Canadian Dollar Talking Points:

- The Canadian Dollar was one of the weaker global currencies coming into this week and this has allowed for a sharp topside breakout to run in USD/CAD.

- EUR/CAD is working on a bearish outside bar on the daily chart, and this points to the possibility of range continuation while CAD/JPY is pushing deeper towards a key spot of resistance.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

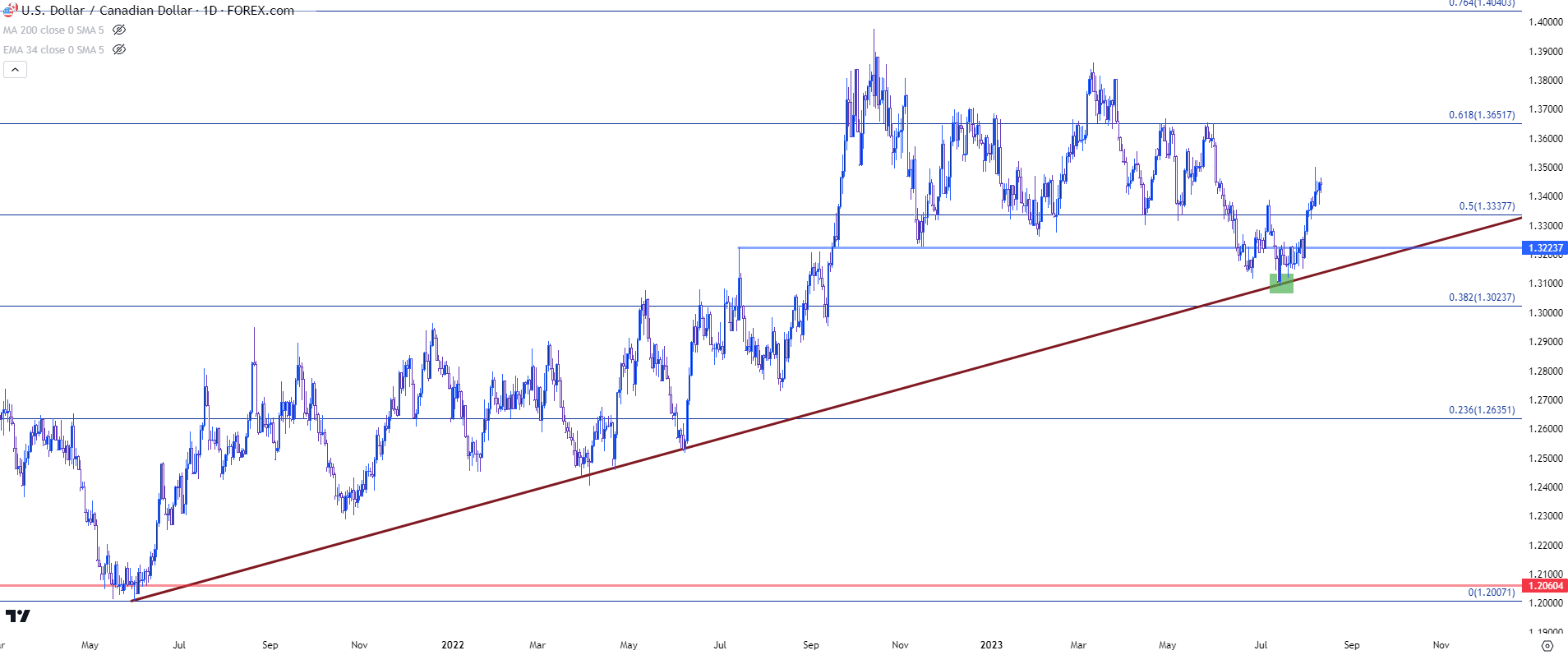

To set the stage we really have to go back to the month of June. This is when the Fed was expected to skip a rate hike for the first time since the hiking cycle had started, and there were scant expectations for any additional hikes coming out of Canada.

But the Bank of Canada surprised when they announced a 25 bp move of tightening on June 7th, and this kicked off a short-term breakdown in what was previously a clean range in USD/CAD. That bearish theme in USD/CAD continued to push into the end of June, with a bounce into a lower-high showing up in early-July. But another run from sellers fell flat as bears were barely able to push below the prior swing low at 1.3125.

And soon after that stall around the 1.3100 handle, another item of support came into the picture in the form of a bullish trendline taken from the lows in March and May, the projection of which caught the low and led into a bounce on July 14th.

That trendline is plotted below, with the support inflection highlighted in green.

USD/CAD Daily Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

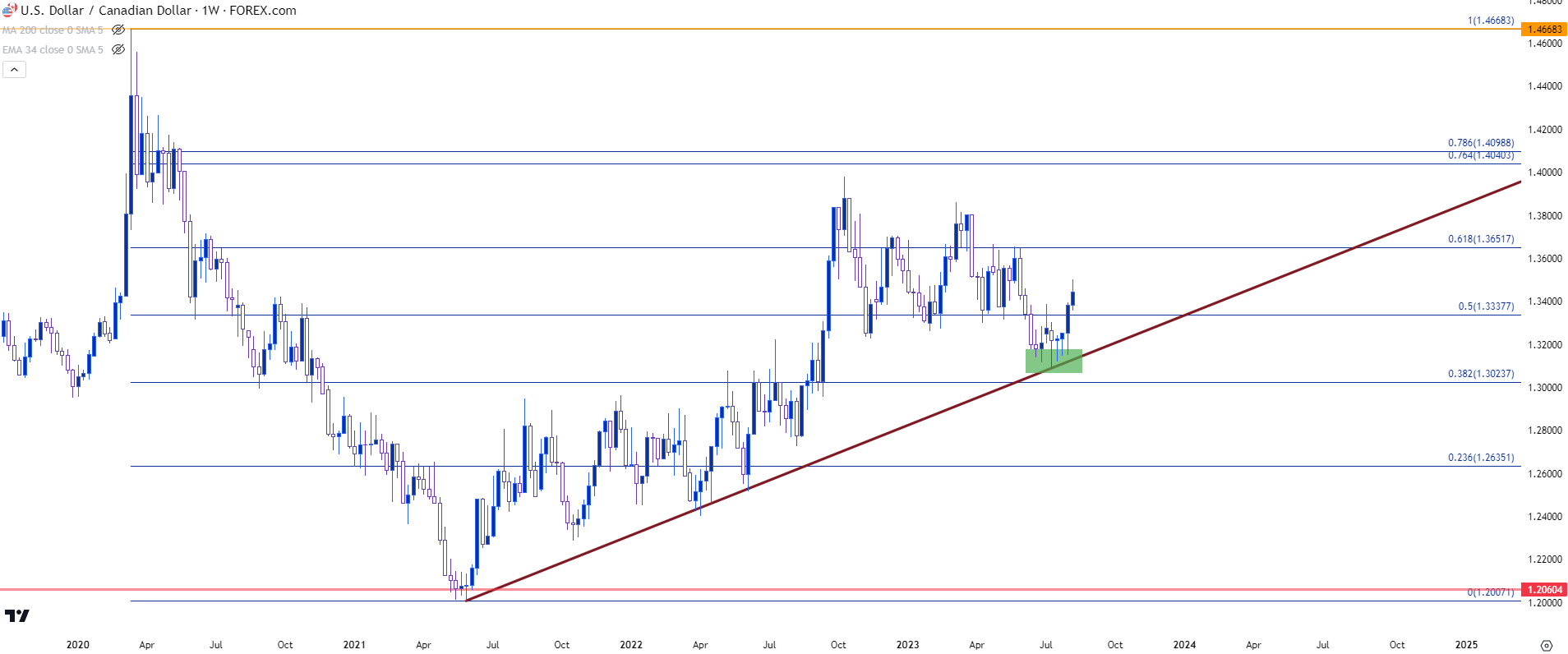

The weekly chart is of note here as it highlights that support inflection and the grinding price action that followed quite well. The green box has now been extended over a six-week period where support was taking over and this shows that bigger picture tug-of-war on full display as sellers were still pushing, trying to evoke a lower-low; but bulls were offsetting that pressure and helping to build that series of underside wicks that illustrates the support response.

