Bullish factors

- Data for the American economy should reinforce the perception that productive activity and the labor market remain strong, which, in turn, corroborates the interpretations that interest rates in the country will remain higher for longer and contribute to strengthening the USDBRL.

Bearish factors

- Possible approval of government economic agendas by Congress can reduce the perception of political risks of Brazilian assets, contributing to the attraction of investments and thus strengthening the BRL.

- A lack of consensus among members of Congress for a new Budget may promote a cautious and risk-averse environment among investors, harming the performance of risky assets, such as the BRL.

Our Brazil team provides regular weekly coverage of the Brazilian economy and the outlook for the Real, accessible by clicking the link in the banner above.

The week in review

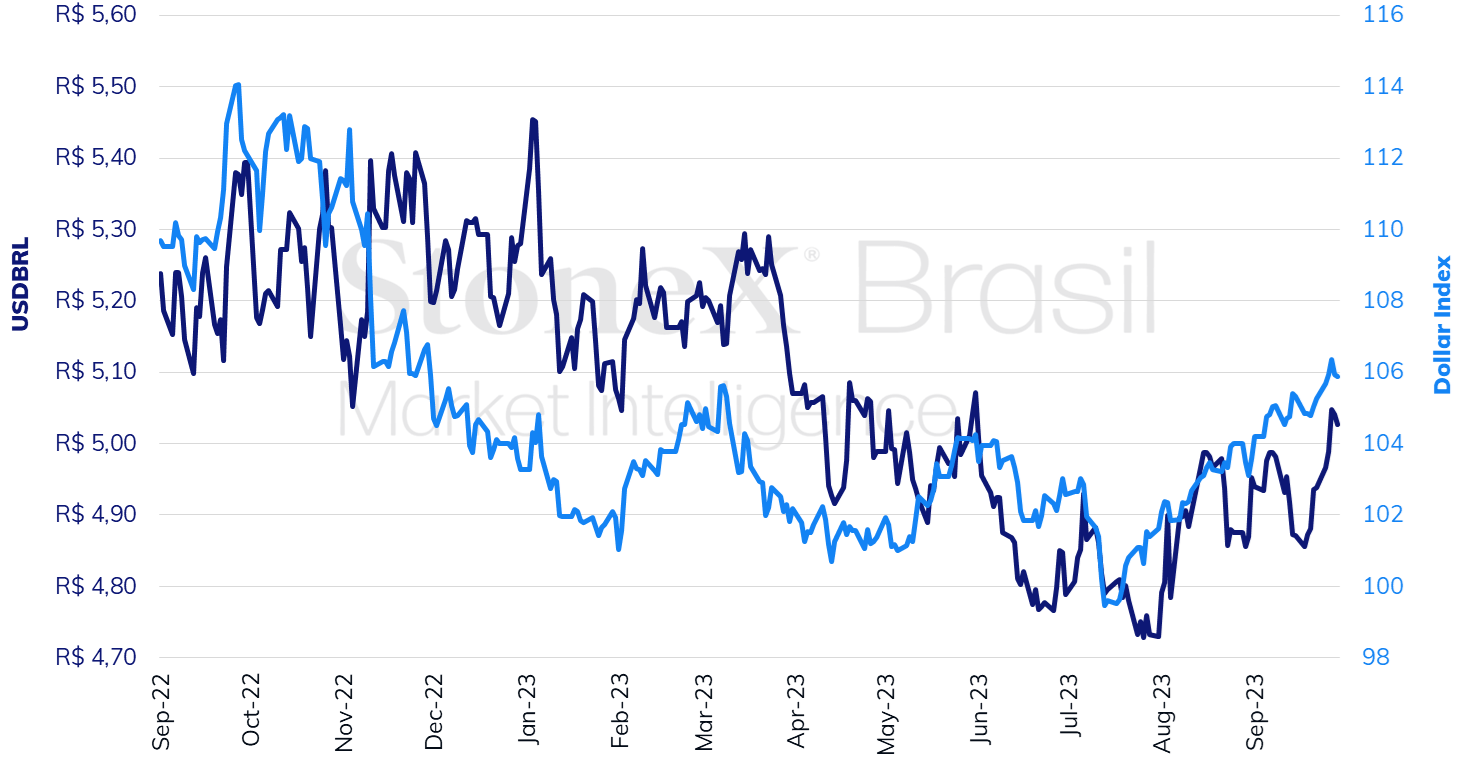

The USDBRL ended the week higher, closing Friday's session (29) at BRL 5.0273, a variation of +1.8% for the week, +1.5% for the month, and -4.8% for the year. The dollar index closed higher for the eleventh consecutive week on Friday's session, with a weekly gain of 0.6%, a monthly gain of 2.2%, and an annual gain of 2.5%. The foreign exchange market reacted to the continuous and sustained rise in US Treasury yields, the release of the minutes of the Monetary Policy Committee (Copom) decision, the release of inflation data for Brazil, the United States, and Europe, and the formation of the end-of-month Ptax rate.

USDBRL and Dollar Index (points)

Source: StoneX cmdtyView. Design: StoneX

THE MOST IMPORTANT EVENT: Data for the United States

Expected impact on USDBRL: bullish

Among the data that will certainly be released this week, it is worth highlighting the Purchasing Managers' Index (PMI) for September by the ISM institute, both for the industrial activity and the services sector. The September data should maintain the pattern of previous months, that is, show contraction (reading below 50 points) for industry and expansion (above 50 points) for services. In recent months, the growth of the American economy has exceeded analysts' estimates by remaining stable even in the face of a cycle of interest rate hikes by the Federal Reserve (Fed). Similarly, requests for unemployment assistance continue to suggest a labor market with high demand for labor and few signs of weakening. Both indicators can contribute to the perception that interest rates in the United States must remain high for a long period to ensure that inflation returns to the Fed's target, strengthening the dollar against other currencies.

