Wall Street put the Federal Reserve's comments and a ‘no rate hike’ meeting in its rear-view mirror as stocks pushed higher today on renewed optimism about the US economy, paradoxically something which might lead the Fed to raise rates as it hinted yesterday. Data on consumer spend and jobless claims point to continuing economic strength

Bottom line – risk-on.

TODAY’S MAJOR NEWS

Fed’s “hawkish pause”

Wall Street got the “hawkish pause” it expected, after 10 hikes in ten months, but the Federal Reserve made it clear that it is not done yet. Rather, it made clear that two more rate hikes would be likely this year. Fed members made it very clear in their statement that they did not want the markets to misconstrue this month’s pause as a pivot, with 12 of the 18 members indicating support for the future rate hikes. The markets had previously priced in one more rate hike in July, and that cuts would begin by the end of the year. If that is the bull market narrative it might be wide of the mark.

Fed Chair Jerome Powell understands the risks of resurgent inflation as long as stimulus remains in the system. He believes that tighter credit standards by banks will help do the job of slowing the economy, reducing the need for further significant rate hikes. However, this thesis needs time to be proven – rather the contrary could be true. A dovish interest policy could is leading to a resurgent stock market, optimistic consumer confidence, an increase in spending, and a rebound in the housing sector. And this could reignite inflation before sufficient stimulus has been withdrawn.

The Fed is trying to talk down this enthusiasm by indicating that two more rates hikes, and at a 6% peak interest rate, might be administered. But is anyone listening? For contrast, the European Central Bank moved forward with another 25-basis point rate hike this morning. Powell made it clear that the primary challenge remaining to hit the 2% mandate for inflation is cooling the consumer economy and bringing down wage inflation. This might take some doing.

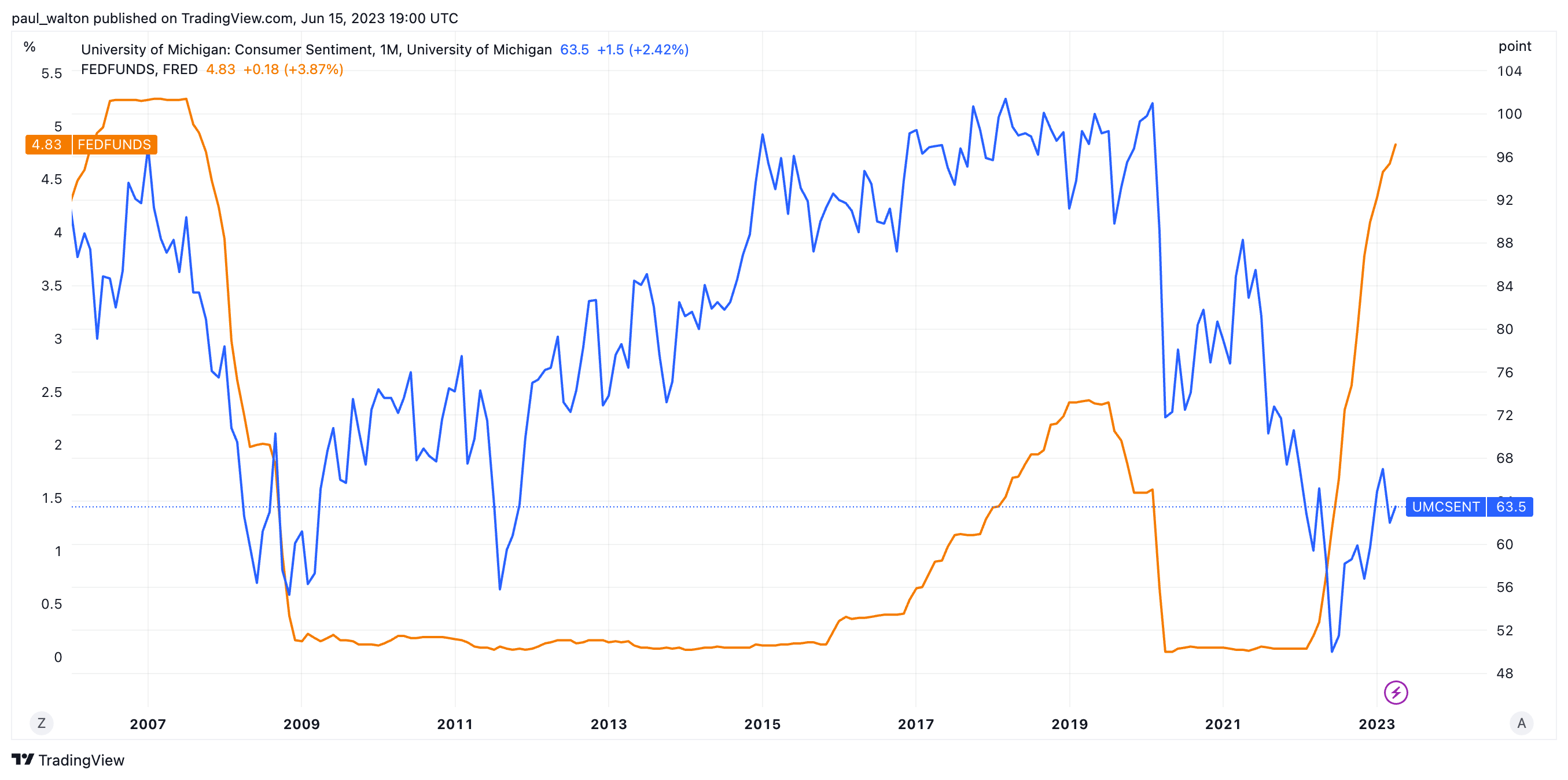

Consumer sentiment can often take time to catch up with rate rises, as the chart below for the University of Michigan Consumer Confidence index versus the Fed Funds rate makes clear. The Fed is betting that its rate increases will, in due course impact consumer spending, the real economy and inflation (as was the case in 2007-08 and 2020 onwards, Covid notwithstanding.)

University of Michigan Consumer Confidence index versus the Fed Funds rate

Source: TradingView, StoneX.

Source: TradingView, StoneX.

Retail sales growth continues to be resilient

- A sustained rate of consumer buying and a resurgence in auto sales were partly offset by falling gas prices in May retail sales

- Retail sales for May grew 1.6% year-on-year, ahead of analyst expectations, with signs of underlying consumer confidence

- Retail sales grew 0.3% month-on-month, versus an expected 0.1% decline, and a shade lower than 0.4% growth in April

- Retail sales minus vehicles and gas rose 0.4% month-on-month, double the expected 0.2% growth, and a shade lower than 0.5% growth in April

Industrial production

- Industrial Production for May was down 0.2% month-on-month in May, below the expected 0.5% rise, and the 0.5% increase in April

- Manufacturing output grew by 0.1%, down from 1.0% growth last month

- Capacity utilization slipped slightly to 79.6% in May, down from 79.8% last month

Jobless claims don’t indicate major layoffs

- Jobless claims continue to reflect a relatively tight labor market when combined with many other data points from the sector, with no signs that current interest rates are leading to lay-offs

- First-time claims for unemployment benefits were unchanged in the week ending June 10 at 262,000, above an expected 248,000

- The four-week moving claims average rose to 246,750, up from 237,500 claims the previous week

- Continuous claims for the week ending June 3 rose 20,00 to 1.775 million, with the four-week moving average dropping by 6,000 to 1.778 million

TODAY’S MAJOR MARKETS

Equity markets

- The S&P 500 and Nasdaq 100 indexes rose 1.0%, and 0.9% respectiveley, while the more broadly based Russell 2000 was up 0.4%

- European stocks rallied despite the ECB’s rate hike, with the DAX up 1.3%

- The Nikkei 225 and FTSE 100 indexes were unchanged and up 0.3%, respectively

- The VIX, Wall Street’s fear index, rose 1.6% to 14.1

Currencies, Bonds and Crypto

- The dollar index fell back 0.8% to 101.8 against a basket of currencies, heading back to the bottom of its year-to-date trading range

- Euro and sterling x-rates versus the dollar were highlights, both up around 1.0%

- Bonds rallied after the Fed’ no-hike meeting, with yields on 2- and 10-year Treasuries lower at 4.63% and 3.73%

- Bitcoin is approaching a testing technical level around $25,000, with today’s 2.8% decline bring that past several week decline to 10%

Commodities

- Gold prices were unchanged at $1,970 per ounce

- Crude oil prices rebounded, up 3.4% to $70.6 per barrel

- Grain and oilseed markets were stronger on the weaker dollar and as continued dryness across the Midwest threatens crop yields

Analysis by Arlan Suderman, Chief Commodities Economist. [email protected].

Market outlook by Paul Walton, Financial Writer. [email protected].