USD/CAD Weekly Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

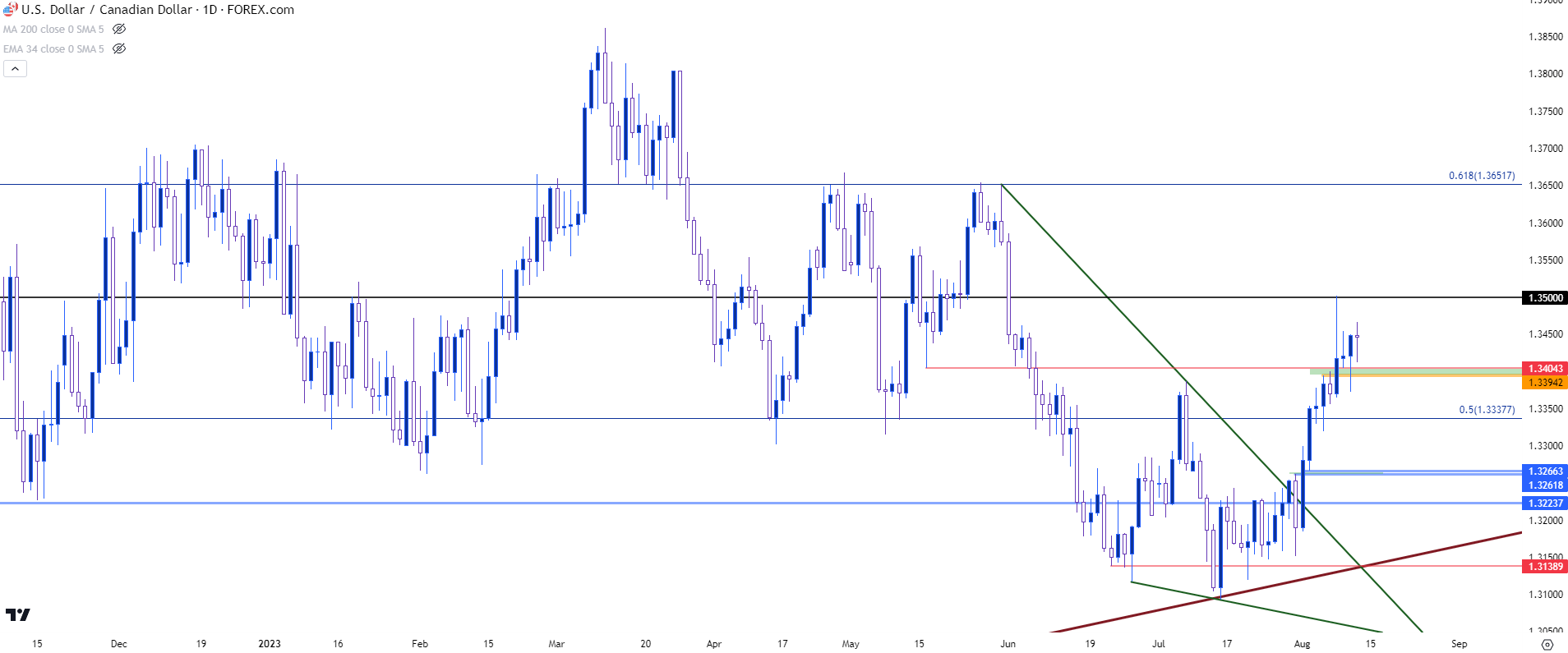

USD/CAD Reading Between the Lines

Something else was happening during that six-week support grind and this is something that I talked about multiple times on the weekly webinar. And that is the formation of a falling wedge, which is often approached with aim of bullish breakout potential. Such formations will often pop up with a prolonged trend runs into a big spot of support that begins to peel bears out of the picture while also starting to attract bulls on the basis of reversal potential.

That bullish reversal began to show in early-August trade and bulls were not bashful after the door closed on July.

That breakout ran through this week’s open with price finally re-testing the 1.3500 level on Tuesday, which I had again looked at in the weekly webinar while highlighting continuation scenarios.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

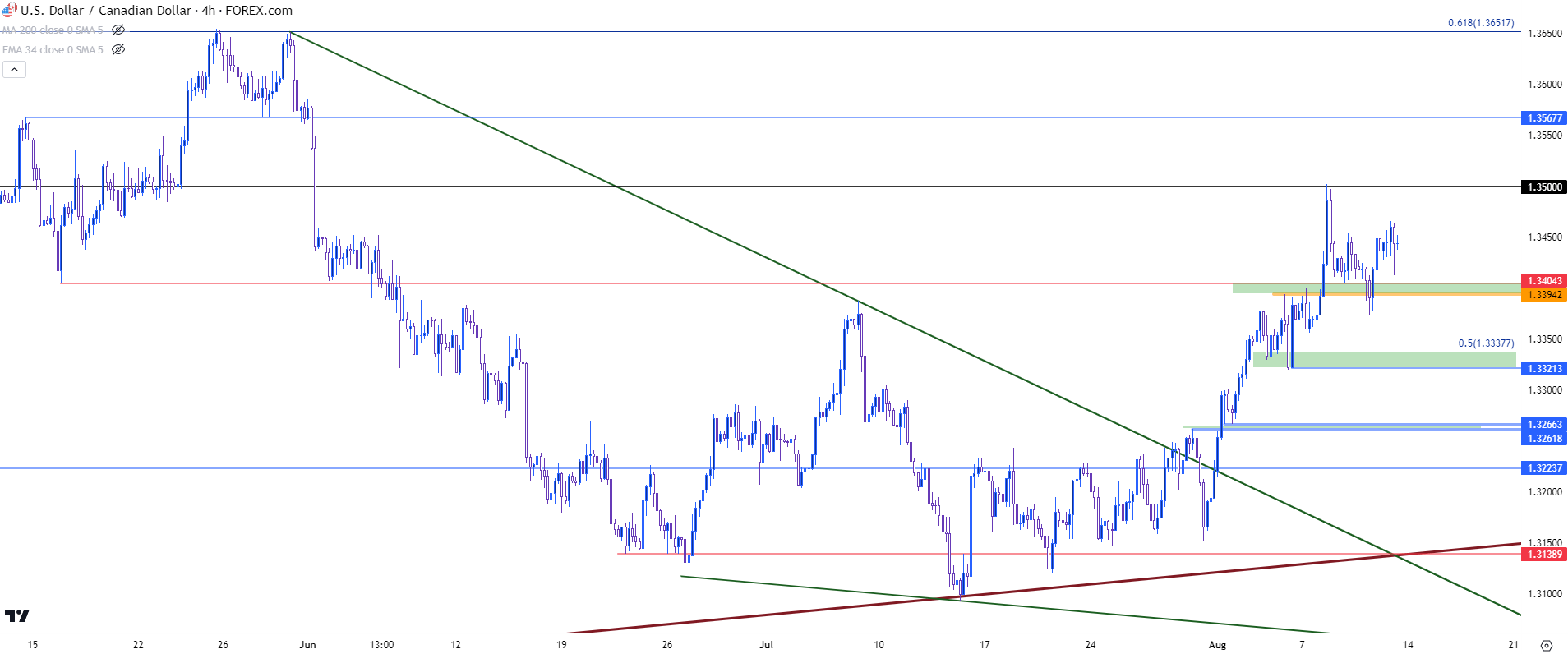

USD/CAD: Is a Higher-Low Already In?

The big question on a shorter-term basis in USD/CAD is whether the pair has already formed a higher-low. The 1.3500 resistance level offered a clean hit on Tuesday, and the initial pullback from that level found support at a key spot around the 1.3400 handle. And while that did lead into a 50-pip bounce, bulls were unable to retain the move and another, deeper pullback developed. Of encouragement for bulls was Friday price action that saw buyers drive right back above 1.3450, which does keep buyers in control of the near-term trend, but the question remains as to whether we’ve already seen the higher-low before another test of the 1.3500 handle.

The topside move priced-in quickly and while that doesn’t preclude continuation scenarios, it does bring question to timing. For next resistance beyond 1.3500, there’s a prior resistance-turned-support swing at 1.3568, after which a key Fibonacci level re-enters the picture at 1.3652.

On the support side of the matter, if that higher-low is not already in-play, there’s another spot of support potential around the Fibonacci level at 1.3338 which spans down to the prior swing low of 1.3321 to create a zone of interest.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

EUR/CAD

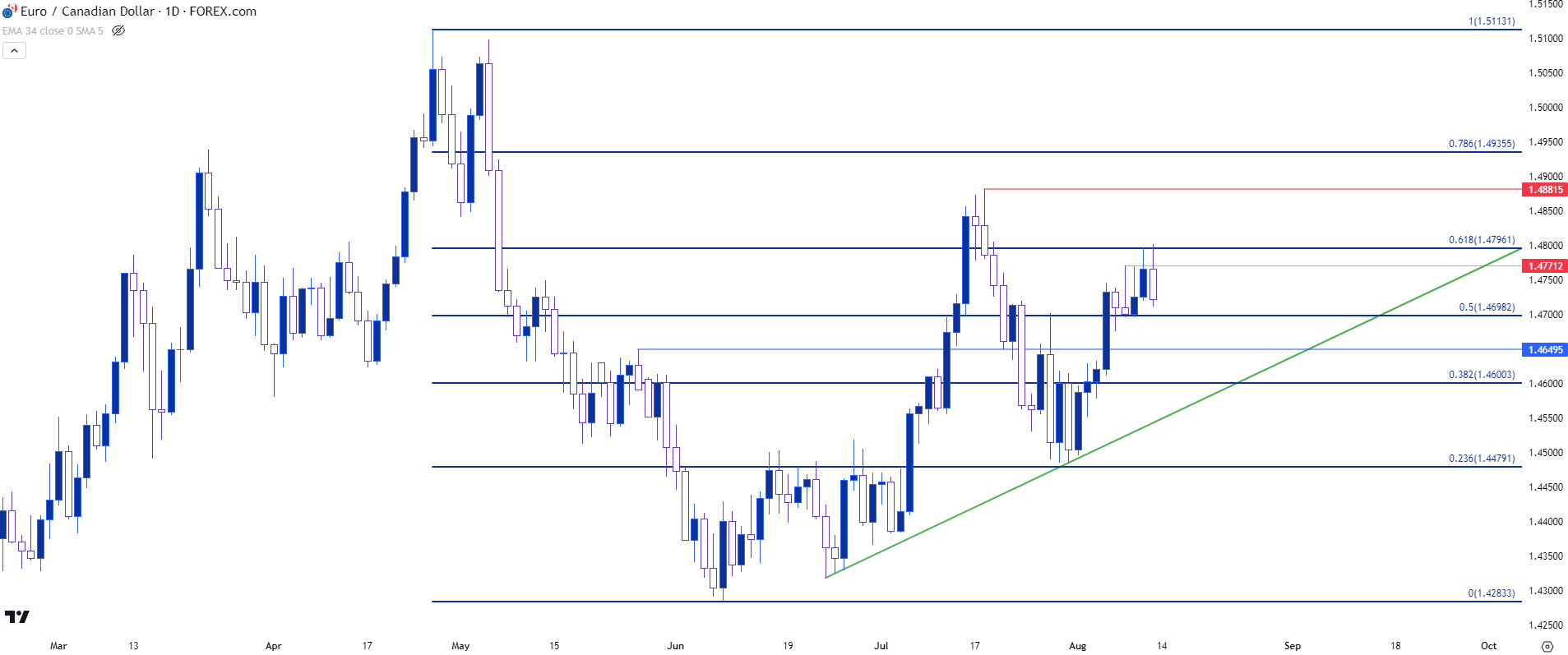

EUR/CAD may have some interest for CAD-bulls or for those looking to work with mean reversion scenarios.

The pair initially tried to push a breakout in early Friday trade but caught resistance at a Fibonacci level, and that resistance hit led to a bearish outside bar on the daily chart. There is support nearby, however, at the 50% mark of the same Fibonacci retracement that plots just inside of the 1.4700 handle.

If sellers can force a move below that support, the next items of support would appear around 1.4650 and then the 1.4600 handle, which is the 38.2% retracement from that same Fibonacci study.

On the bullish side of the pair, a daily close above the 1.4800 level would negate the bearish short-term move and this would expose the three-month-high at 1.4882 as the next item of resistance.

