Australian Dollar technical outlook: AUD/USD short-term trade levels

- Australian Dollar rally off downtrend support now testing downtrend resistance

- AUD/USD monthly opening-range taking shape between well-defined levels

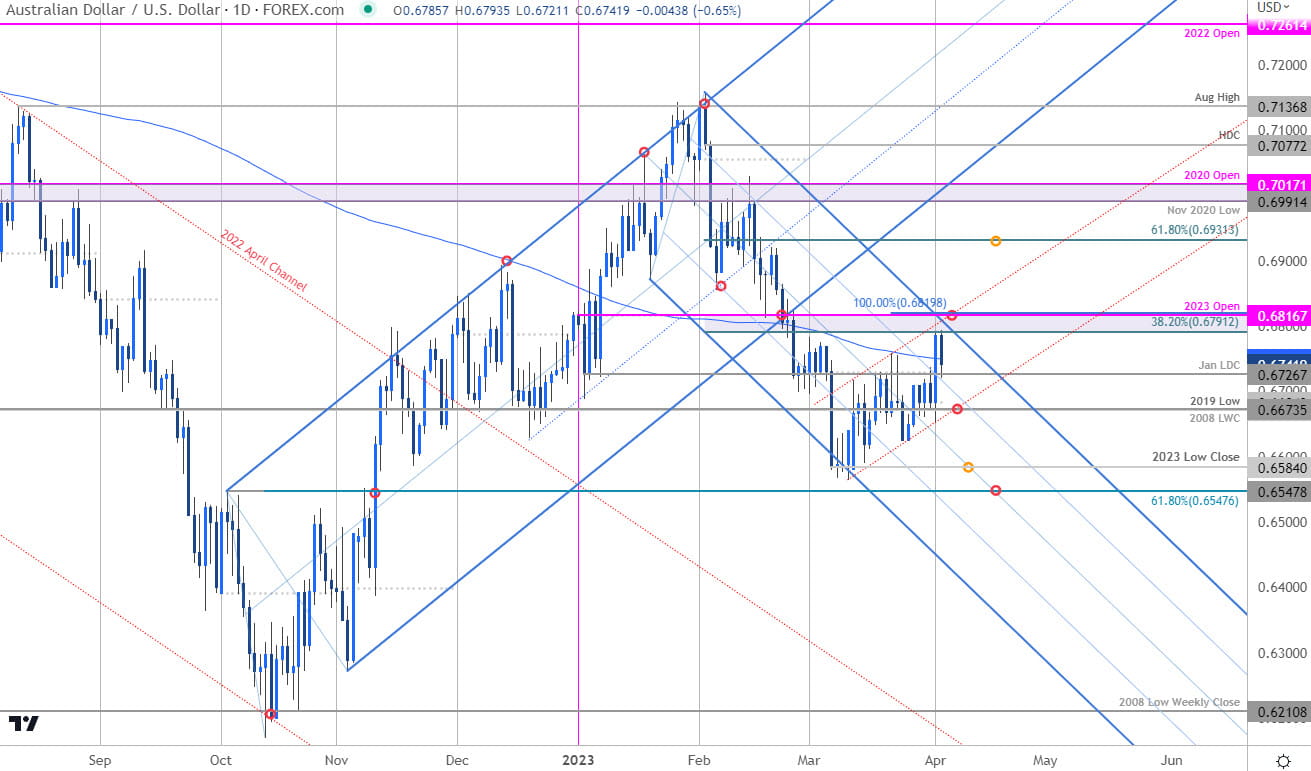

- Resistance 6791-6819 (critical), 6931, 6991-7017– support 6670/73, 6640 (key) 6584

The Australian Dollar plunged rallied more than 3.4% off the March lows with the advance now testing the first major resistance hurdle. The battle lines are drawn heading into the April open with the multi-week rally vulnerable while below today’s highs. These are the updated targets and invalidation levels that matter on the AUD/USD short-term technical chart.

Discussing this Aussie setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar short-term outlook (Feb 16th) we noted that AUD/USD was, “testing the weekly / monthly opening-range lows – looking for a reaction.” Aussie broke lower the following week with price plunging more than 8.2% off the yearly high before rebounding off downtrend support.

The recovery is testing downtrend resistance at a major pivot zone this week at 6791-6819- a region defined by the 38.2% Fibonacci retracement of the yearly range, the objective yearly open, and the 100% extension of the March rally. A break / daily close above this threshold is needed to suggest a more significant low was registered last month / a large reversal is underway. That said, bulls at risk while below this zone.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading within the confines of the same descending pitchfork formation we highlighted in February with Aussie failing today at confluent resistance around the upper parallel. The weekly opening-range is straddling the January low-day close at 6727- looking for a breakout to offer guidance here.

Initial support now rests with the 2008 low-week close / 2019 low at 6670/73 with a break / close below the yearly low-day close at 6640 needed to mark resumption. Such a scenario would expose subsequent support objectives at the yearly low-close at 6584 and a key Fibonacci confluence at 6541/47- look for a larger reaction there IF reached.

A topside breach of this formation would likely fuel another accelerated run towards the 61.8% retracement at 6931 with key resistance eyed around the November 2020 low / 2020 yearly open at 6991-7017.

Bottom line: AUD/USD has responded to confluent resistance early in the month and the focus in on a breakout of the 6640-6819 zone for guidance. From a trading standpoint, rallies should be limited by the 68-handle IF price is heading lower on this stretch. As always, stay nimble here into the monthly opening-range with Non-Farm Payrolls on Friday likely to fuel some added volatility here. I’ll publish an updated Australian Dollar weekly technical forecast once we get further clarity on the longer-term AUD/USD trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen short-term outlook: USD/JPY searches support into April open

- Gold short-term price outlook: XAU/USD breakout pending

- Canadian Dollar short-term outlook: USD/CAD teases the break

- Euro short-term outlook: EUR/USD support test at prior resistance

- US Dollar short-term price outlook: six-days down into support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex