One week ago today, I outlined my bias for bitcoin to bounce. And it didn’t disappoint, with a 7.5% rally within 24 hours. US CPI had come in line with expectations, which was a green light for risk appetite as it bought Fed cuts back into the mix. Bitcoin was given another leg higher on reports that the SEC may approve an Ether ETF, yet one week on I am now questioning whether we may have already seen the meat of the move and if bulls should tread with caution.

Bitcoin futures positioning – from the weekly COT report:

To say asset managers remained heavily net-long bitcoin futures would be quite an understatement, with 17k long contracts relative to just 518 short contracts. And that means net-long exposure has tracked prices very closely since Q4 2021. Whilst an initial glance suggests a divergence between net-long exposure and prices has occurred these past two weeks, it is worth noting that the rally began last Wednesday thanks to the US inflation report – or a day after the latest COT data was collected. Therefore I suspect net-long exposure to have increased when the next COT report is released on Friday.

With that said, the trade-volume index is not backing up the rally of the past week. And that raises a false flag for the current rally which took prices back above 70k. And if we look elsewhere, we have another reason to be concerned for bulls over the near-term.

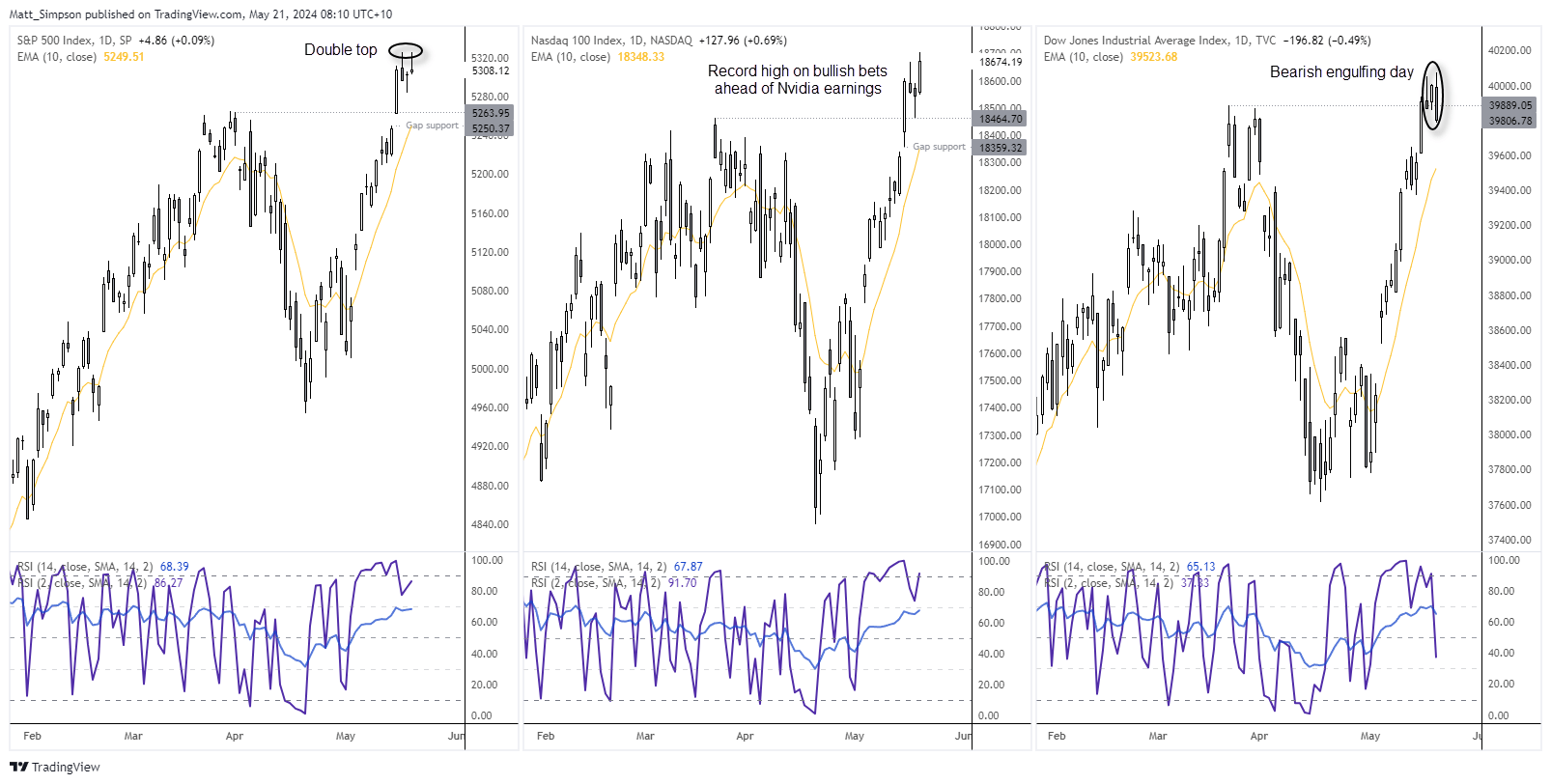

Wall Street indices are mixed at the cycle highs:

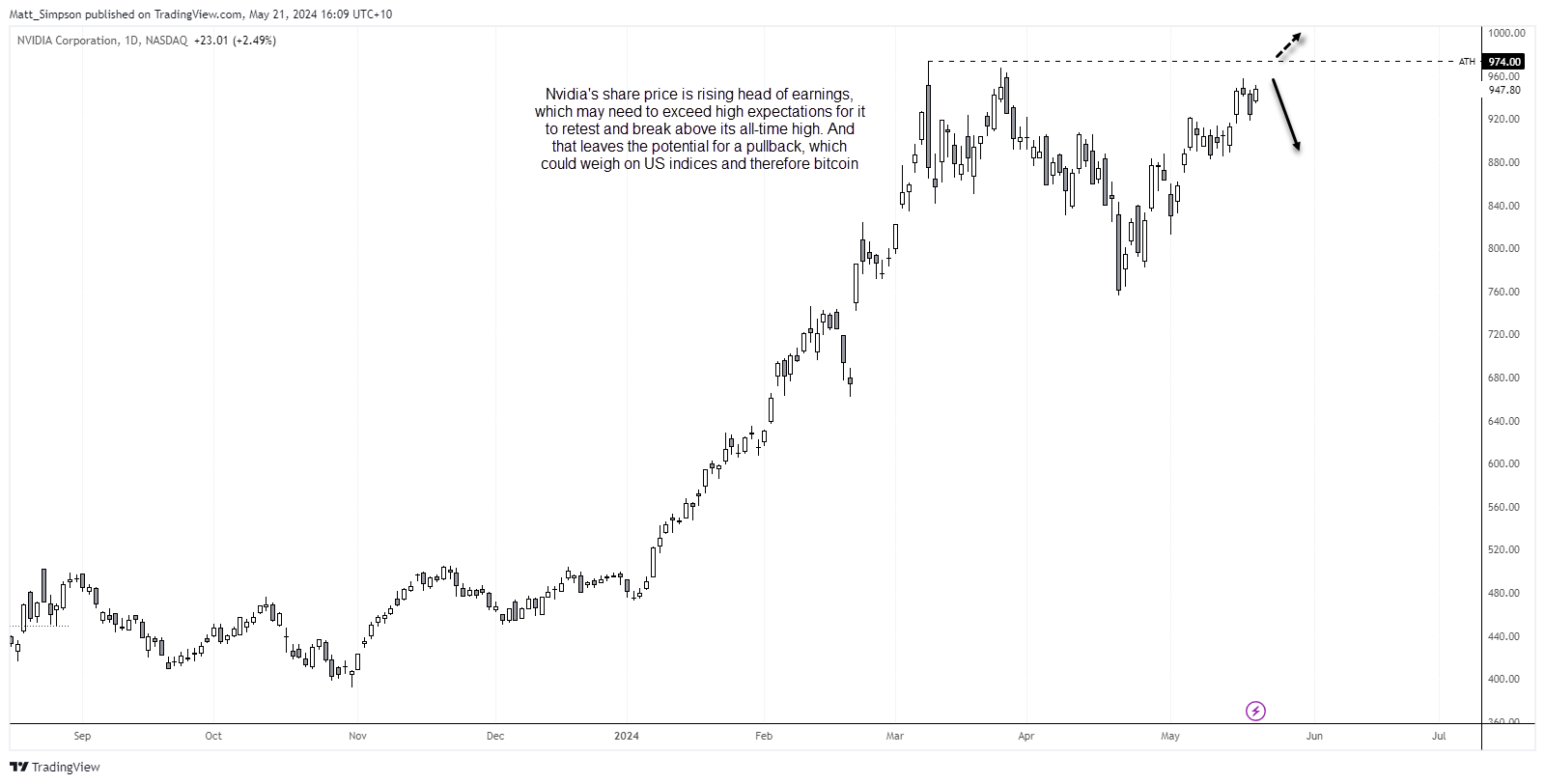

US indices posted mixed result on Monday, with the Nasdaq 100 hitting a fresh record high, yet a double top formed on the S&P 500 and a bearish engulfing day on the Dow Jones. Bullish bets ahead of Nvidia’s earnings reports supported the technology index on Monday, and should the company meet or exceed expectations then tech stocks could rally and take bitcoin higher with it. But what if expectations are already high? I suspect that may be the case, and that leaves Nvidia, the Nasdaq 100 and therefore Bitcoin vulnerable to a pullback.

Furthermore, and as I have repeatedly pointed out in recent articles, bitcoin is essentially a stock market proxy. Sure, bitcoin has its micro drivers which can prompt it under or outperform relative to its crypto peers or Wall Street. But in recent years, wherever Wall Street has traded, bitcoin tends to follow.