EUR/CAD Daily Price Chart

Chart prepared by James Stanley, EUR/CAD on Tradingview

CAD/JPY

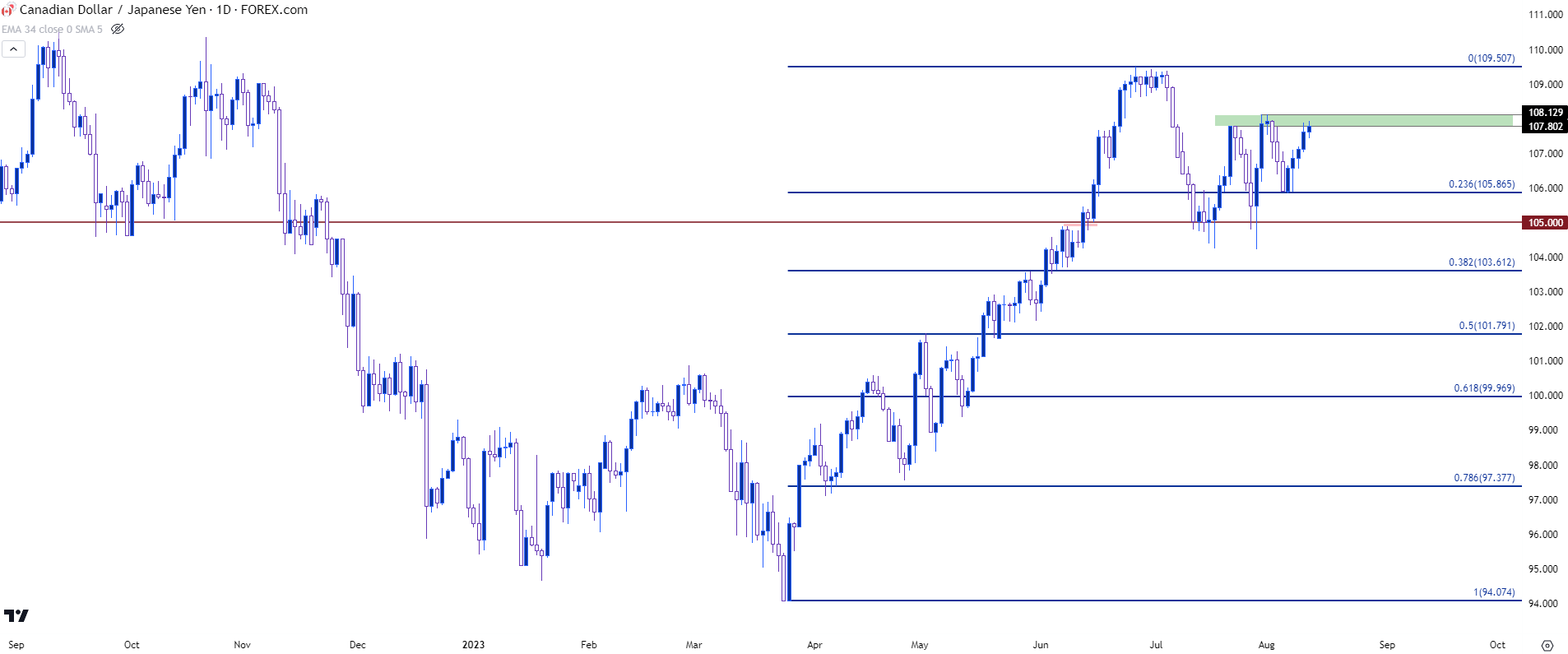

While both the US Dollar and the Euro are surrounded by questions involving future rate moves, the Bank of Japan has been clearer that no changes are expected anytime soon. This has allowed for a clean bullish breakout in USD/JPY to run back up to the 145 level and in CAD/JPY, that Yen-weakness has been on full display, as well.

The daily chart below highlights this theme well but it’s the shorter-term chart below that which may pique the interest of CAD-bulls. Last Friday and this Monday offered a support inflection at the 23.6% Fibonacci retracement of the April-June bullish move, and that led to five consecutive days of gains this week, propelling price to the same resistance that’s held the highs over the past few weeks. That zone runs from 107.80 up to 108.13 and is shown in the green box below.

