British Pound Forecast: GBP/USD

GBP/USD extends the rebound from the monthly low (1.2907) to keep the Relative Strength Index (RSI) above 30, and the exchange rate may stage a larger recovery going into the UK Budget as it starts to carve a series of higher highs and lows.

British Pound Outlook: GBP/USD Recovery Emerges Ahead of UK Budget

GBP/USD trades to a fresh weekly high (1.3012) following the weaker-than-expected US Job Openings and Labor Turnover Survey (JOLTS), and it remains to be seen if the update from Chancellor of the Exchequer Rachel Reeves will influence the exchange rate as the Bank of England (BoE) starts to unwind its restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It seems as through the Monetary Policy Committee (MPC) will continue to switch gears after keeping UK interest rates unchanged at the September meeting as the majority insists that ‘in the absence of material developments, a gradual approach to removing policy restraint would be warranted.’

However, plans to tighten fiscal policy may put pressure on Governor Andrew Bailey and Co. to support the UK economy, and the MPC may show a greater willingness to achieve a neutral policy sooner rather than later in an effort to avoid a recession.

With that said, the British Pound may face headwinds ahead of the BoE meeting on November 7 amid speculation for lower UK interest rates, but GBP/USD may further retrace the decline from the monthly high (1.3390) as the RSI reverses ahead of oversold territory.

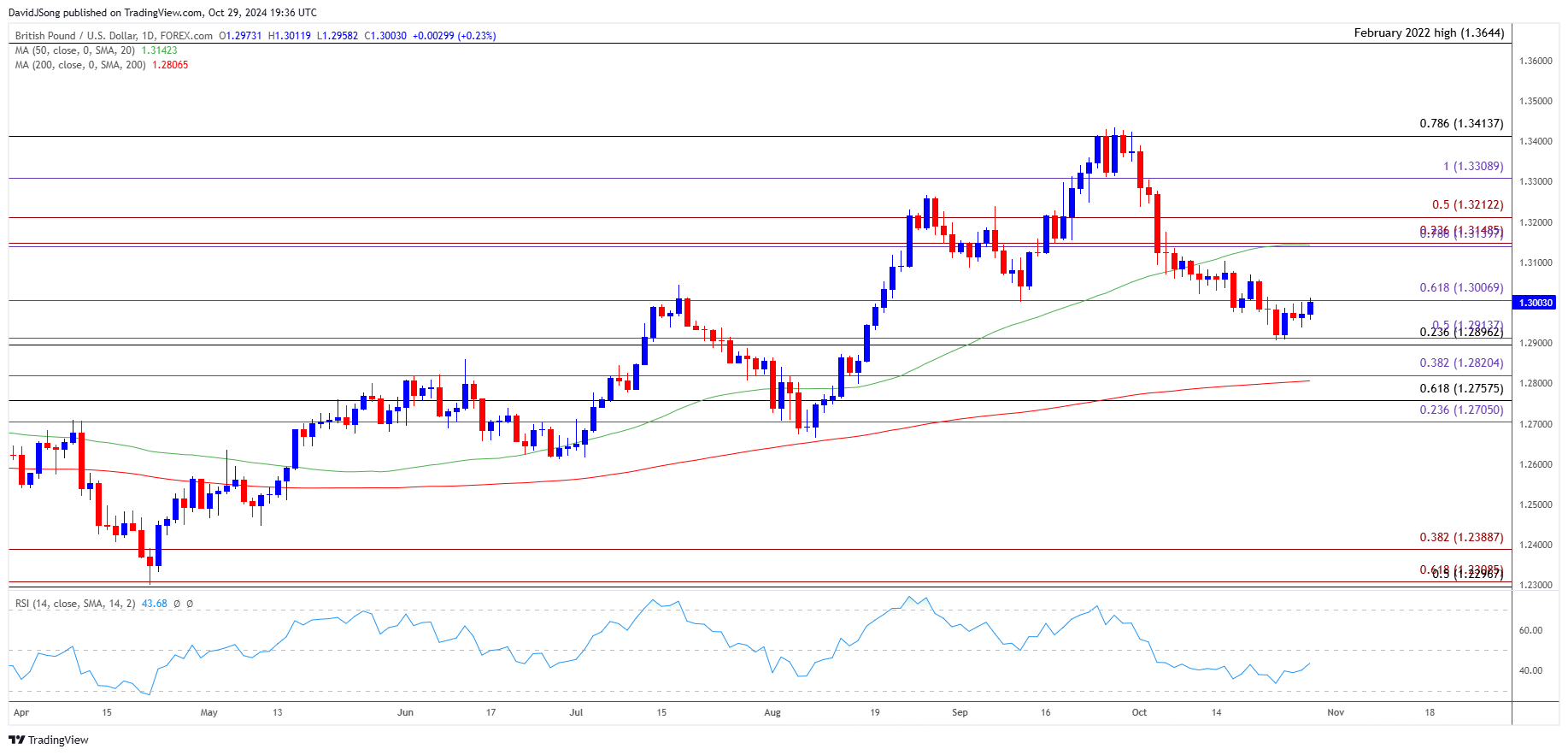

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD appeared to be stuck in a narrow range following the failed attempt to break/close below the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region but a close above 1.3000 (61.8% Fibonacci extension) may push the exchange rate back towards the 1.3140 (78.6% Fibonacci extension) to 1.3150 (23.6% Fibonacci extension) zone.

- A break/close above 1.3210 (50% Fibonacci extension) brings 1.3310 (100% Fibonacci extension) on the radar, with the next area of interest coming in around the monthly high (1.3390).

- At the same time, a break/close below the 1.2900 (23.6% Fibonacci retracement) to 1.2910 (50% Fibonacci extension) region opens up 1.2820 (38.2% Fibonacci extension), with the next area of interest coming in around 1.2710 (23.6% Fibonacci extension) to 1.2760 (61.8% Fibonacci retracement).

Additional Market Outlooks

Monetary vs Fiscal Policy: Implications for FX Markets

USD/CAD Eyes August High as RSI Holds in Overbought Territory

AUD/USD Vulnerable amid Failure to Defend September Low

Gold Price Forecast: RSI Falls Back from Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong