Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- Australian Dollar plummets into key support pivot at yearly lows

- AUD/USD now challenging yearly opening-range- risk for price inflection

- Resistance 6600, 6650, 6670/73– support 6647/65 (key), 6500, 6451

The Australian Dollar plunged nearly 3.5% off the monthly highs with the sell-off now testing a critical support pivot at the yearly lows. The threat now rises for major inflection into this zone as the yearly opening-range is challenged. These are the updated targets and invalidation levels that matter on the AUD/USD short-term technical chart.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar short-term outlook we highlighted that AUD/USD was approaching support near 6547/65- a region defined by the 61.8% retracement of the 2022 advance and the objective yearly opening-range lows (March). We noted that, “rallies should be limited to the 6700 IF Aussie is indeed heading lower on this stretch with a break below the objective April opening-range needed to clear the way for a larger decline.” Price ripped through resistance for a final test of the yearly open (6817) before turning sharply lower with the decline now testing key support at the objective yearly low- once again, risk for price inflection into this threshold.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD trading within the confines of a descending pitchfork formation extending off the April / May highs with a break below the median-line today now testing key support. Initial resistance stands at 6600 backed closely by the objective weekly open at 6650 and the 2008 low-week close / 2019 low at 6670/73. Ultimately, a breach / close above the April high-day close at 6708 is needed to invalidate this multi-week downtrend.

A break / close below this key support zone would validate a breakout of the yearly opening-range- such a scenario would threaten an accelerated decline towards the 25% parallel (currently ~6500), the 61.8% Fibonacci extension of the yearly decline at 6451 and key support at the 78.6% retracement at 6381.

Bottom line: AUD/USD is testing key support at the objective yearly range-lows – looking for possible exhaustion / inflection into this zone (watch the weekly close). From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 6708 IF price is heading lower on this stretch. Review my latest Australian Dollar weekly technical forecast for a closer look at the longer-term AUD/USD trade levels.

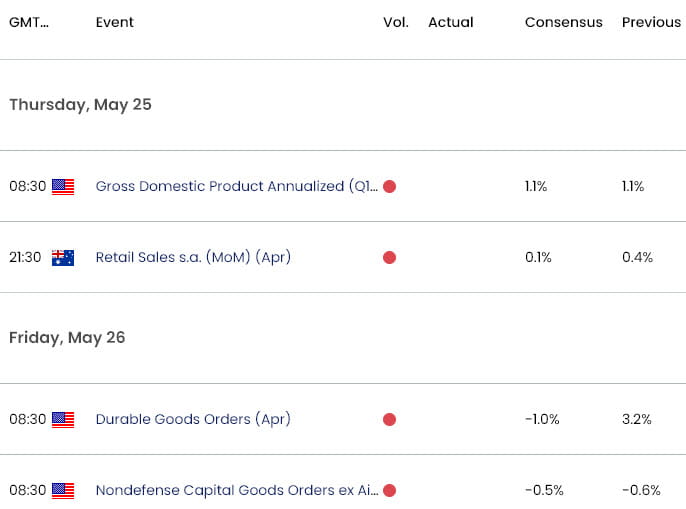

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold Short-term Price Outlook: XAU/USD Plunge Searches for Support

- Japanese Yen Short-Term Outlook: USD/JPY Ripper Eyes May / 2023 Highs

- Canadian Dollar short-term outlook: USD/CAD moment of truth at yearly support

- British Pound short-term outlook: GBP/USD breakout faces BoE

- Euro short-term outlook: EUR/USD resistance on Fed- ECB, NFP on tap

- US Dollar short-term outlook: USD battle-lines drawn ahead of Fed

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex