Australian Technical Forecast: AUD/USD Weekly Trade Levels

- Australian Dollar rally rejected at downtrend resistance- plunges back below 52-WMA

- AUD/USD testing initial support into Q3- Core PCE, RBA, NFPs on tap

- Resistance 6670/74, ~6728, 6816– support 6607 (key), 6467, 6393

The Australian Dollar plummeted another 0.8% this week with AUD/USD now testing support at the low-week close. The battle-lines are drawn into July with the broader outlook weighted to the downside while below the objective 2023 yearly open. These are the updated targets and invalidation levels that matter on the AUD/USD weekly technical chart into the third quarter.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Aussie setup and more. Join live on Monday’s at 8:30am EST.

Australian Dollar Price Chart – AUD/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; AUD/USD on TradingView

Technical Outlook: In my last Australian Dollar Technical Forecast we noted that AUD/USD was, “testing a critical pivot zone into multi-year trend resistance- risk for inflection into 6725.” Aussie ripped through this level with price rallying another 2% before failing into confluent resistance at 6890-6922- a region defined by the 61.8% Fibonacci retracement pf the yearly range and the objective high-week close. A reversal off this key range has now plunged more than 4.4% in just two weeks and takes Aussie back below the 52-week moving average (now 6728).

The decline is testing support this week at the objective 2023 low-week close around 6607- a close below this threshold is needed to mark resumption of the broader downtrend towards subsequent support objectives at the 61.8% extension of the decline off the yearly highs (6467) and the 2022 October reversal close at 6393 (look for a larger reaction there IF reached). Resistance is now eyed back at 6728 with broader bearish invalidation now lowered to the objective yearly open.

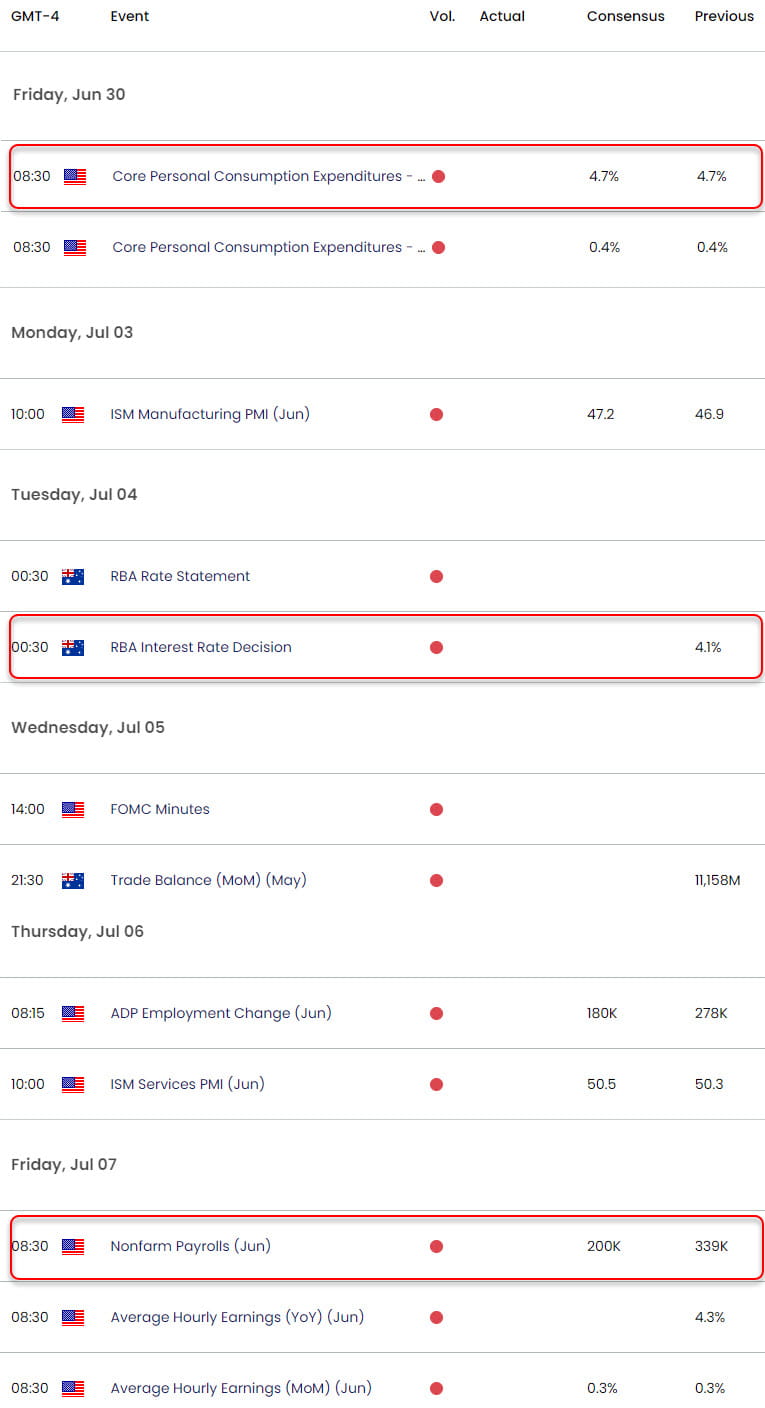

Bottom line: Aussie has reversed back within the confines of the multi-year downtrend with price now testing the initial support. From a trading standpoint, a good zone to reduce portions of short-exposure / lower protective stops – rallies should be limited to 6816 IF price is heading lower on this stretch with a close below the 66-handle needed to mark resumption. Keep in mind we are heading into the close of the month / quarter with US Core PCE, the RBA interest rate decision, and Non-Farm Payrolls on tap into a shortened holiday week– stay nimble into the July open. Review my latest Australian Dollar Short-term Outlook for a closer look at the near-term AUD/USD technical trade levels.

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Crude Oil (WTI)

- Gold (XAU/USD)

- Canadian Dollar (USD/CAD)

- Euro (EUR/USD)

- Japanese Yen (USD/JPY)

- British Pound (GBP/USD)

- US Dollar (DXY)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex