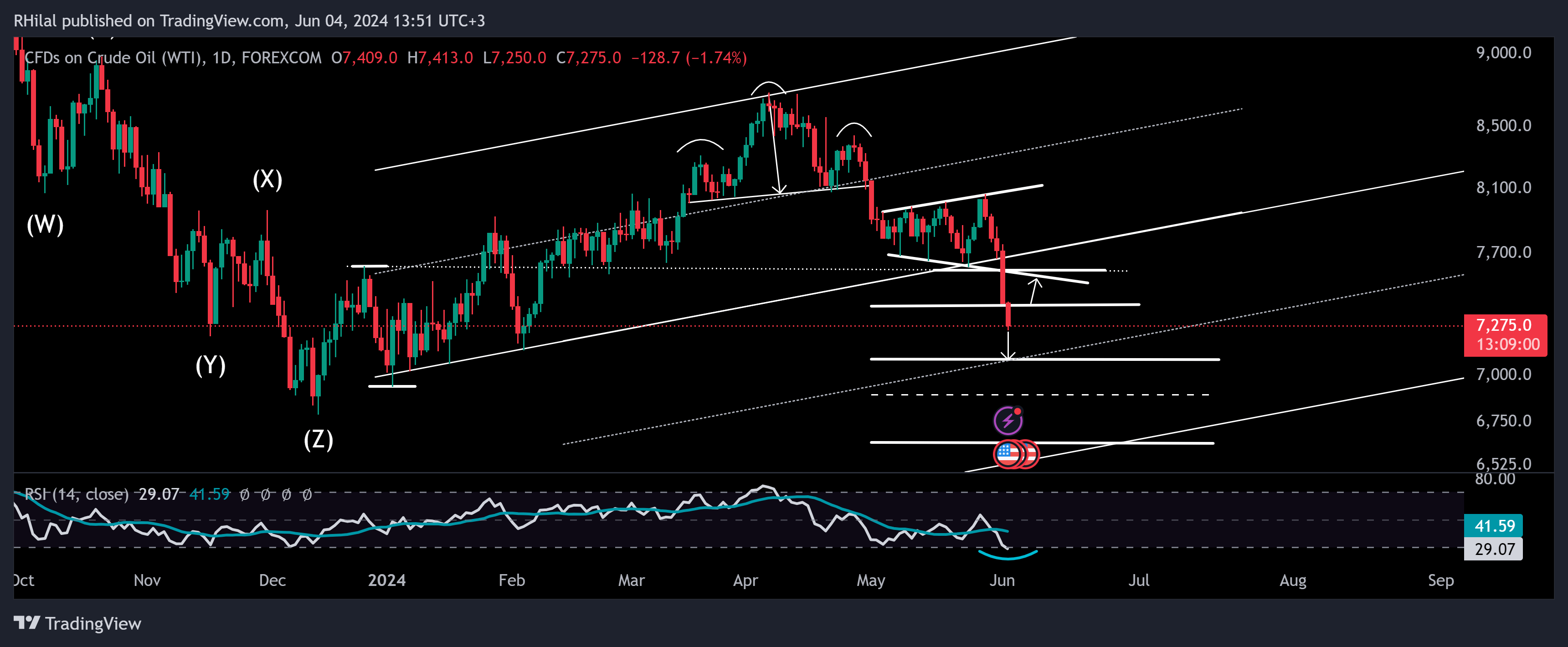

• Crude Oil is retesting February lows with oversupply concerns

• USOIL Daily Relative Strength Index hits lowest level since March 2023

• Silver dives deeper into 29$ territory, bulls look for buying opportunities

Bearish market anticipation is looming over oil markets with oversupply concerns. OPEC supply policies are not guaranteed to shift by October, yet the market priced in an oversupply amid a weaker demand outlook for the economies. JOLTS Job openings are in sight today for an early insight on the employment state and economic activity potential, ahead of the non-farm payrolls on Friday. From a technical view, the steep drop of oil charts is accompanied with a steep retest to oversold relative strength index levels, spiking contrarian investor interest.

With respect to Silver, the precious metal hit a deep dive after retracing its 11 year-highs at 32.50$ per ounce, and bulls are looking for retracement opportunities to reload their long positions onto the potential evergreen investment.

Technical Analysis:

Crude Oil Analysis: Daily Time Frame – Logarithmic Scale

With bearish dominance crude oil’s trend has dropped beyond the yearly up trending channel and is headed towards the mid zone of its bearish duplicate. The next key level in sight is the 70.80 level, being the 0.618 extension level from the 2023 high, 2023 low, and 2024 high. A further drop would head to the lower channel extremity towards the 66-zone, given the breakout below 69. Positive rebounds can meet resistance levels back at the previous broken supports, near 74 and 75.50.

Silver Analysis: Daily Time Frame – Logarithmic Scale

Heading deeper into the 29-price zone territory, buying opportunities can potentially be found near the 29 – 28.50 price zone given the breakout below the latest 29.58 low. As previously mentioned, market odds are valid game players, and an extreme drop can retest the 26 level. On the upside, the 31.50 and 32.50 levels are potentially the next resisting barriers prior to the continuation of the primary uptrend.