Bank of Canada (BoC) Interest Rate Decision

The Bank of Canada (BoC) took further steps to unwind its restrictive policy in September, with the central bank lowering the benchmark interest rate by 25bp to 4.25% from 4.50%.

Canada Economic Calendar – September 4, 2024

After delivering its third straight rate cut, the BoC stated that ‘as expected, inflation slowed further to 2.5% in July,’ with the central bank going onto say that ‘excess supply in the economy continues to put downward pressure on inflation.’

Nevertheless, the BoC acknowledged that ‘price increases in shelter and some other services are holding inflation up,’ and it remains to be seen if Governor Tiff Macklem and Co. will retain its current approach in achieving a neutral stance as the ‘Governing Council is carefully assessing these opposing forces on inflation.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

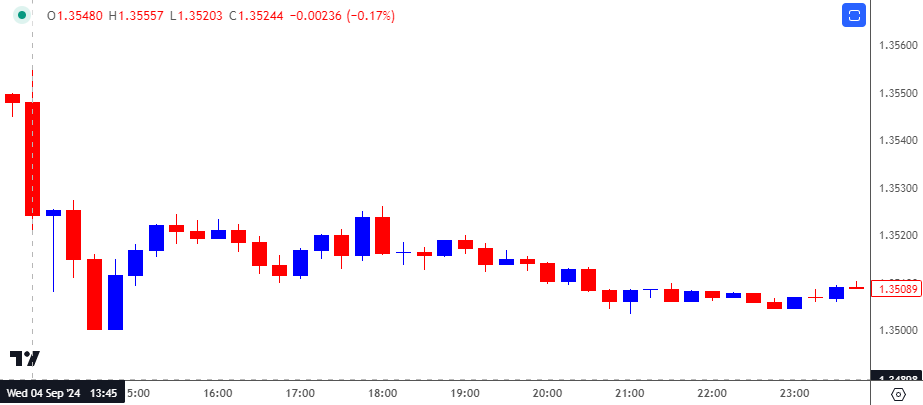

USD/CAD Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/CAD on TradingView

The Canadian Dollar showed a bullish reaction the BoC meeting even as the central bank continued to unwind its restrictive policy, with USD/CAD trading lower throughout the day to close at 1.3500. Nevertheless, the weakness in USD/CAD was short-lived as the exchange rate closed the week at 1.3583.

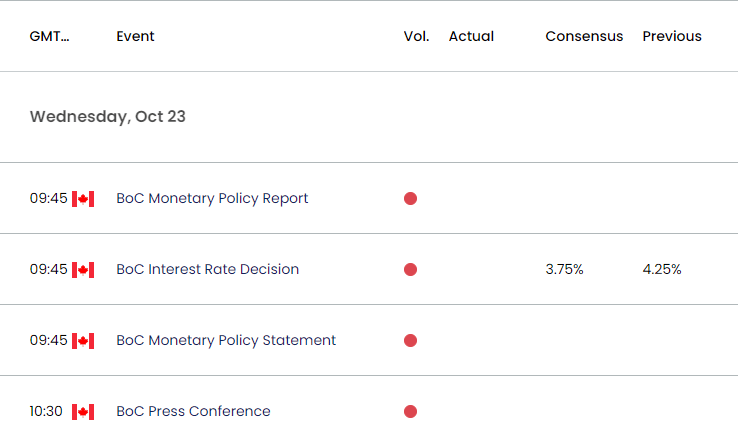

Looking ahead, the BoC is expected to boost its efforts in normalizing monetary policy, with the central bank anticipated to reduce the benchmark interest rate by 50bp in September to 3.75% from 4.25%.

With that said, another BoC rate cut may produce headwinds for the Canadian Dollar as the central bank takes additional steps to support the economy, but a shift in the forward guidance for monetary policy may generate a bullish reaction in Loonie should Governor Macklem and Co. reveal plans to conclude its rate-cutting cycle.

Additional Market Outlooks

US Dollar Forecast: AUD/USD Falls Toward September Low

Gold Price Breakout Pushes RSI into Overbought Zone

US Dollar Forecast: USD/JPY Vulnerable on Failure to Test August High

USD/CAD Rally Eyes August High as RSI Pushes into Overbought Zone

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong