Australian Dollar Outlook: AUD/USD

AUD/USD clears the August low (0.6349) to register a fresh yearly low (0.6337), and the exchange rate appears to be on track to test the November 2023 low (0.6318) as it carves a series of lower highs and lows.

Australian Dollar Forecast: AUD/USD Falls to Fresh Yearly Low

Keep in mind, AUD/USD struggled to hold its ground following the Reserve Bank of Australia (RBA) meeting as the central bank revealed that ‘the Board is gaining some confidence that inflation is moving sustainably towards target’ after keeping the cash rate at 4.35%.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

The comments suggest the RBA is getting closer to changing gears after keeping interest rates on hold throughout 2024, but data prints coming out of Australia may encourage Governor Michele Bullock and Co. to further combat inflation as the employment report is anticipated to show a resilient labor market.

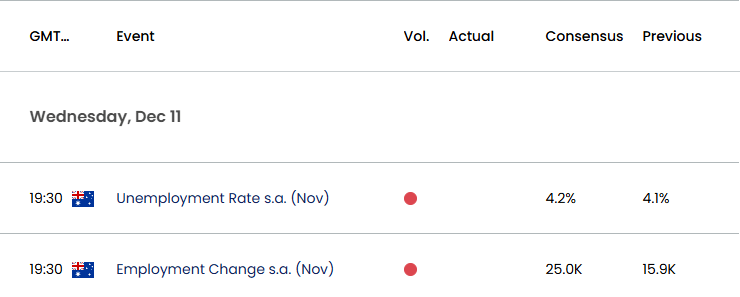

Australia Economic Calendar

Australia is expected to add 25.0K jobs in November following the 15.9K expansion the month prior, and a positive development may generate a bullish reaction in the Australian Dollar as it raises the RBA’s scope to further combat inflation.

With that said, another rise in Australia Employment may curb the recent weakness in AUD/USD, but the exchange rate may attempt to test the November 2023 low (0.6318) should the bearish price series may persist.

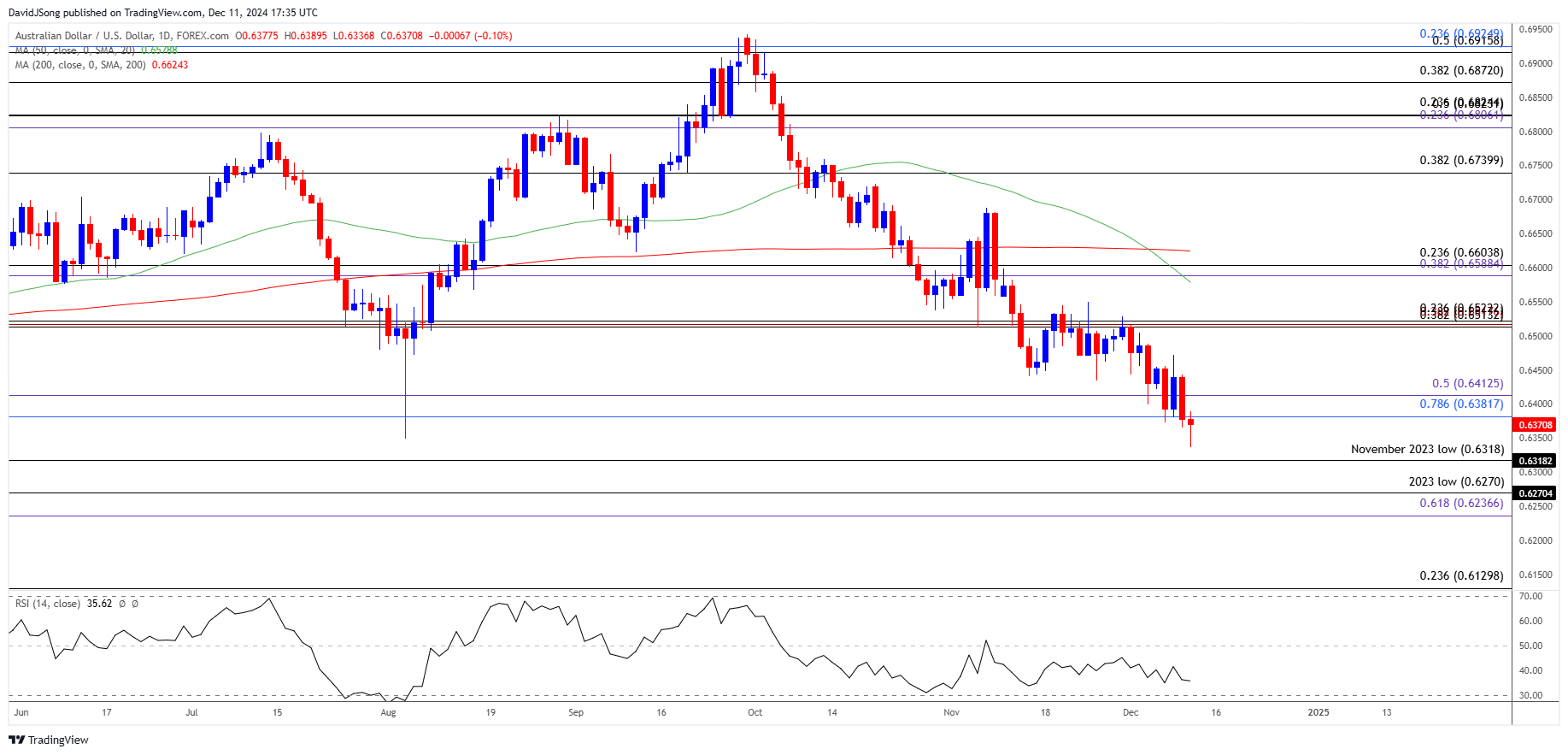

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; AUD/USD on TradingView

- AUD/USD trades to a fresh yearly low (0.6337) after closing below the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone for the first time in 2024, with a breach below the November 2023 low (0.6318) bringing the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) region on the radar.

- Next area of interest comes in around 0.6130 (23.6% Fibonacci retracement), but lack of momentum to below the November 2023 low (0.6318) may keep the Relative Strength Index (RSI) above oversold territory.

- Need a move above the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone for AUD/USD to clear the bearish price series, with a break/close above the 0.6510 (38.2% Fibonacci retracement) to 0.6520 (23.6% Fibonacci retracement) region bring the 0.6590 (38.2% Fibonacci extension) to 0.6600 (23.6% Fibonacci retracement) area back on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Rallies Ahead of US CPI Report

EUR/USD Monthly Opening Range Intact Ahead of ECB Rate Decision

USD/CAD Forecast: Canadian Dollar Vulnerable to BoC Rate Cut

GBP/USD Remains Susceptible to Bear Flag Formation

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong