The price action so far today is emblematic of a textbook “risk off” day: stocks are falling across the globe, oil is trading off by nearly 3%, bond yields are generally retreating, and the yen is the strongest performing major currency (though we would note that gold bugs still can’t seem to catch a break!).

One other apparent outlier is the Australian dollar, which is traditionally seen as one of the major currencies that is most sensitive to risk appetite. While it’s hardly setting traders’ heat maps ablaze, the Aussie is holding its ground against currencies that are generally perceived as “safer” (such as the US dollar and Swiss franc) and gaining ground against its commodity dollar rivals (the New Zealand and Canadian dollars).

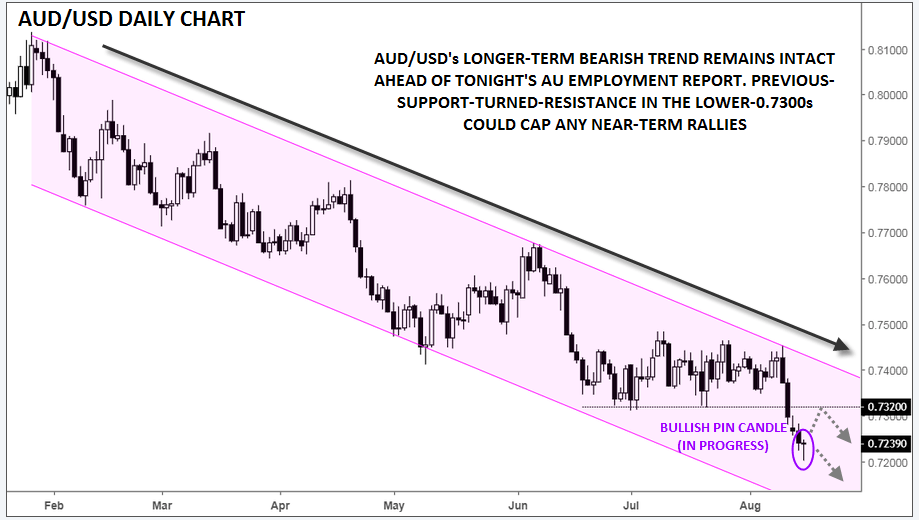

Taking a step back, AUD/USD remains in the middle of its bearish channel, a structure that we recently dubbed “The Cleanest Medium-Term Trend in FX”. While the momentum is undoubtedly bearish following last week’s big breakdown below support in the lower-0.7300s, today’s relative strength in the Aussie may create a hammer, or “bullish pin,” candle on the daily chart, which could signal a near-term shift from selling to buying pressure.

Fundamentally speaking, the situation in Turkey continues to drive global risk sentiment, even though it has little direct economic on Australia or the US! On that front, investors were dealt some reassuring news as Qatar pledged a $15B investment in Turkey amidst the lira crisis.

Closer to home for Aussies, traders will get their first look at the July employment data from Down Under. Economists are expecting a 15.0k gain in net jobs after last month’s stellar 50.9k reading, with the unemployment rate expected to hold steady at 5.4%. It’s worth noting that these figures are extremely volatile on a month-to-month basis, so AUD/USD may initially see some sharp moves as investors digest the data. Needless to say, a decent report could help put a bid under the pair for a possible bounce back toward previous-support-turned-resistance in the 0.7310-20 range, whereas a miss could erase today’s tentative bullish signs and extend the longer-term downtrend.

Source: Stockcharts.com, FOREX.com