And advocates of the Dow theory would likely point out that a ‘true’ breakout on the Nasdaq needs to be accompanied by the S&P 500 and Dow Jones. And with latter two indices stumbling around cycle highs on the eve of a key earnings report from Nvidia – which will essentially tell the Nasdaq which way to go – bitcoin traders should take note of the potential for it to move in either direction form here.

Bitcoin futures technical analysis:

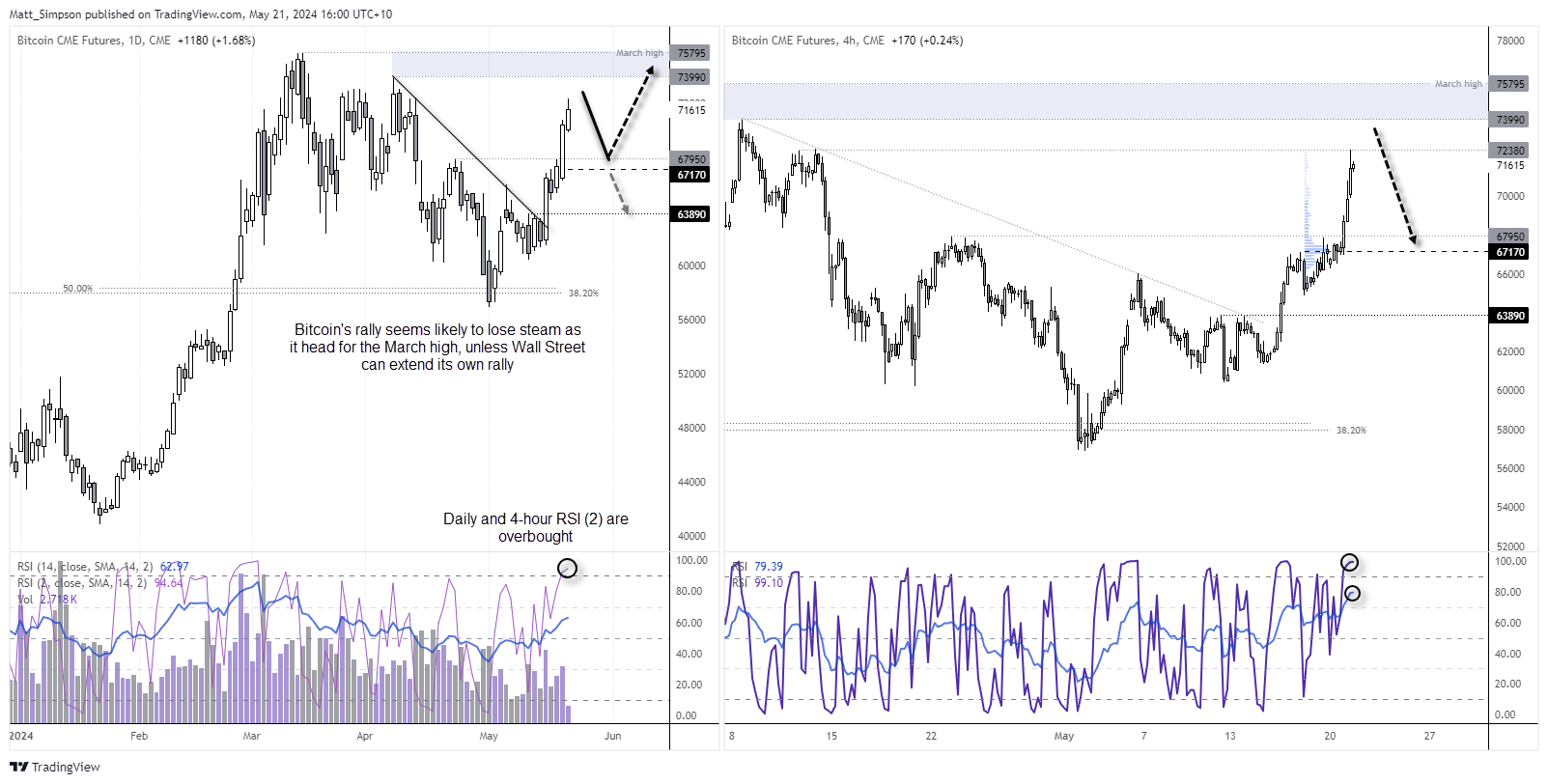

The daily chart shows a clear bullish-range expansion day above trend resistance last week, and subsequent daily close above $70k. But with the daily and 4-hour RSI (2) overbought, along with the 4-hour RSI (14), I suspect its current rally is closer to its end that its own beginning. Especially since likely resistance areas include the March high and $74k area.

From here, bitcoin might be a better market to fade (sell into the rally) with a stop above resistance levels in anticipation of Nvidia’s earnings not living up to the hype, and Wall Street indices faltering and pulling back from the current highs. $70k and the $67-$68k area make viable downside targets for bears. But as traders remain heavily net long, such a move could then be an opportunity for bulls to reload at lower levels for another crack at the March high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge