- IEA: clean energy spending hits all-time high in 2024

- IEA Short-term Energy Outlook is due today

- Crude Oil inventories are at 11-month lows

- Fed Chair Powell testifies ahead of June CPI data

The latest clean energy investment event in London highlighted the all-time high levels of global spending on clean energy. Corporations are holding the largest share of energy investments, and households have doubled their share since 2015. With green agendas on track towards the net zero emission plans by 2030 and 2050, the future of oil demand is set at risk.

From a short-term perspective, the broader market's bullish sentiment, driven by expectations of easing monetary policy and positive economic growth projections, is positively impacting oil trends. This sentiment was supported by the start of the summer driving season and hurricane season, which contributed to a drop in crude oil inventories to 11-month lows.

Later today, Jerome Powell’s testimony on the semi-annual monetary policy report is expected to introduce market volatility, with investors hoping for indications of a rate cut. Market sentiment may shift if tomorrow’s CPI results do not align with the recent disinflationary trend, increasing the focus on risk management strategies.

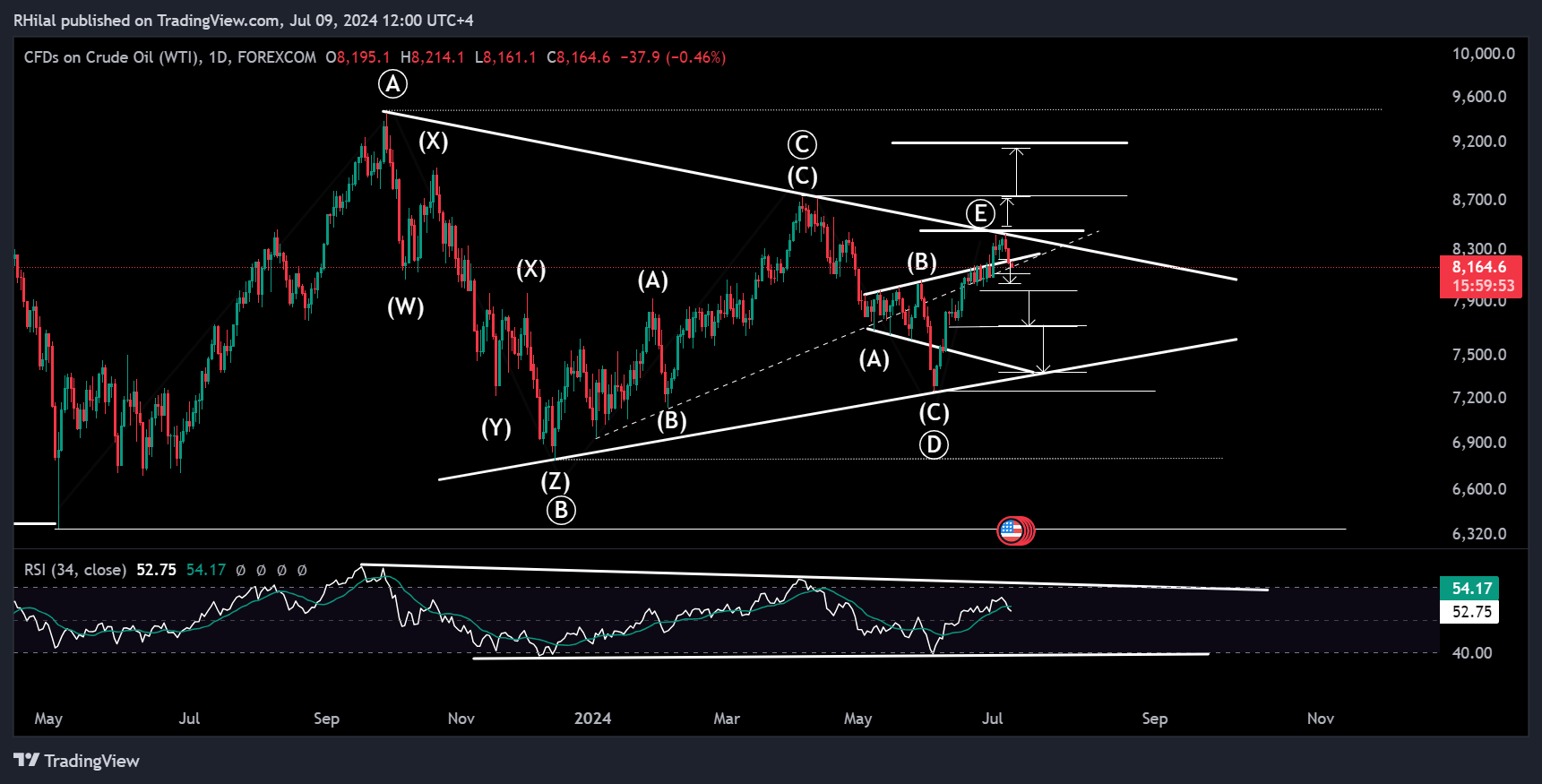

Crude Oil Forecast: Daily Time Frame – Logarithmic Scale

Source: Trading view

After retesting the 0.618 extension and reaching the 84.50 high at the upper border of its triangle, oil is now trading back within the previous consolidation range formed in May. The recent one-month uptrend appears to be reversing, with a double top pattern suggesting a potential decline towards the 80 border, followed by the previously mentioned 77 level.

The broader market remains relatively bullish, anticipating insights on easing monetary policy from Fed Chair Powell's testimony. Another surge in market enthusiasm, beyond already priced-in effects, along with oil crossing the 85 region, could revive the trend towards the yearly high of 87 and potentially into the 90s range. However, a bearish reversal is currently in play.

--- Written by Razan Hilal, CMT