What is CFD trading?

CFD trading is a way of speculating on financial assets, like share dealing or ETF investing. However, CFD trading is a little bit different – because unlike investing in funds or stocks, you never own the underlying market.

Instead, you buy or sell a contract for difference (or CFD for short).

CFDs mirror the live prices of financial markets. When you trade one, you're getting the same exposure as you would if you had bought the asset it tracks.

But instead of investing in the market, you're buying a contract. And that contract enables you to exchange the difference in an asset's price from when you open your position to when you close it.

Let's take a look at a quick example to see how that works in practice.

CFD trading example: Tesla

Tesla is trading at $750, and you want to take your position on it. You could invest in Tesla stock with share dealing, or you could buy Tesla CFDs.

Investing

You invest in Tesla by buying 100 shares at $750. Tesla climbs to $800, and you sell your stock. You're selling each share for $50 more than you paid for it, giving you a $5000 profit.

CFD trading

You trade Tesla by buying 100 CFDs at $750, then close your position at $800. Your exchange the difference in Tesla's price with your provider, earning $50 for each CFD, or $5000.

As you can see, the result from each position was the same, but the method of getting there was a little different.

If Tesla shares had fallen to $700, then the result would be the same again.

With investing, you'd be selling your shares for $50 less than you paid for them. With CFD trading, you'd still exchange the difference in Tesla's price – but because the market has moved against you, you pay your provider $50 per share.

Why trade CFDs?

At this point, you might be wondering why traders would choose not to own any financial markets when they open positions. The answer is that CFDs come with some extra features and flexibility that you'd struggle to find when investing.

Let's take a look at three key features of CFDs.

1. Going short

As we've seen, a CFD is just a contract where your provider agrees to pay you the amount that a market has moved in your favour.

Because you aren't taking ownership of the market, you can choose whether you want to profit from upward movements (known as going long) or downward ones (known as shorting) when you open your position.

- You go long by buying CFDs. This will return a profit if the market has moved up when you close your position

- You go short by selling CFDs. Here, you'll profit if the market has fallen when you close your position

For example, say you believe that the price of oil is about to fall due to weakness in the global economy. With contracts for difference, you could profit from the bear market by selling Brent crude CFDs.

If Brent crude's price falls, you can close your position and pocket the difference in its price. However, if oil's price rises instead, you'd earn a loss.

2. Margin

When you open a CFD position, you don't have to pay its total value. Instead, you put down a deposit that might be 5% or 10% of the position's cost. After all, you aren’t actually buying the underlying asset, you’re just speculating on its price movements.

This is called leveraged trading, and deposit you have to pay is known as your margin.

Leverage gives you more flexibility over how to allocate your capital. If you wanted to trade £50,000 of Rio Tinto CFDs, you might only have to put down £10,000, meaning you aren't tying up all your available funds in a single position.

Your profit and loss would both be based on the full £50,000, though. So while leverage can be a powerful tool, you'll want to trade carefully and keep an eye on your risk management.

3. Range of markets

But there's another benefit to never owning the assets you're trading – you aren't limited in what you can buy or sell. If it's a financial market with a price, then you'll probably be able to go long or short on it with a CFD.

With FOREX.com, for instance, you can access over 300 global assets. That includes 220 stocks, 15 indices, 80 forex pairs, precious metals and more.

As well as giving you choice, this can be useful for diversifying your exposure. By trading markets in different asset classes and regions, you can lower your overall risk.

How do you trade CFDs?

You trade CFDs in a similar way to buying other financial markets, such as stocks. You buy or sell a set amount of your chosen asset, and how much you buy or sell dictates your profit or loss.

The main difference is what you're trading. Instead of shares, currencies or commodities, you buy and sell contracts that mimic the live prices of shares, currencies and commodities.

A Coca-Cola CFD will always track the price movements of Coca-Cola shares, for example. Buying one Coca-Cola CFD is the equivalent of buying a single share of Coca-Cola. You'll earn $1 for every dollar it moves up, and lose $1 for every dollar it moves down.

Buy 100 Coca-Cola CFDs, and you'll make or lose $100 dollars for each point that the shares move.

Buy and sell prices

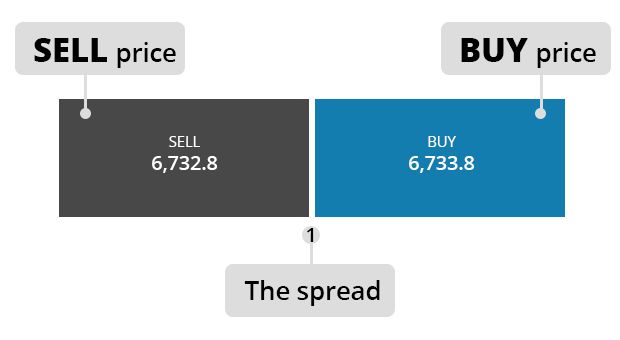

You'll always see two prices listed on a CFD market. The first is the sell price, and the second is the buy price. The difference between the two is called the spread.

Often, you'll find that all the costs to trade a CFD are incorporated into the spread, so you won't pay commission. On some markets, however, you'll pay via a commission instead. You'll notice that the spread is much smaller on these markets.

On long positions, you'll open at the buy price and close at the sell price. On short ones, you start by selling CFDs and close by buying them.

Start CFD trading today

If you’re new to CFD trading, then you might want to start out with a demo account. CFD demos enable you to test out trading markets with virtual currency, honing your skills before you commit real capital.

You can open a free FOREX.com demo in seconds.

CFD trading tips for beginners

1. Stick with what you know

You can choose from an enormous number of CFD markets to trade, but that doesn’t mean you have to leap into obscure assets immediately.

At the outset it’s usually a better idea to pick a small number of markets that you’re already familiar with. Once you start to gain confidence, you can look to diversify a bit more.

2. Start out small

Position sizing can be hugely beneficial when trading. Essentially, the idea is to only risk a small percentage of your total capital on each trade – perhaps 1% or 2%.

Keeping your total outlays small means you can learn from your mistakes without losing too much. If you’re only risking 2% on any trade, then you could afford to get 50 trades wrong in a row before losing your balance.

3. Always use a stop

Stops (stop-loss orders) help you control your risk on any given trade by automatically closing a position if it hits a specific level of loss. They take some of the emotion out of trading, and mean you don’t have to constantly watch each open position.

Successful traders won’t open a position without attaching a stop – no matter how experienced they are. However, standard stops don’t put an absolute cap on your risk as they can suffer from slippage. For that, you’ll need a guaranteed stop.