It was a volatile day for markets on Tuesday, most of it stemming from promise of stimulus from China. A joint press conference from the PBOC (People’s Bank of China) and two of its financial regulators revealed multiple rate cuts will arrive to help boost the economy. Regulators also announced measures to boost the share market. You can read a full report from my colleague David Scutt, but initial reaction was positive from APAC markets.

China A50 futures surged 6.5% on Tuesday and rose a further 2.7% overnight, while Hang Seng futures are up around 8.3% from Tuesday morning’s open. The ASX 200 caught a small tailwind alongside Wall Street, rising 0.3% overnight. The S&P 500 and Dow Jones closed at a record high, and the Nasdaq 100 reached a 48-day high.

Read David Scutt’s breakdown of China’s stimulus: Hang Seng, China A50, SGX iron ore: Rate cuts, lots of them, but does it solve China’s problem?

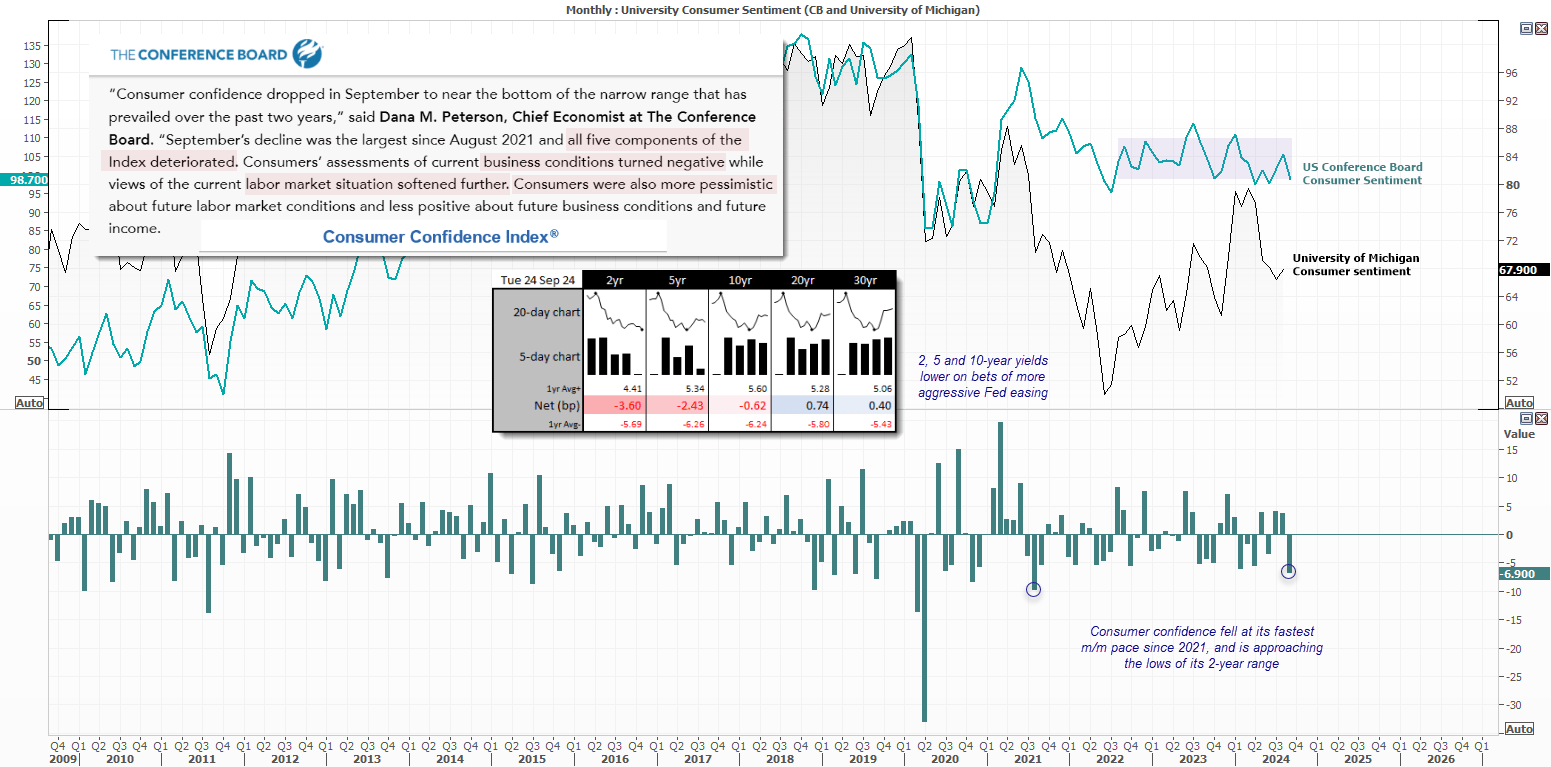

US consumer confidence has also taken a knock, which bolstered bets of more aggressive Fed easing. Confidence fell -6.9 points at its fastest pace since August 2021, and now sits at the bottom of its 2-year range according to the Confidence Board. All five components of the headline index also deteriorated.

