Ahead of Thursday’s US CPI release, the US dollar has remained relatively stable this week, following a decline last week due to the release of mostly weaker US economic data. However, the AUD/USD pair continues to edge higher, and overnight it was supported by a sharp rally in the AUD/NZD pair after the kiwi was hit by a dovish surprise in the rate statement of the Reserve Bank of New Zealand. The Aussie remains one of the strongest among G10 currencies, owing to a hawkish central bank and expectations interest rates will remain higher for longer in Down Under. The upcoming release of US inflation data is likely to alter the odds of a September rate cut in the direction of the surprise, putting the AUD/USD forecast into focus after it surged through a major long-term resistance trend.

Before discussing the upcoming US data, let’s have a quick look at the AUD/USD chart first.

AUD/USD forecast boosted by technical breakout

Source: TradingView.com

The weaker dollar last week sent the AUD/USD above key resistance in the 0.6650 region. Here, we had the resistance trend of the bearish channel the Aussie was stuck inside since February 2021. The fact that we have now broken higher bodes well for the AUD/USD bulls. Assuming short-term support in the range between 0.6650 to 0.6705 does not give way now, the path of least resistance on the AUD/USD will remain to the upside, with the bulls now potentially aiming for 0.6850 resistance (and potentially much higher).

Key US data coming up this week

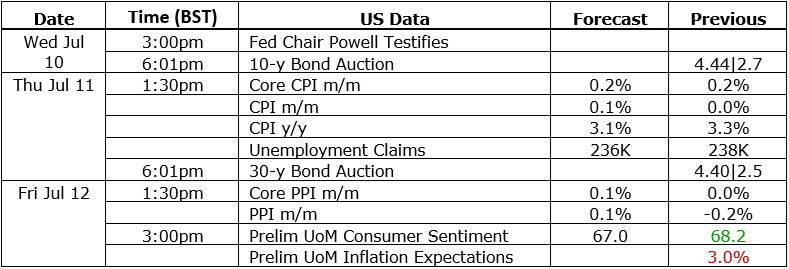

In addition to CPI and PPI measures of inflation, we will also have the University of Michigan’s consumer sentiment and inflation expectations surveys, all coming up later on in the week.

AUD/USD forecast could get another lift if US CPI signals return to disinflation

The latest Consumer Price Index (CPI) data will come out on Thursday, July 11. Last month, core CPI rose by a weaker-than-expected 0.2%, and the headline reading was flat. US dollar bears had hoped for a bigger drop, but the dollar stayed steady against the yen and euro until weak US economic data last week caused a decline. Another weak CPI result could signal that disinflation is back on track, supporting the case for a September cut. This outcome should boost the AUD/USD forecast, while a surprising hot inflation print would have the opposite impact.

There will be more inflation data on Friday, when we'll get the Producer Price Index (PPI) and the University of Michigan’s Inflation Expectations survey (as well as Consumer Sentiment). The UoM’s Inflation Expectations survey dropped to 3.0% from 3.3%. Lower inflation expectations could lead to weaker actual inflation through a reduced wage-price spiral. The UoM consumer sentiment gauge has been falling and missing expectations.

Other data points like the ISM manufacturing and services PMIs have also been weak lately. The latest non-farm jobs report showed a rise of 206,000 payrolls, which was better than expected. However, revisions to the previous two months' data brought the three-month average to its lowest since January 2021. Unemployment increased to 4.1%, and average hourly earnings grew at their slowest rate since Q2 2021, aligning with the Fed's 2% inflation target.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R