Economic agenda in Congress

Expected impact on USDBRL: bearish

Two weeks after the entry of the center-right party (Centrão) into the coalition supporting the government in Congress, conflicts in the relationship between the Executive and the Legislative branches continue to surface. Last week, the President of the Chamber of Deputies, Arthur Lira (PP-AL), publicly complained about the delay of the Administration in implementing the changes in the leadership of Caixa Econômica Federal and threatened to "block" the voting agenda until the agreement was fulfilled. Later, after a meeting between Lira and the Minister of Finance, Fernando Haddad, the parliamentarian committed to submit three important projects for voting next week, namely, the Provisional Measure proposing to tax exclusive investment funds, offshore funds, and the Legal Framework for Loan Guarantees.

Already in the Federal Senate, there must be an extraordinary session to vote on the Desenrola bill, which limits credit card interest rates. After a better-than-expected start, the articulation of the federal government's priority projects with the National Congress has been slow and subject to criticism. Accordingly, the approval of these measures can be well evaluated by investors and reduce the perception of political risks of Brazilian assets, contributing to the attraction of investments and thus strengthening the BRL.

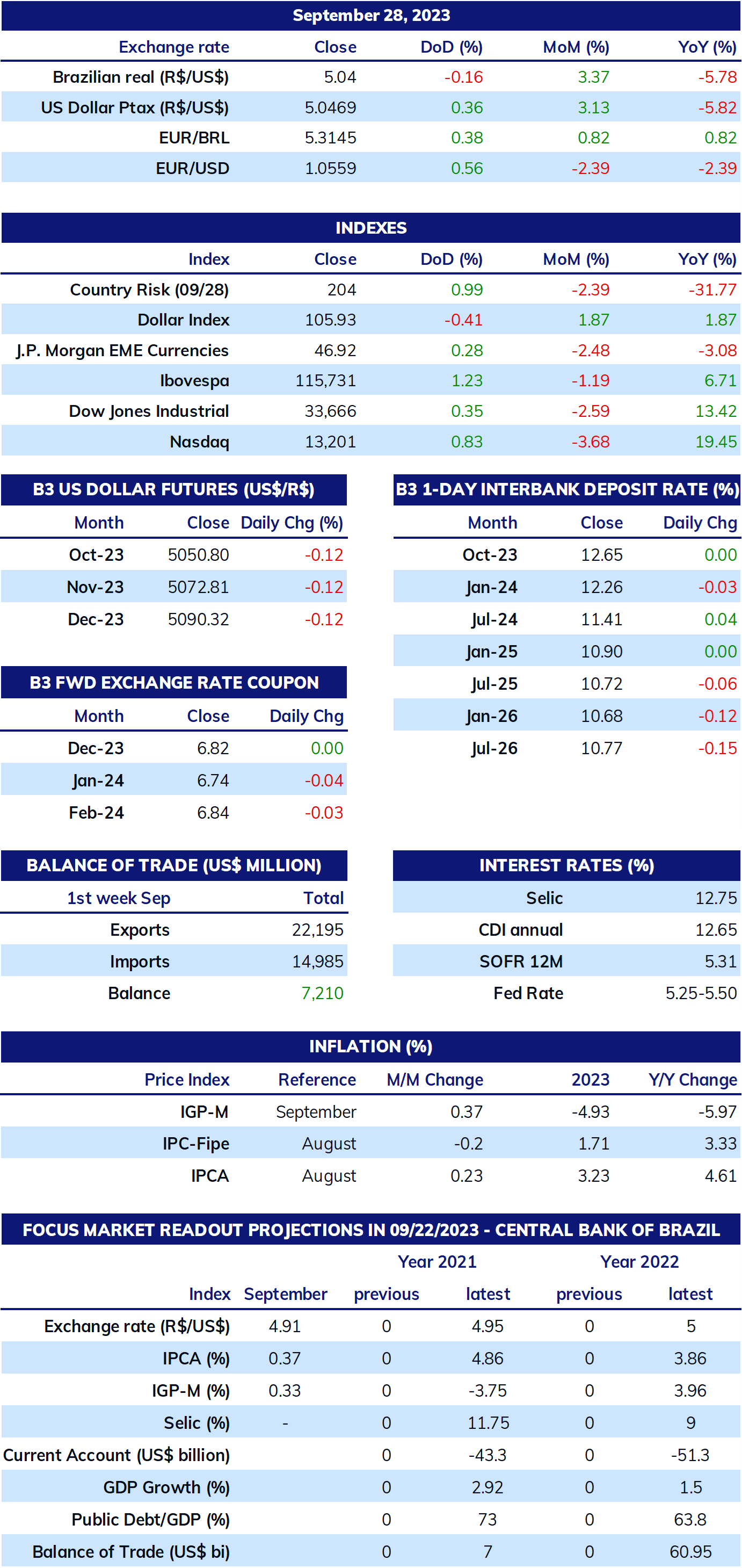

Key Indicators

Sources: Central Bank of Brazil; B3; IBGE; Fipe; FGV; MDIC; IPEA and StoneX cmdtyView.

Analysis by: Leonel Oliveira Mattos ([email protected]), Alan Lima ([email protected]), and Vitor Andrioli ([email protected]).

Translation by Rodolfo Abachi ([email protected]).

Financial editor: Paul Walton ([email protected]).