Article Outline

- Key Events: Chinese Data, Inventories, and Ceasefire Agreements

- Crude Oil Technical Analysis: 3-Day Time Frame

- Technical Analysis (TA) Tip: Fibonacci Extensions

Crude oil began 2025 with positive momentum, bolstered by holiday traffic and optimism around China’s economic stimulus measures. These factors offset concerns stemming from Trump’s bearish energy agenda. The development of China’s economic policies remains in the spotlight after its pivotal role in OPEC’s 2024 supply quota restrictions.

Referring to my 2025 oil outlook, oil prices this year are set to be shaped by a mix of competing forces: China’s economic strategies, Trump’s energy policies, OPEC’s decisions, geopolitical conflicts, and the ongoing global shift toward clean energy.

While the market is currently range-bound, it is recording gains on the back of improved demand expectations fueled by holiday traffic and China’s economic pledges. However, the primary trend remains bearish.

Key Events to Watch

China

Inflation Data: CPI and PPI figures on Thursday

Next Week: Data on loan prime rates, new Chinese loans and foreign direct investments, both of which are near decade lows.

Inventories

Inventories have been in deficit since November, driven by holiday traffic and strong seasonal demand. Inventories will be watched on Wednesday for any shift in sentiment given the end of the holiday season

OPEC and IEA Reports

Next Week: Market focus will be on the aftermath of OPEC’s fifth consecutive downward revision of oil demand and prices in December 2024

2025 Outlook

The outlook for 2025 remains uncertain amid the upcoming Trump presidency, marked by sharp divergences in trade policies, geopolitics, and economic stimulus measures. These factors are likely to lead the Federal Reserve and central banks toward cautious monetary stances, including further rate reductions to balance inflation risks.

Geopolitical tensions also remain a critical factor, with the Middle East ceasefire yet to reach a stable resolution. This uncertainty supports commodities like gold and keeps oil positioned as a hedging tool, maintaining upward pressure on its valuation.

Technical Analysis: Quantifying Uncertainties

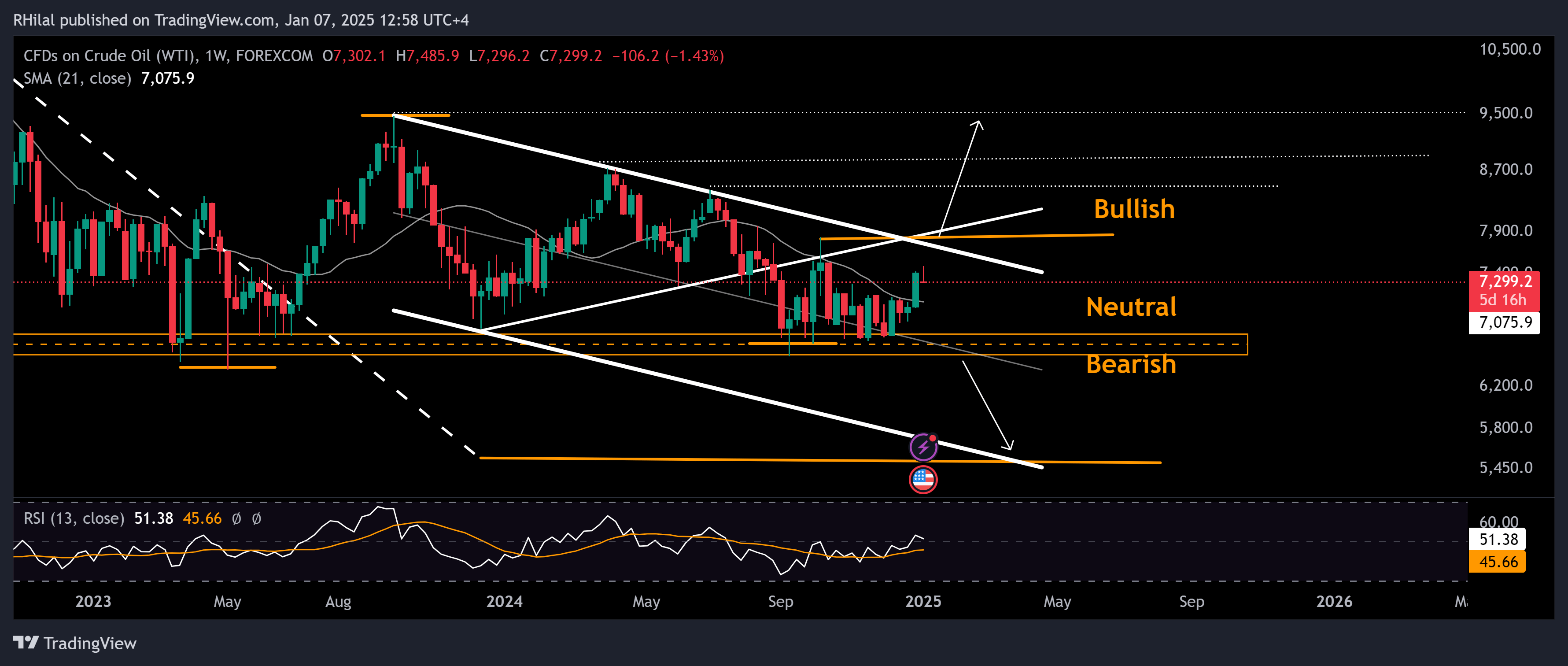

Crude Oil Forecast: 3Day Time Frame – Log Scale

Source: Tradingview

Bullish sentiment has lifted oil prices above the $72 resistance level, the 20-day simple moving average (SMA), and the 3-day Relative Strength Index (RSI) above its moving average and neutral zone, reinforcing a short-term positive bias on the chart.

However, overall price action remains constrained within the down trending channel extending from 2023 highs. A decisive close above $78.30 is required to confirm a shift to a sustained upward trend, with potential resistance targets at $84, $87, and $95.

On the downside, aligning with the broader downtrend since the 2022 highs, the major support zone lies below $72, within the $68–$64 range, which has held as key support since December 2021. A clear close below $64 could trigger further declines toward $60, $55, and $49 in extreme scenarios.

TA Tip: Fibonacci Extension Tool

If price action successfully breaks out above the defined down trending channel and the $78.30 high, the Fibonacci extension tool can be applied. The May 2023 low, September 2023 high, and September 2024 low can be used as reference points to project the next potential highs for crude oil. Fibonacci levels aligning with previous support/resistance points can be inserted in the forecasting equation.

Written by Razan Hilal, CMT

Follow on X: @Rh_waves

YouTube: Forex.com