- Bulls are reloading long gold positions with each retest of the 2327 – 2315 levels

- Bearish sentiment regarding U.S. economic activity has halted with the stronger-than-expected U.S. ISM Services PMI indicator

- Crude oil inventories have increased, and oil is continuing its bullish rebound

The trend of bearish U.S. economic data came to a halt yesterday with the ISM Services PMI reaching 9-month high, exceeding expectations. This week's bearish economic data reflected concerns over the U.S. economy's demand potential, which weighed on commodity prices. The highest volatility of the week is expected with the release of non-farm payrolls on Friday.

Critical support levels were tested by commodities this week, including silver's lower end of the 29-price zone, gold's lower end of the 2300 price zone, and oil's lower end of its yearly trend, touching critical oversold indicator levels.

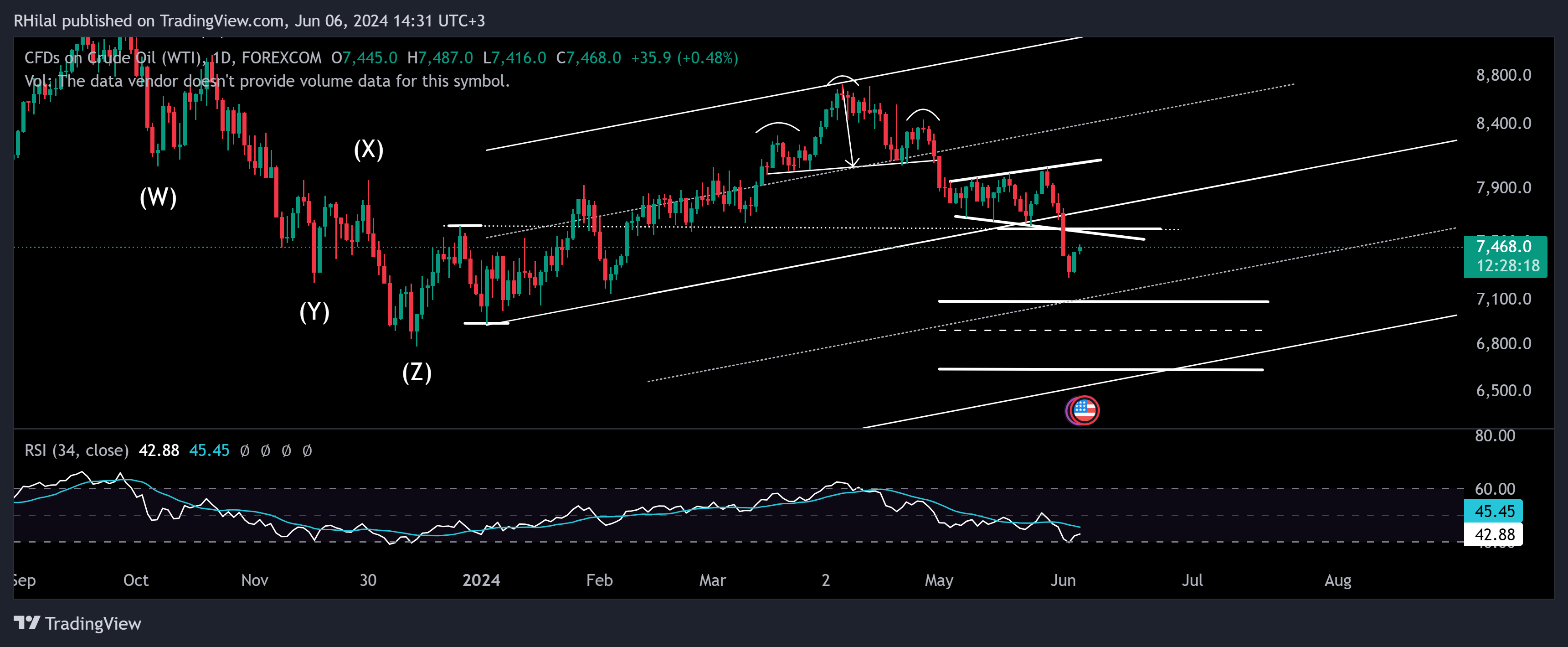

Crude Oil Outlook: USOIL – Daily Time Frame – Logarithmic Scale

From a daily perspective and considering the smoothed relative strength indicator, oil rebounded from its oversold zone after hitting a weekly low at 72.50. The potential increase in supply over demand has been priced into the charts, and further disappointing growth metrics would be necessary to push oil prices lower. Support can be found near the 71 zone, while resistance levels are expected around 75.60 and 77.60.

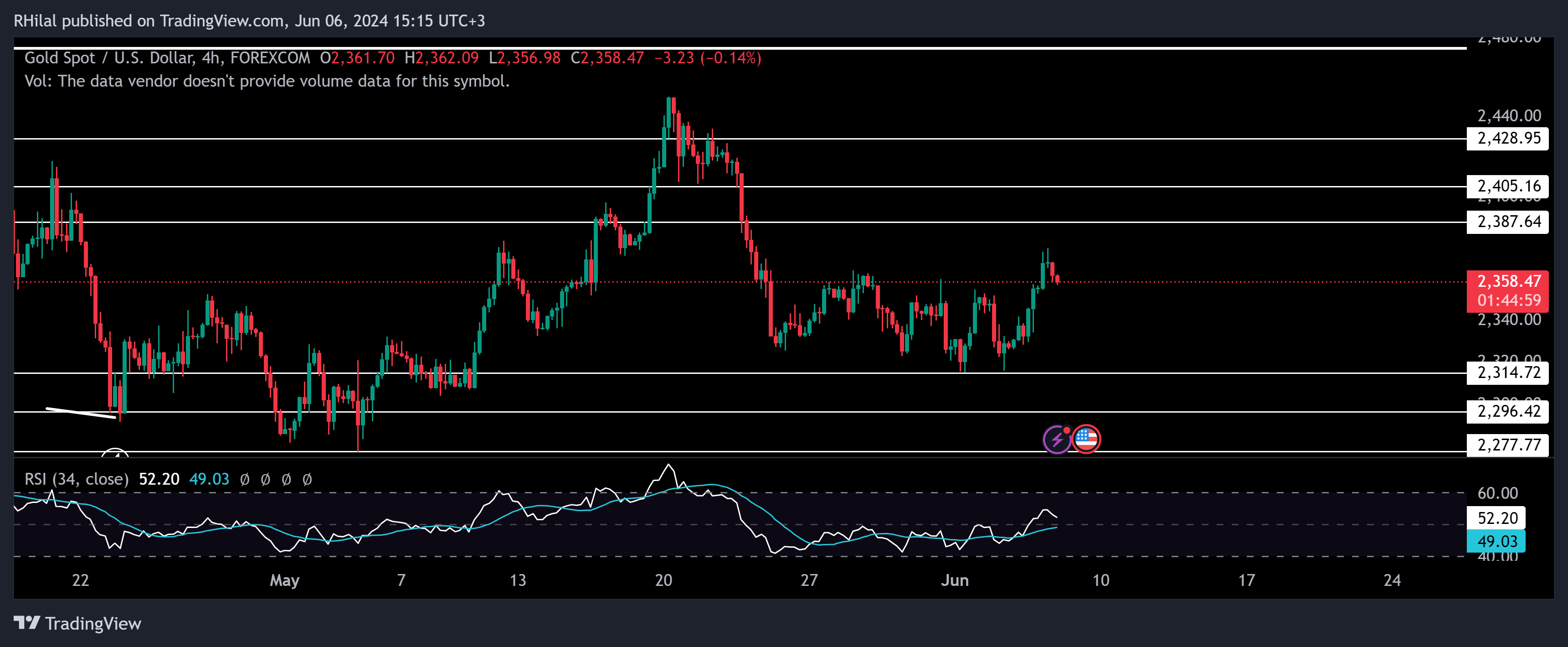

Gold Outlook: 4H Time Frame – Logarithmic Scale

Bulls are dominating bear trends near the lower end of the 2300 price zone. The 2315 support level has been retested twice, and any attempts for a lower breach have the potential to reverse near the 2300, 2290, and 2270 areas respectively. From a smoothed relative strength perspective, there is more upside potential, and a break above 2380 can boost uptrends back towards 2390, 2405, and 2430.

--- Written by Razan Hilal, CMT