CAD/JPY Daily Price Chart

Chart prepared by James Stanley, CAD/JPY on Tradingview

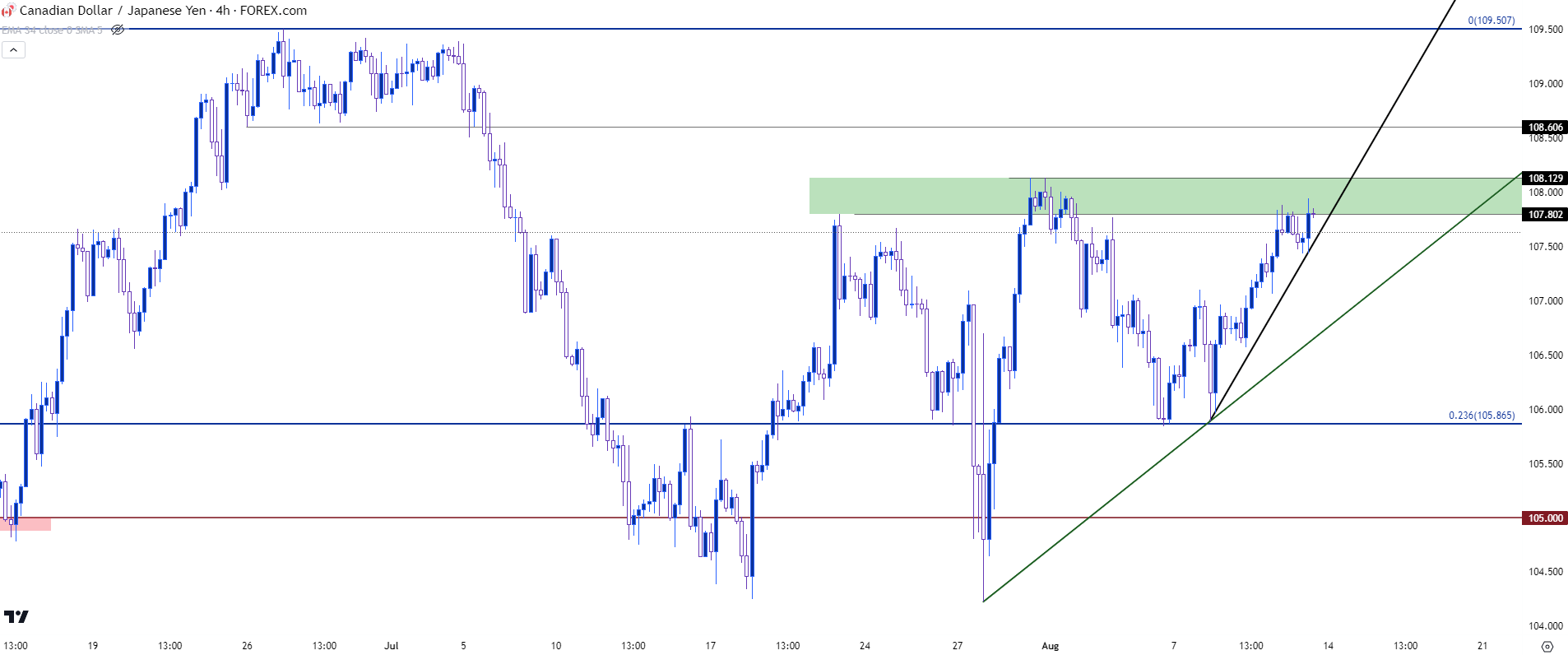

From the four-hour chart below, we can see the stark rate of gains over the past week and there’s elements of an ascending triangle formation given the continued tests of horizontal resistance to go along with a series of higher lows. This can keep the pair of interest for CAD-bulls and the next area of resistance beyond the current zone would be around the 108.61 prior swing-low. Above that, it’s the 109.50 level that stands out and this is also the current nine-month-high in the pair.

On the other side of the matter - traders should be on-guard for possible intervention announcements out of Japan. The USD/JPY pair just began to re-test the 145.00 level and this has been a spot of drama of late as there's been threat or indication of possible intervention from the Japanese Finance Ministry around that spot. So, if we do see something similar in the early-portion of next week, the focus would go towards a re-test of support at the Fibonacci level of 105.87, after which the psychological level at 105.00 would come back into the picture. A daily close below that level would indicate failure from bulls to retain the trend.

CAD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, CAD/JPY on Tradingview

--- written by James Stanley, Senior Strategist