Australian Dollar Technical Outlook: AUD/USD Short-term Trade Levels

- AUD/USD 7.3% plunge off yearly high halts at support near yearly lows

- Australian Dollar stuck in multi-week, contractionary range- breakout imminent

- Resistance 6497-6514, 6582/91, 6622/28 (key)– Support 6433 (key), 6401, 6362

The Australian Dollar plunged more than 7.3% off the yearly highs with the decline rebounding off support last week near the yearly lows. AUD/USD has been straddling the 2024 low-day close for the past few weeks with price contracting into December opening-range. Battle lines drawn on the Aussie short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this AUD/USD technical setup and more. Join live on Monday’s at 8:30am EST.Australian Dollar Price Chart – AUD/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In last month’s Australian Dollar Short-term Outlook we noted that, “From a trading standpoint, look to reduce portions of short-exposure / lower protective stops on a stretch toward 6500…” We specifically highlighted, “subsequent support objectives at the April LDC at 6433 and the 2022 trendline / April low near 6362.” AUD/USD briefly registered an intraday low at 6434 last week before rebounding with price contracting into the median-line of a proposed descending pitchfork extending off the September high. The focus into the start of the month is on a potential breakout here with the multi-month downtrend vulnerable while above these lows.

Australian Dollar Price Chart – AUD/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Notes: A closer look at Aussie price action shows AUD/USD carving the weekly opening-range just below the 2024 LDC / monthly open 6497-6514. A breach / close above this threshold would threaten a larger bear market correction towards 6582/91 and the September low / 38.2% retracement of the late-September decline / 200-day moving average at 6622/28- both areas of interest for possible topside exhaustion / price inflection IF reached. Ultimately a close above the November high-day close (HDC) at 6680 would be needed to put the bulls back in control.

A break / close below 6433 would threaten downtrend resumption towards subsequent support objectives at the 2024 / April close low at 6401 and the April low at 6362. Note that losses below this threshold would constitute a breakout of the objective yearly opening-range lows and threaten another bout of accelerated losses towards the next major technical consideration near 6283/96- a region defined by the 88.6% retracement of the 2022 advance and the 2023 low-close.

Bottom line: A two-month decline off the yearly high takes Aussie towards support near the 2024 lows. The immediate focus is on a breakout of the weekly opening-range for guidance with the broader short-bias vulnerable while above 6433. From a trading standpoint, rallies should be limited to the 200-day moving average IF price is heading lower on this stretch with a break of the range lows needed to mark downtrend resumption.

Keep in mind we are in the early throws of the December opening-range with US non-farm payrolls on tap in Friday. Stay nimble into the release and watch the weekly close here for guidance. Review my latest Australian Dollar Weekly Forecast for a closer look at the longer-term AUD/USD technical trade levels.

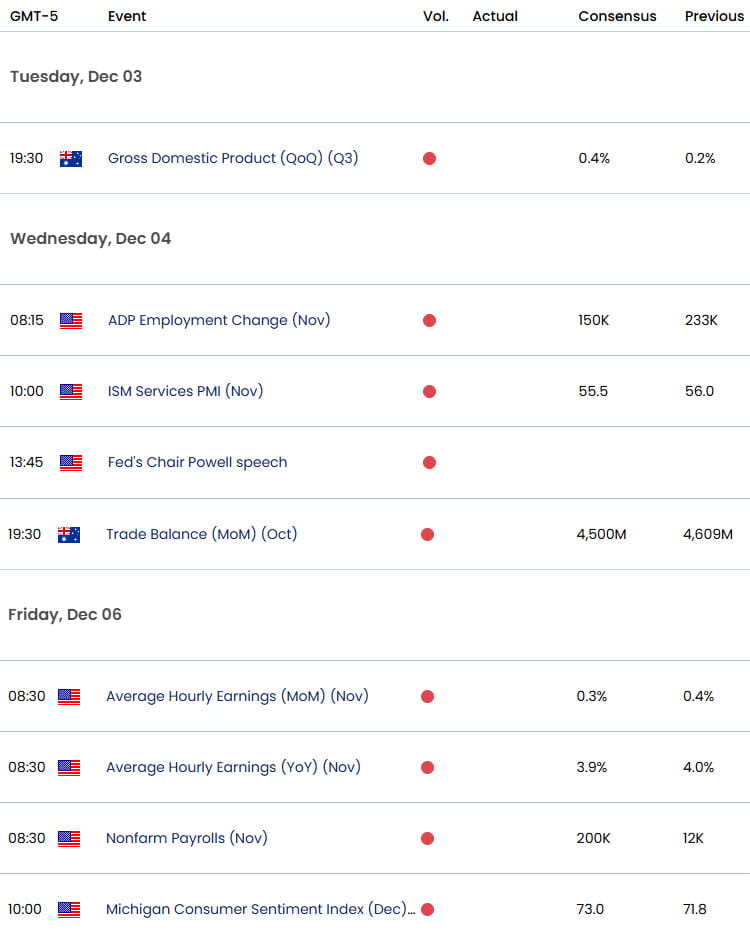

Key AUD/USD Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Euro Short-term Outlook: EUR/USD Threatens Bear Market Rebound

- Gold Short-term Outlook: XAU/USD Recovery Eyes Pivotal Resistance

- Canadian Dollar Short-term Outlook: USD/CAD Trump Rally Unravels

- Japanese Yen Short-term Outlook: USD/JPY Bears Charge Uptrend Support

- Swiss Franc Short-term Outlook: USD/CHF Bulls Relent at Resistance

- British Pound Short-term Outlook: GBP/USD in Freefall- Support Ahead

- US Dollar Short-term Outlook: USD Trump Bump Extends into Resistance

Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex