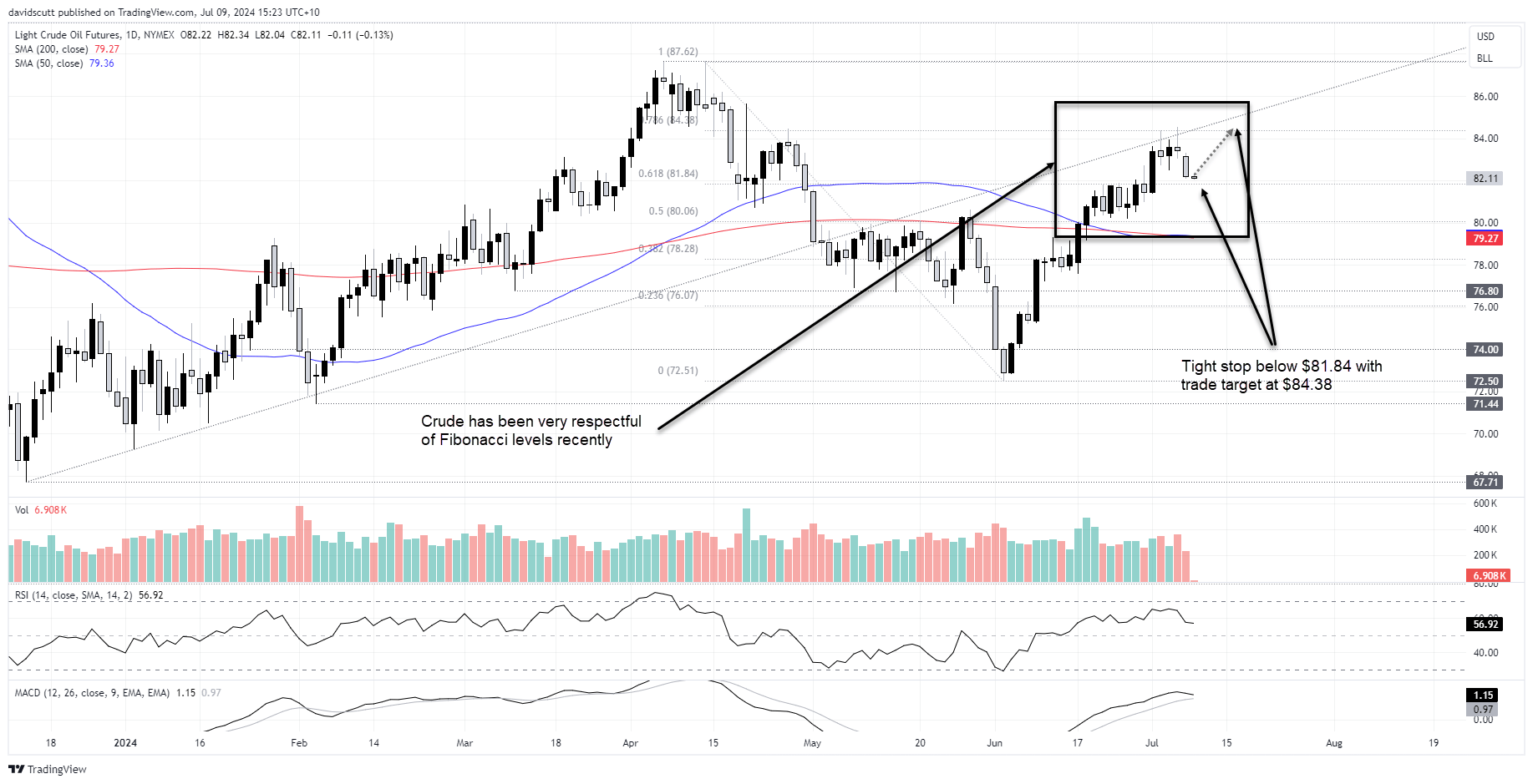

- WTI crude oil futures have been respectful of Fibonacci retracement levels recently

- Crude has also enjoyed a strong correlation with S&P 500 futures over the past month

- Jerome Powell has little reason to deliver a hawkish message to Senate policymakers later today

- Early rate cuts from the Fed should benefit cyclical assets such as crude

Overview

WTI crude oil has been respectful of Fibonacci retracements over the past few weeks. It’s also enjoyed a strong correlation with US S&P 500 futures over the past month, suggesting risk appetite is playing a role in determining its fluctuations. With Jerome Powell having little reason to remain hawkish before the US Senate Banking Committee later Tuesday, the pullback in recent days provides a decent entry level for longs.

Crude oil long setup

You can see what I mean by respectful when looking at the WTI daily chart, with the rally stalling out at the 78.6% Fibonacci retracement of the April to June high-low before reversing back towards the 61.8% retracement where the price was capped up until last week.

Concerns about damage to oil infrastructure caused by Hurricane Beryl and perennial hopes for a peace deal in the Middle East were said to be behind the reversal, but when you look at the charts, a lot of the price action can be explained by simple technicals.

Considering the 61.8% retracement acted as resistance earlier this month, it may now act as support, allowing for long trades to be set targeting a rebound back above $84. A tight stop below would offer protection and decent risk-reward.

Powell likely to be dovish

While weekly inventory data from API and EIA carries the risk of kneejerk reactions depending on the detail conveyed, before they arrive in the coming days, Jerome Powell’s appearance before the Senate Banking Committee looms as a key risk event for markets and broader risk appetite.

To be clear, I think Powell will be dovish. Not only because his commentary has been on that side of the spectrum for a while now but also because he has little reason to be hawkish. Disinflation looks to have returned, unemployment is drifting higher and economic data is rolling over. Importantly, he’s stated on numerous occasions that policy settings are restrictive. Given recent dataflow, it’s arguably more than just restrictive.

Should he deliver no pushback to markets that are 80% priced for the first rate cut to arrive in September, it could lead to another wave of risk appetite, something that should benefit crude considering it will help foster the soft-landing narrative for the economy.

Over the past month on a rolling daily basis, the correlation between WTI and S&P 500 futures sits at 0.81, signaling a strong positive relationship between the two variables.

-- Written by David Scutt

Follow David on Twitter @scutty