USD/CNH Key Points

- The Biden Administration is reportedly considering capping sales of advanced artificial intelligence processors to some countries that may serve as conduits for China.

- We’ve seen an uptick in Donald Trump’s polling figures, raising the likelihood of a “trade war” with China.

- USD/CNH is flirting with its most bullish day of the year (0.59%).

Traders have been hyper-focused on developments out of China for the last several weeks now, with the world’s second-largest economy announcing a raft of stimulus measures aimed at revitalizing the property sector, boosting liquidity, and restoring consumer confidence. The total package is estimated at 7.5 trillion yuan (around $1.07 trillion), making it potentially the largest in China's history, but traders are increasingly skeptical that without an equivalently large fiscal spending package, the impact on consumer spending and economic growth will ultimately be short-lived.

Against that backdrop, we’ve seen a big drop in China’s currency, the yuan, today. There are two primary factors driving today’s move. First, the Biden Administration is reportedly considering capping sales of advanced artificial intelligence processors to some countries. While exports to China are already restricted, some policymakers are concerned that China is using countries in the Middle East to facilitate more purchases of the most advanced semiconductors, and closing that loophole could weigh on future Chinese growth.

Separately, we’ve also seen an uptick in Donald Trump’s polling figures, to the point that he’s now approaching a 60/40 favorite on some election prediction markets. On Bloomberg today, the former President pontificated that “the most-beautiful word in the dictionary is ‘tariff,’” raising fears of another “trade war” with China if he’s elected. All else equal, large tariffs on China would be bearish for the yuan and bullish for the US dollar.

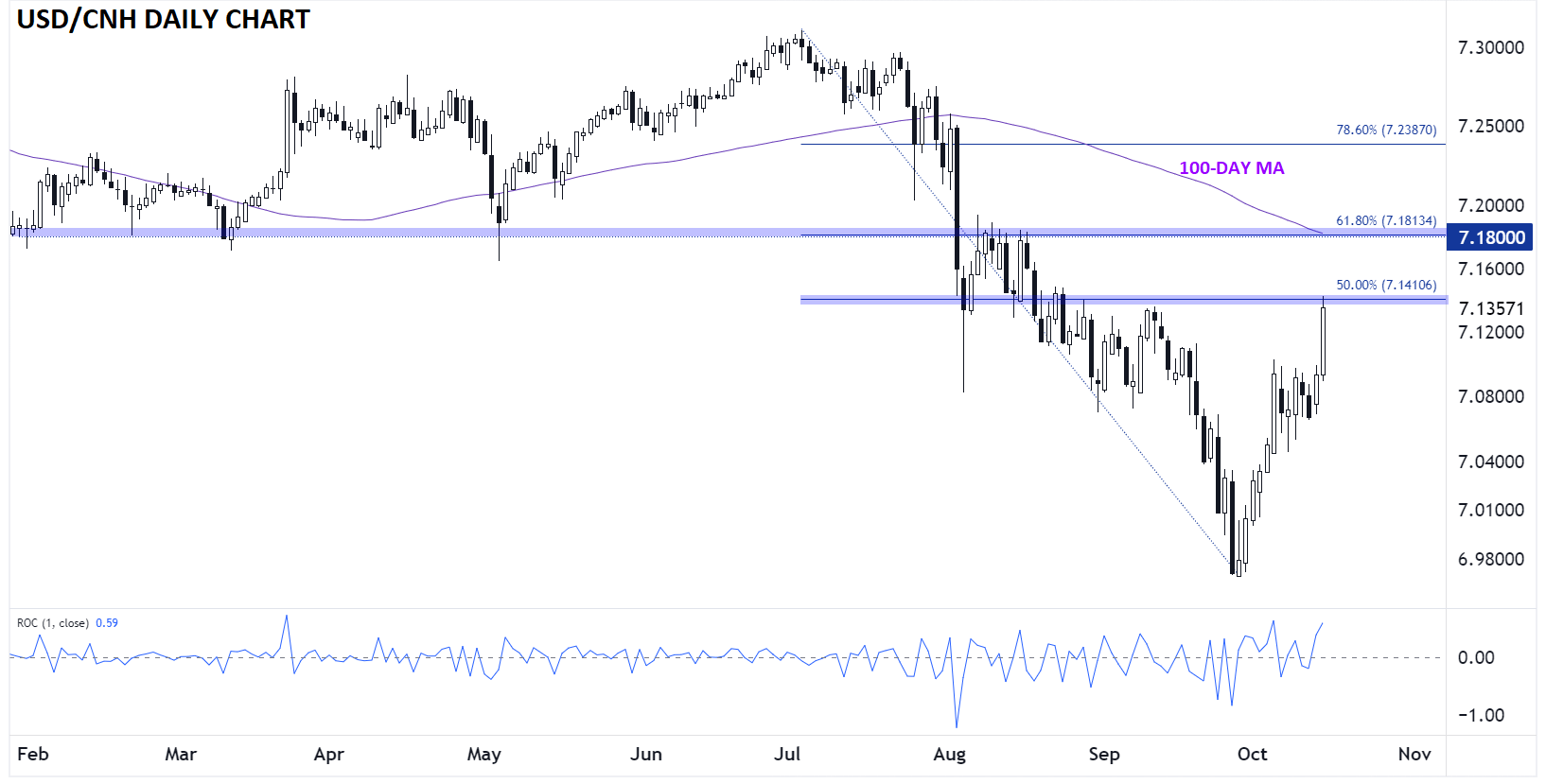

Chinese Yuan Technical Analysis – USD/CNH Daily Chart

Source: TradingView, StoneX

The chart above shows, the performance of the US dollar relative to the offshore-traded Chinese Yuan (CNH). As the 1-day ROC in the bottom panel shows, the pair is flirting with its most bullish day of the year (0.59%) on the back of the rumors of a potentially tighter cap on semiconductor exports and Trump’s rising odds of winning the election.

As of writing, USD/CNH has retraced about half of its July-September drop, marking a possible resistance level near 7.14. If that level succumbs to continued strength, the next technical level to watch will be the 61.8% Fibonacci retracement at 7.18.

-- Written by Matt Weller, Global Head of Research

Check out Matt’s Daily Market Update videos on YouTube and be sure to follow Matt on Twitter: @MWellerFX