British Pound technical forecast: GBP/USD weekly trade levels

- British Pound validates breakout of 2023 opening-range highs

- GBP/USD rally approaching key confluence zone at long-term, downtrend resistance

- Sterling resistance 1.2757/73 (critical), 1.3104– support 1.2397-1.2448, 1.2084, ~1.2010

The British Pound has rallied for eight of the past nine-weeks with GBP/USD breaching the yearly opening-range highs last week. The advance has now extended nearly 6.7% off the March / yearly lows and exposes a possible run-on long-term, downtrend resistance- NFP, Bank of England on tap. These are the updated targets and invalidation levels that matter on the GBP/USD weekly technical chart.

Discuss this Pound setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

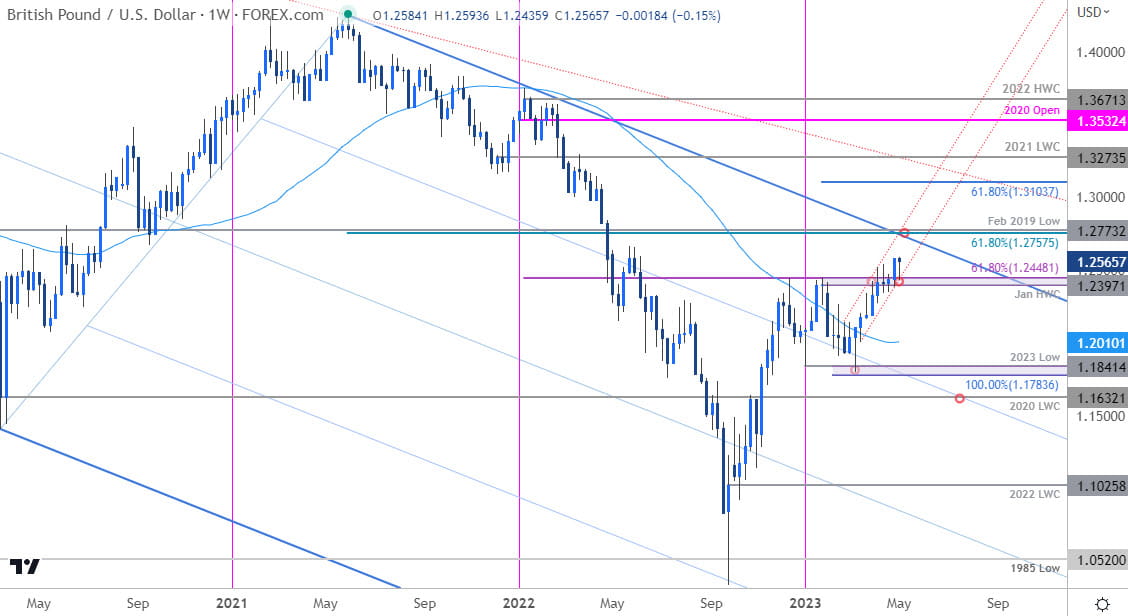

British Pound Price Chart – GBP/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last, British Pound Weekly Forecast (March) we noted that GBP/USD had, “reversed off key support with a five-week rally now approaching key resistance at the yearly opening-range highs.” The pivot zone in focus was at “1.2397-1.2448- a region defined by the yearly high-week close and the 61.8% Fibonacci retracement of the 2022 decline. Risk for topside exhaustion / price inflection into this zone over the next few weeks.”

Sterling held below this threshold for nearly five-weeks before finally breaching late-last week. The breakout now threatens a rally towards a key technical confluence at multi-year trend resistance around 1.2757/73- a region defined by the 61.18% retracement of the 2021 decline and the February 2019 low (an area of interest for possible exhaustion / price inflection IF reached).

Initial weekly support now rests at former resistance (1.2397-1.2448) and price will need to hold above this zone for the immediate advance to remains viable– a break / close below would risk a larger correction back towards the objective yearly-open at 1.2084. Broader bullish invalidation now raised to the 52-week moving average, currently ~1.2010.

Bottom line: A breakout of the yearly opening-range shifts the medium-term focus higher in the British Pound with the advance now within striking distance of multi-year downtrend resistance. From at trading standpoint, look to reduce long-exposure / raise protective stops on a stretch towards 1.2757/73- losses should be limited to last week’s lows IF price is heading higher. Keep in mind we still have US non-farm payrolls tomorrow with the BoE interest rate decision on tap next week. I’ll publish an updated British Pound short-term outlook once we get further clarity on the near-term GBP/USD technical trade levels.

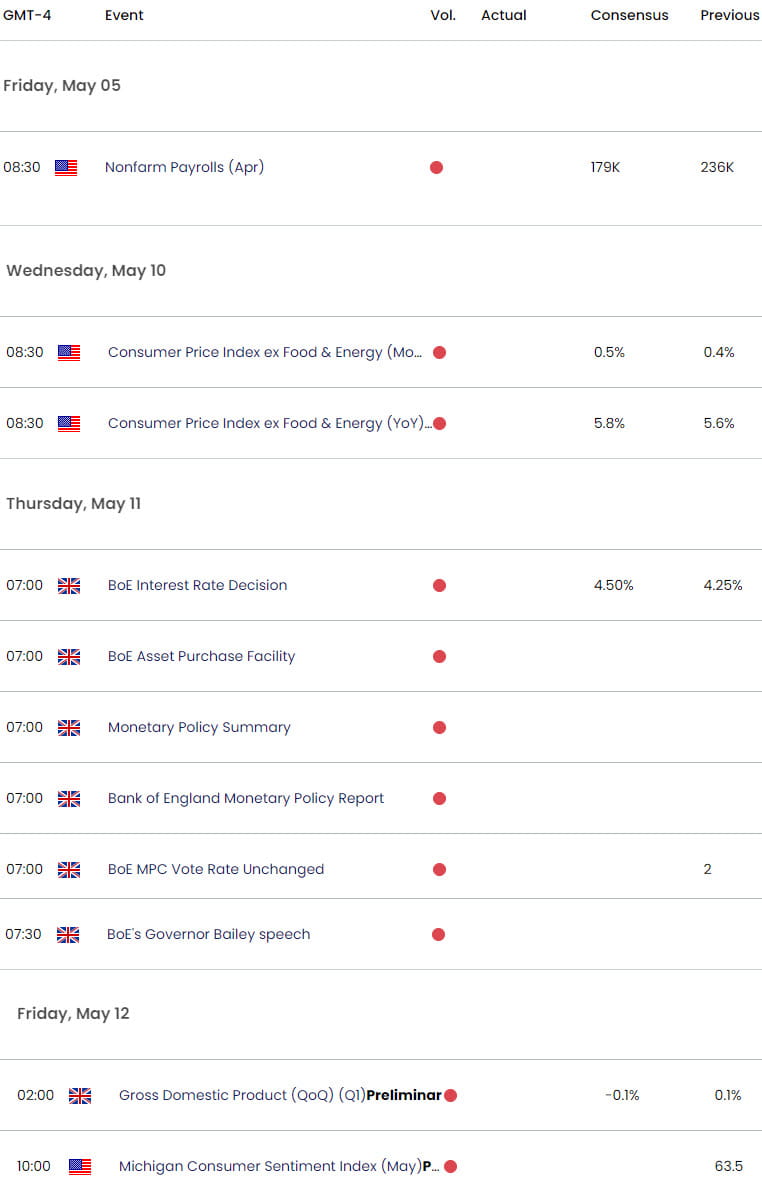

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Crude Oil (WTI)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Gold (XAU/USD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- US Dollar (DXY)

- S&P 500 (SPX500)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com