British Pound Technical Outlook: GBP/USD Short-Term Trade Levels

- British Pound breaks September opening-range highs- poised to mark fifth daily advance

- GBP/USD now approaching technical resistance- risk for exhaustion / price inflection into PCE

- Resistance 1.3414 (key), 1.3515, 1.36- Support 1.3259/73, 1.32 (key), 1.3091

The British Pound is poised to mark a fifth-consecutive daily advance with GBP/USD rallying to fresh yearly highs today. A breakout of the September opening-range now takes Sterling into the first major technical consideration near uptrend resistance and the immediate advance may be vulnerable into this threshold in the days ahead. Battle lines drawn on the GBP/USD short-term technical charts.

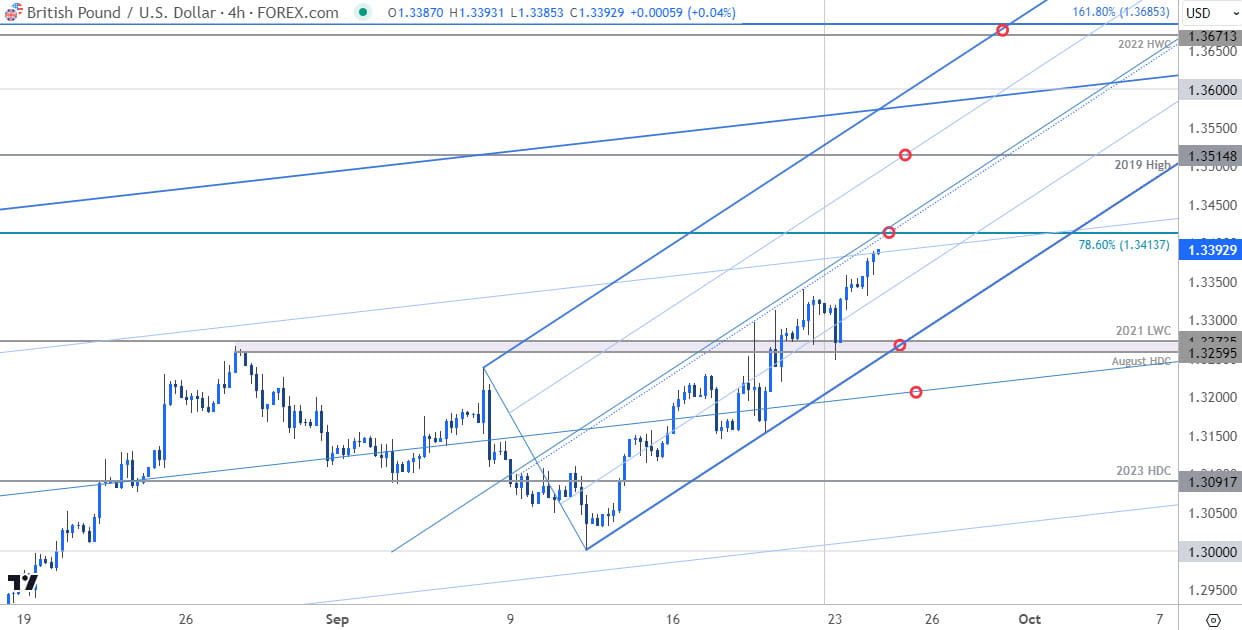

British Pound Price Chart – GBP/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Technical Outlook: In my last British Pound Short-term Outlook, we noted that, “The broader April rally remains vulnerable into the start of the month with the immediate focus on a breakout of this week’s range for guidance. From a trading standpoint. Losses should be limited to 1.2943 IF price is heading higher on this stretch with a close above 1.3274 needed to fuel the next leg in price.” Sterling plunged nearly 1.8% off the monthly highs in the following days with price registering an intraday low at 1.3002 before rebounding sharply.

A subsequent breach of the September opening-range highs has fueled a rally of more than 3% with GBP/USD now approaching initial resistance at 78.6% retracement of the 2012 decline at 1.3414- note that the 75% parallel of the yearly pitchfork (blue) rests just below this level and we’re looking for possible topside exhaustion / price inflection into this threshold over the next few days.

British Pound Price Chart – GBP/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; GBP/USD on TradingView

Notes: A closer look at Sterling price action shows GBP/USD trading within the confines of an embedded ascending pitchfork with the median-line further highlighting near-term resistance here into 1.3414. The weekly opening-range is set just above initial support at the August high-day close (HDC) / 2021 low-week close (LWC) at 1.3259/73. Ultimately, a break below the median-line of the broader structure (currently near ~1.32) would be needed to suggest a more significant high is in place with such a scenario exposing subsequent support objectives at the 2023 HDC at 1.3091.

A topside breach of this key pivot zone would likely fuel another accelerated bout of gains with subsequent resistance eyed at the 2019 high at 1.3515 and the 1.36-handle. The next major technical consideration is seen just higher at 1.3671/85- a region defined by the 2022 HWC and the 1.618% extension of the October advance. Look for a larger reaction there IF reached.

Bottom line: A five-day rally is now approaching confluent resistance into the yearly uptrend. From a trading standpoint, look to reduce portions of long-exposure / raise protective stops on a stretch towards 1.34147 – losses should be limited to the median-line IF price is heading higher on this stretch with a close above this pivot zone needed to fuel the next leg.

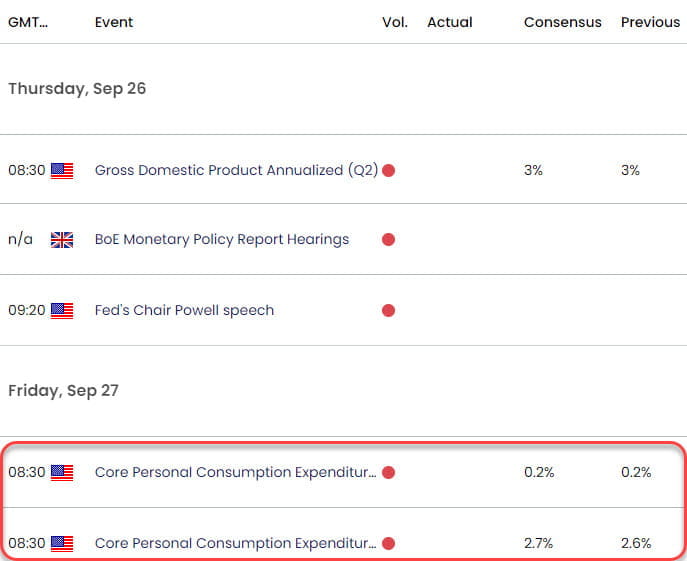

Keep in mind we get the release of key US inflation data this week with the August Personal Consumption Expenditure (PCE) on tap Friday. Stay nimble into the release and watch the weekly close here for guidance.

Key GBP/USD Economic Data Releases

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex