Australian Dollar Outlook: AUD/USD

AUD/USD no longer carves a series of higher highs and lows as it struggles to push above the weekly high (0.6247), and the exchange rate may give back the rebound from the monthly low (0.6131) should it continue to track the negative slope in the 50-Day SMA (0.6394).

AUD/USD Vulnerable amid Struggle to Push Above Weekly High

AUD/USD halts a three-day rally despite the larger-than-expected rise in Australia Employment, and the Australian Dollar may continue underperform against its US counterpart amid the uncertainties surrounding the Asia/Pacific region.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

Nevertheless, the ongoing expansion in employment may keep the Reserve Bank of Australia (RBA) on the sidelines as the economy adds 56.3K jobs in December versus forecasts for a 15.0K print, and it remains to be seen if the central bank will keep the cash rate on hold in 2025 as authorities in China, Australia’s largest trading partner, pledge to further support the economy this year.

China Economic Calendar

In turn, developments coming out of China may sway AUD/USD as the Gross Domestic Product (GDP) report is anticipated to show a 5.0% expansion for the fourth quarter of 2024, and a positive development may prop up the Australian Dollar as it instills an improved outlook for the Asia/Pacific region.

With that said, AUD/USD may attempt to further retrace the decline from the monthly high (0.6302) as it holds above the weekly low (0.6131), but the exchange rate may continue to track the negative slope in the 50-Day SMA (0.6394) as it still holds below the moving average.

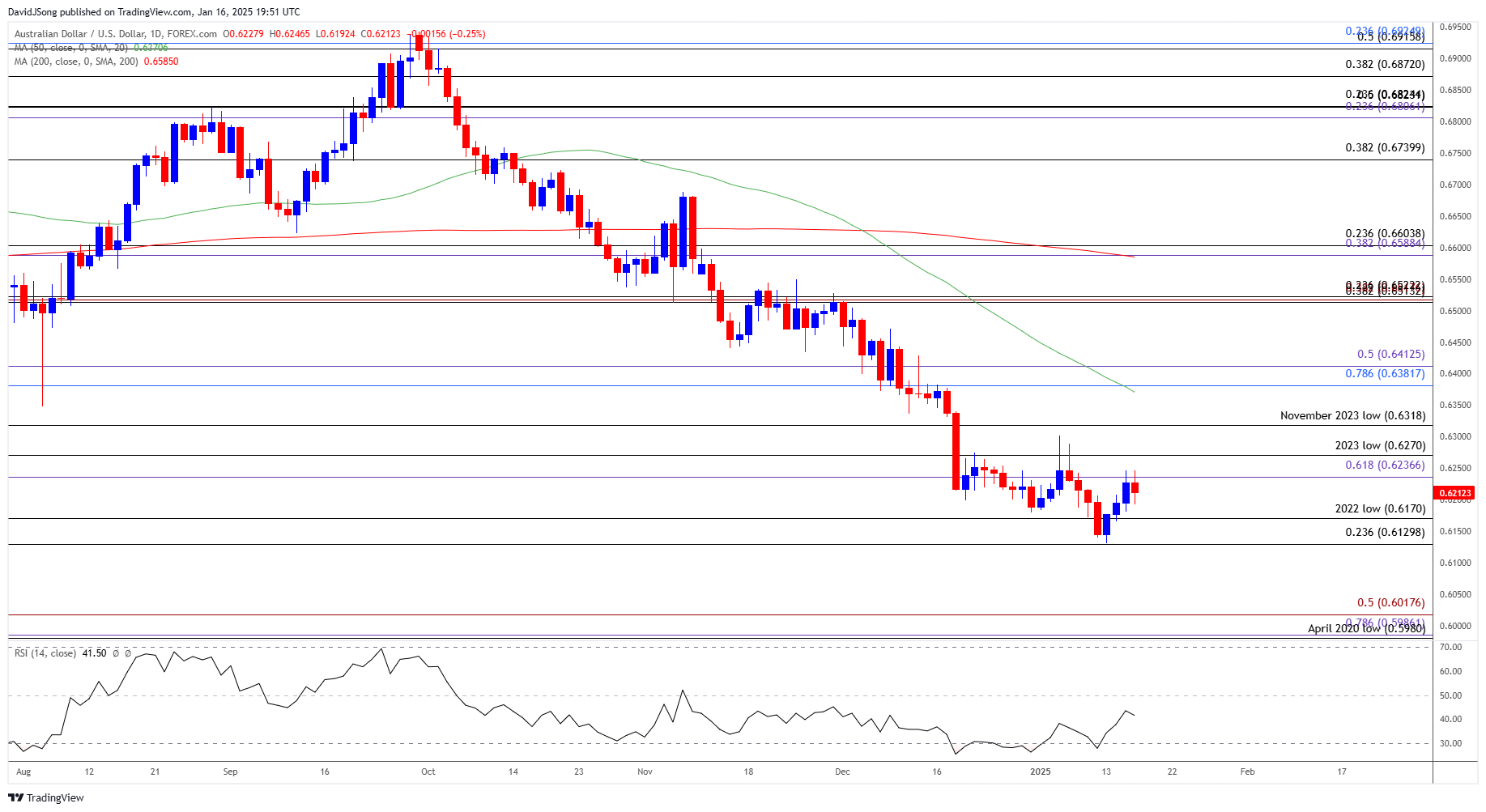

AUD/USD Price Chart – Daily

Chart Prepared by David Song, Senior Strategist; AUD/USD on TradingView

- The rebound in AUD/USD appears to be stalling as it struggles to push above the weekly high (0.6247), and the exchange rate may give back the advance from the start of the week as it no longer carves a series of higher highs and lows.

- Lack of momentum to trade back above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) may push AUD/USD towards the monthly low (0.6131), with a break/close below the 0.6130 (23.6% Fibonacci retracement) to 0.6170 (2022 low) region opening up the April 2020 low (0.5980).

- At the same time, a break/close above the 0.6240 (61.8% Fibonacci extension) to 0.6270 (2023 low) region may push AUD/USD towards the monthly high (0.6302), with a breach above the November 2023 low (0.6318) bringing the 0.6380 (78.6% Fibonacci retracement) to 0.6410 (50% Fibonacci extension) zone on the radar.

Additional Market Outlooks

USD/CHF Snaps Bearish Price Series to Hold Above Weekly Low

US Dollar Forecast: USD/CAD Susceptible to Test of Monthly Low

Gold Price Recovery Stalls Ahead of December High

EUR/USD Vulnerable Amid Push Below January Opening Range

--- Written by David Song, Senior Strategist

Follow on X at @DavidJSong