- Crude oil outlook positive amid OPEC+ supply cuts

- Crude oil boosted from multiple sources today: US dollar, bigger than expected crude product draw, and positive risk sentiment after China set ambitious growth target

- WTI technical analysis point to bullish breakout

With gold hitting a record high today and Bitcoin yesterday, crude oil and most other financial markets have gone a bit under the radar. But the US dollar looks like it may have peaked today, with major FX pairs all surging higher. Meanwhile WTI crude oil has climbed above the $80 handle, before easing back a little. But recent bullish price action and a supportive macro backdrop suggest more gains could be on the way, following a lengthy consolidation in a tight range.

Why is crude oil on the rise?

Crude oil has found support from multiple sources today, not least a weaker US dollar. We also saw a bigger than expected crude product draw, which is pointing to strong demand, while Saudi raised its prices to Asian buyers. Positive risk sentiment and China’s ambitious growth target also helped to support oil.

The greenback fell after the ADP private sector payrolls report showed fewer-than-expected job gains, while a separate report revealed job openings and hiring slid. The official employment report, due for release on Friday, will shed more light into the employment sector, which has held up remarkably well throughout periods of heightened inflation. Meanwhile, Jerome Powell didn’t say anything new, so there was no reason for the dollar bulls to show up.

Meanwhile, the latest crude inventories report revealed stockpiles rose as expected, but there was a notable drawdown in stocks of oil products like gasoline and distillates:

- Gasoline stocks: -4.46mm (-1.4mm expected) - biggest draw since Nov

- Distillates: -4.13mm (-400k expected) - biggest draw since May

Crude oil prices were already on the rise before the Department of Energy released its weekly inventories report, with prices boosted by a weak dollar and after Saudi Arabia unexpectedly increased prices of its main grade to buyers in Asia. The risk-on sentiment across the financial markets also contributed to crude oil’s rise.

Meanwhile, the Chinese government’s plan to help expand its economy by 5% is also boosting oil prices, since China is the world’s largest importer of oil. If we see the announcement of stimulus measures to deal with issues facing the economy, including a debt crisis in its real-estate sector, then this could boost all sorts of risky assets, including crude oil.

Crude oil outlook

Looking ahead, barring surprising weakness in global data to point to subdued demand for oil, crude prices are likely to extend their gains in light of recent bullish price action and an overall supportive macro backdrop – thanks, largely, to the ongoing intervention by the OPEC+ group.

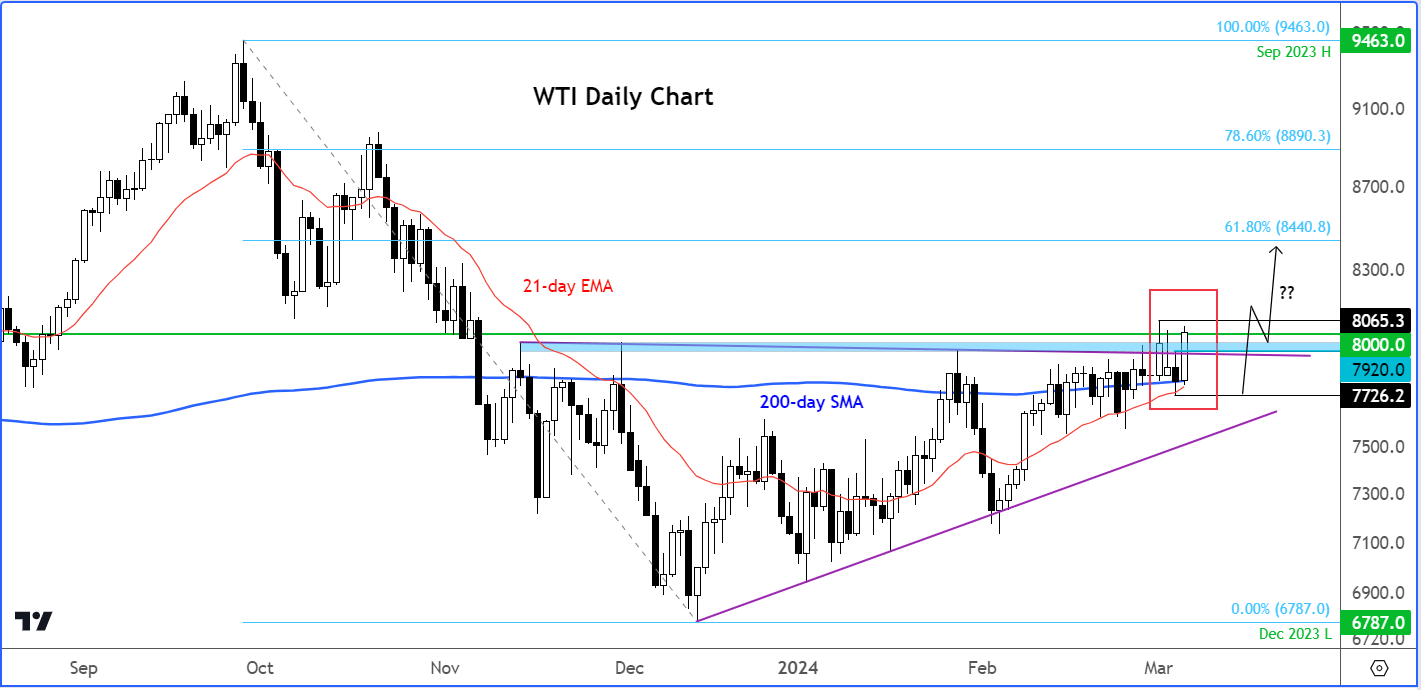

Crude oil outlook: WTI technical analysis

Source: TradingView.com

Crude oil has broken above Tuesday’s high of $79.20ish, which is bullish. This is because on Tuesday, oil had created a bearish candle, and now that we have broken above it, this has taken out many bearish speculators. Prices have repeatedly sold off from around the $79.00 handle on multiple occasions since November. Now that we have a clean break above it, the technical path of least resistance has been confirmed to the upside.

The bulls will be eying a daily close above $80 to maintain the bullish momentum. If so, WTI could be heading towards $82.00 next, and potentially climb towards $84.40, which corresponds with the 61.8% Fibonacci retracement level of the downswing from September.

The line in the sand for me is at around $77.25 now, where this week’s rally has started. Should oil prices break that level, then this could lead to a sharp withdrawal of bids, leading to a correction. However, this is not my base case scenario.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R