Dovish comments from Fed members were also lapped up by rates markets. Goolsbee thinks the Fed’s interest rate is 100bp above the neutral rate and that “we have a long way to come down to get the interest rate to something like neutral”. Bostic sees a further deterioration on the labour market as good reason to increase pace of easing, although this is not his baseline.

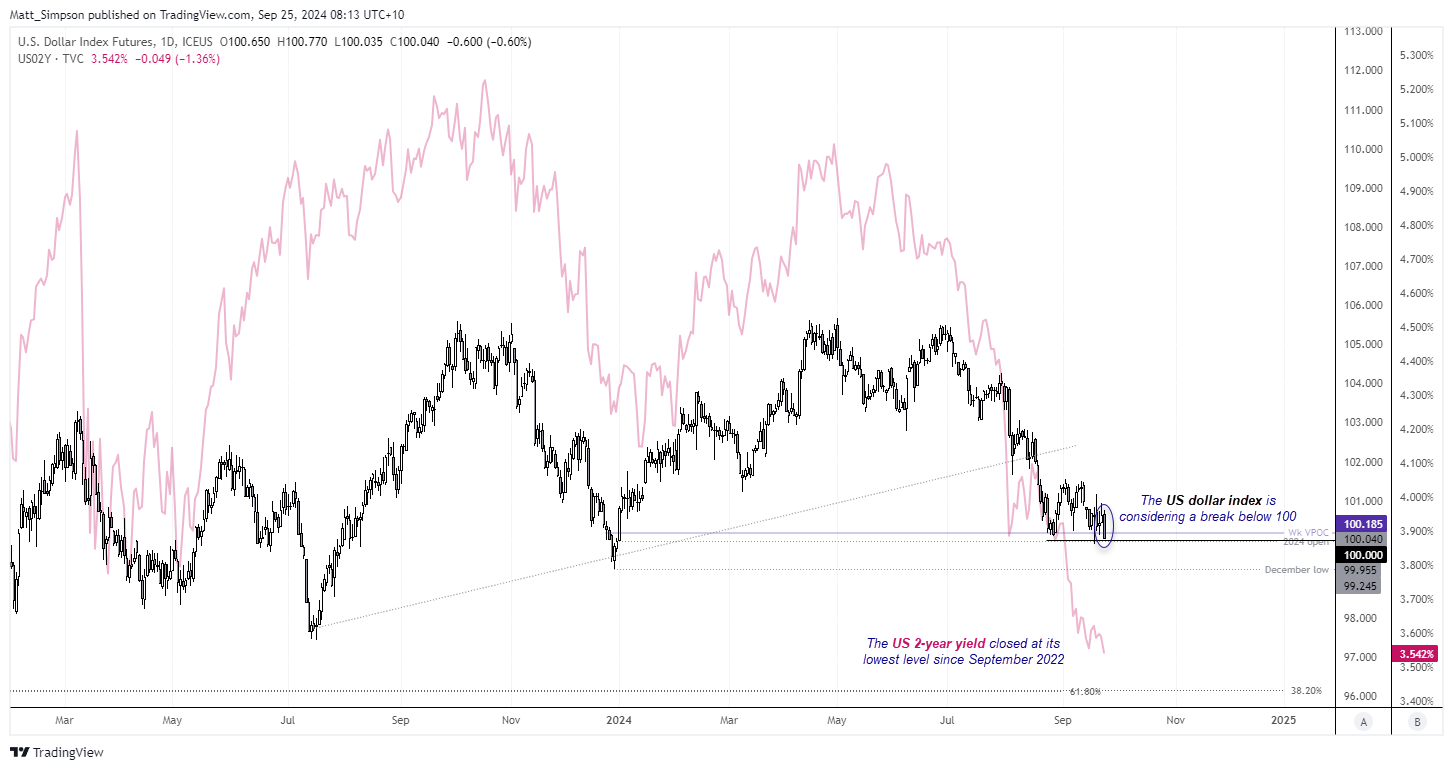

The USD was the weakest FX major and was dragged lower with short-term yields on bets of 75bp of Fed cuts by December. The 2-year yield closed at 3.54%, its lowest level since September 2022, Fed fund futures now imply an 80% chance rates could be cut to 4-4.25% by December (which allows a 25bp cut in November and 50bp in December). Gold reached its latest record high on a combination of Middle East headlines, dovish-Fed bets and lower yields and US dollar.

The RBA held their cash rate at 4.35% and their statement contained few surprises. Inflation remains “too high” and they remain vigilant to upside surprises, and “the Board is not ruling anything in our out”. This means the RBA retain their slight hawkish bias and that the gulf between their communication and market pricing (of multiple cuts) remains in place. And that gap needs to begin closing before we can expect even a single cut.

Events in focus (AEDT):

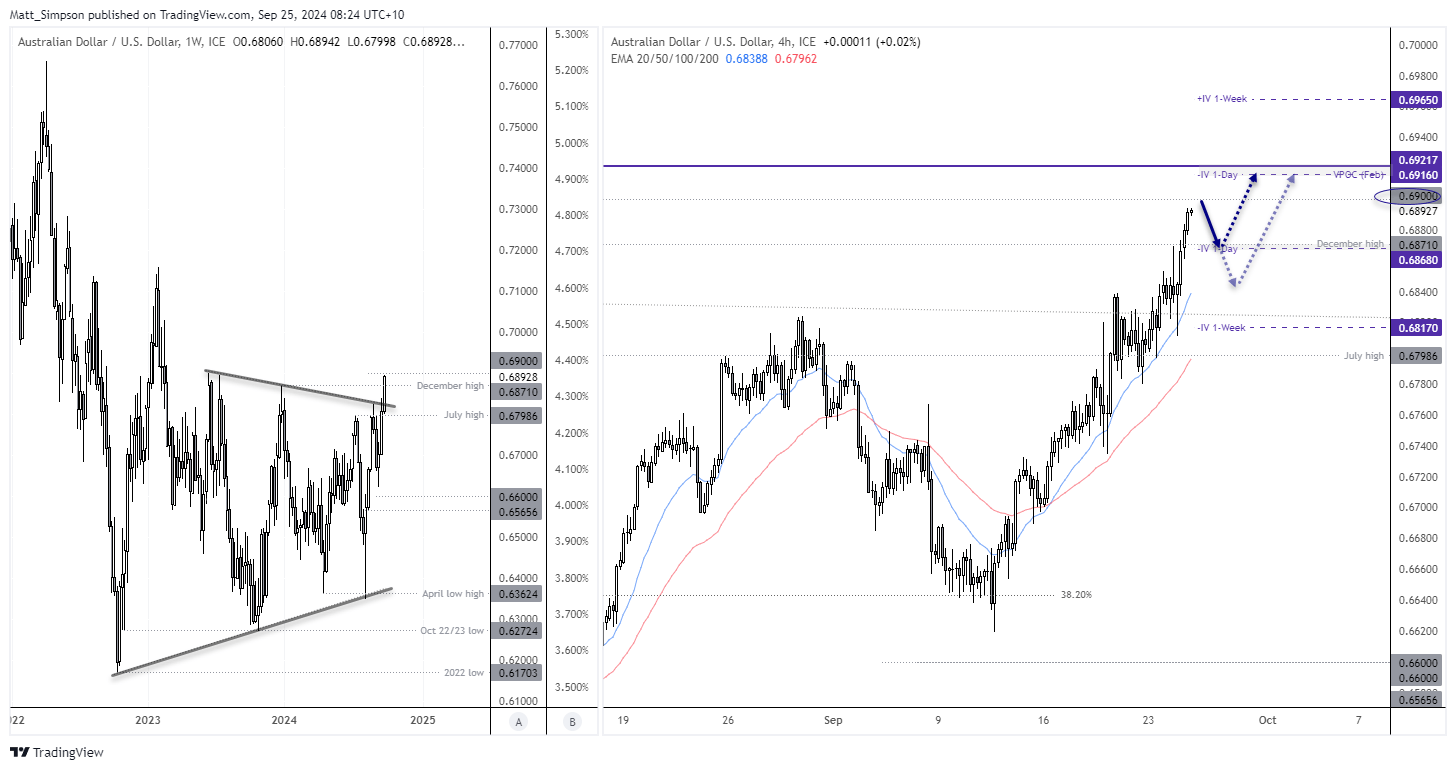

With the Fed in full easing mode, some are calling for earlier rate cuts from the RBA. This means any weakness in today’s inflation figures might be pounded upon by AUD/USD bears. But to expect any sizeable pullback on AUD/USD likely requires a bounce for the US dollar from the $100 area.

- 11:30 – AU monthly inflation report, RBA chart pack

- 15:00 – JP BOJ corporate services price index

AUD/USD technical analysis:

We may be witnessing the upside breakout from the near-two-year triangle pattern earlier than I suspected. The false break of 64c was met with a sharp reversal higher, thanks to a dovish Fed, USD in freefall and rising stock market.

The 1-hour chart shows a strong bullish rally, although there has been some turbulence along the way. Still, prices continue to respect the 20-bar EMA and an eventual breakout above 69c appears to be on the cards. Yet 69c resistance looms nearby, and prices have not tested the 20-bar EMA for a while.

Today, I am on guard for a slight pullback on the potential for softer inflation figures from Australia. Yet dips are likely to remain favourable for bulls, who could wait for evidence of a swing low to form around support levels.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge