Fixed-asset investment rose at a slower rate for the ninth consecutive month in November. Rising 5.25% ytd (year to date) compared with 6.1% previously it has fallen from a high of 12.6% just five months ago. State-owned investment fell to 3% ytd and private investment fell to 7.7%. In both cases, the rate of investment has diminished over recent months and looks set to slide further as we head into 2022. Consumption was also lower with retail sales falling to 3.9% and missing forecasts of 4.6% and down from 4.9% y/y. With numbers coming in this consistently weak it beckons further easing for fiscal and monetary policy as we head into the new year.

Read our guide on the PBOC (People's Bank of China) and inflation

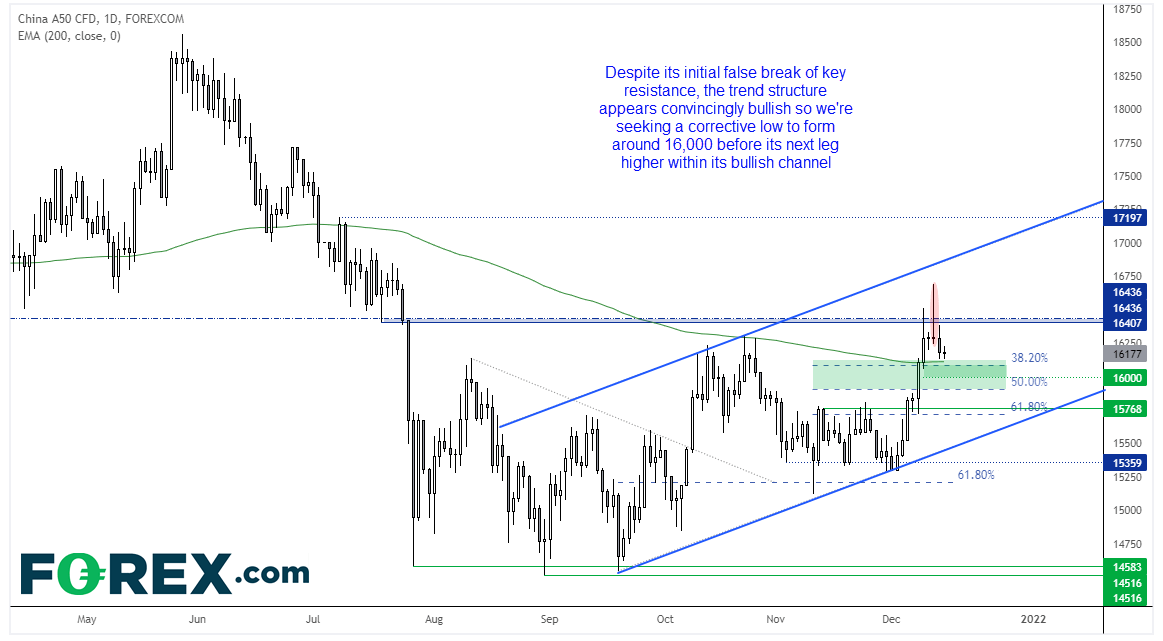

Bulls eye 17k on the China A50

On Monday the China A50 index rose to a near-4 month high. Yet its inability to hold onto those initial gains meant that the index closed the day with a bearish pinbar, and back below key resistance to warn of a bull-trap. However, we see this as a minor setback as opposed to a meaningful top.

The rally from the December low was seen with conviction and its pullback from the high is trying to form a base above the 200-day eMA. Even if price retrace further, we are quietly confident a base may form above or around 16,000 and for it to retain its bullish trend structure overall. Furthermore, a bullish trend is now being carve out with increasingly bullish momentum. A daily close above 16,450 and brings the upper channel trendline into focus for bulls.

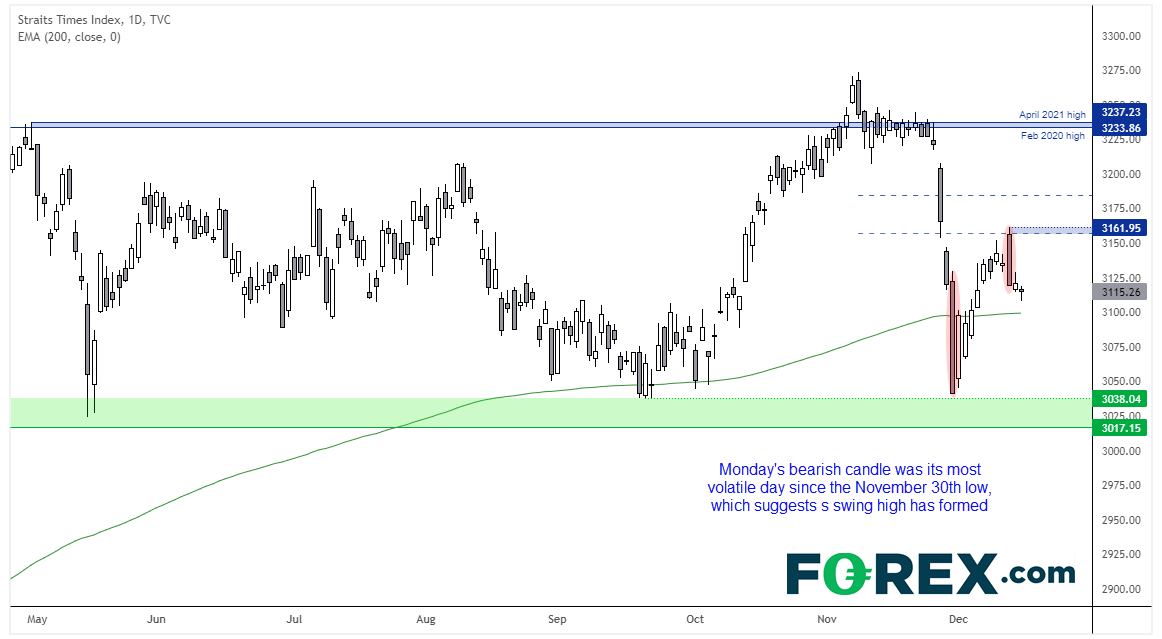

Volumes not supportive of STI’s rally

We noted in a previous report that Asian indices appeared set to bounce, although we weren’t quite as sure as to how high. Singapore’s premier index (STI) may have answered that question with its bearish engulfing candle on Monday. The bearish Marabuzo candle closed at the low od the day and was its most volatile (and bearish) session since the November 30th low. Ultimately momentum has realigned with the bearish move from the November high, and volumes during the rise from 3040 lows have been below average which suggests the bounce is corrective.

Therefore, our bias remains bearish beneath this week’s high / 50% retracement level. We may find 3100 holds as support initially as it is a round number near the 200-day eMA, but whilst prices remain below 3162 then we suspect another dip towards the 3017 – 3038 lows remain a possible scenario.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.