Key points:

- US inflation expectations and CPI report could be a key driver for the US dollar’s direction next week

- Australia’s employment figures for January will be monitored to see if December’s full-time job culling was a one off, or a new trend (and potentially reshape the RBA’s policy expectations)

- The RBA’s chief economist is likely to stick to the RBA’s script and not reveal a dovish surprise

Potential market drivers for AUD/USD, AUD/JPY, ASX 200

- Remarks by Marion Kohler, Head of Economic Analysis, at the Australian Business Economists Annual Forecasting Conference, Sydney (Tuesday Feb 13m 08:55 AEDT / 21:55 GMT Monday)

- NAB business confidence (Tuesday Feb 13m 08:55 AEDT / 21:55 GMT Monday)

- US CPI (Wednesday 00:00 AEDT / 13:30 GMT Tuesday)

- Labour force report, Thursday (Thursday, 11:30 AEDT / 00:30 GMT)

Remarks by Marion Kohler

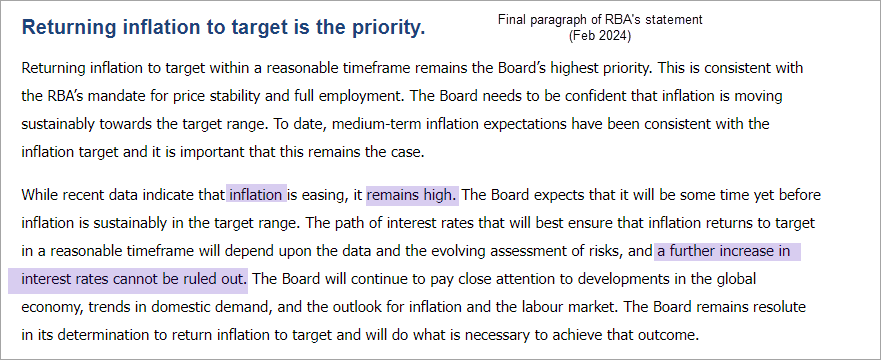

The RBA are in no rush to cut rates if we’re to believe their statement and press conference from their last meeting. And that is likely to be the message sent from the RBA’s head of economic analysis next week at the annual ABE forecasting conference (Australian Business Economists). The RBA released their quarterly Statement on Monetary Policy (SOMP) at their last meeting, and whilst it shows slightly lower CPI expectations, their statement retained a hawkish bias as inflation remains “too high”. I therefore see little chance of a dovish surprise from their chief economist next week.

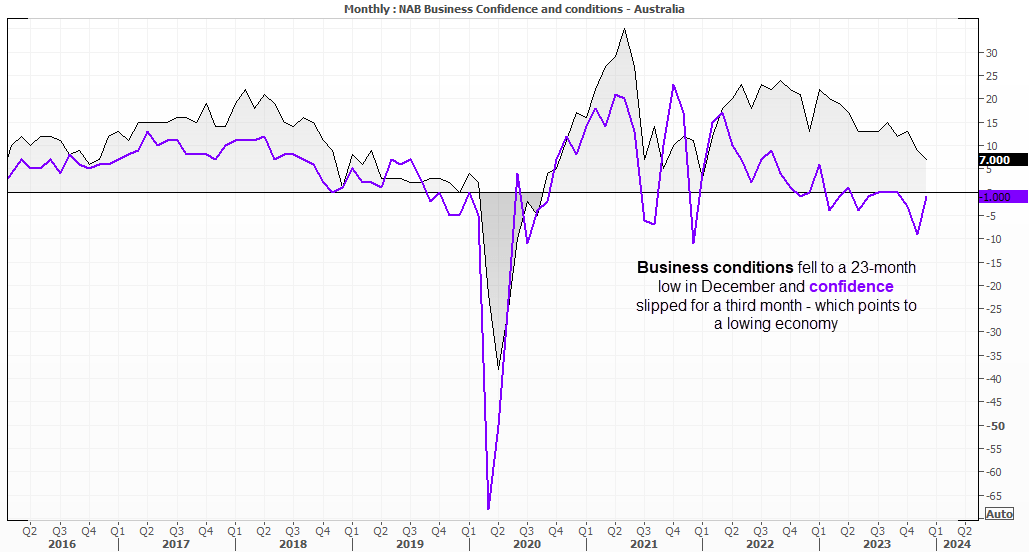

NAB business confidence

Business confidence fell for a third month in December, and business conditions slipped to a 23-month low according to the National Australian Bank (NAB) survey, led by a decline in manufacturing and construction. Perhaps more importantly, input costs had eased with lower labour and purchase costs. The basic takeaway from NAB was that “economic growth had eased considerably by the end of 2023” despite a stronger-than-expected start to the year. And if we’re to see business confidence and conditions continue to soften, it points to weaker growth and an increased likelihood of RBA cutting interest rates from 4.35%.

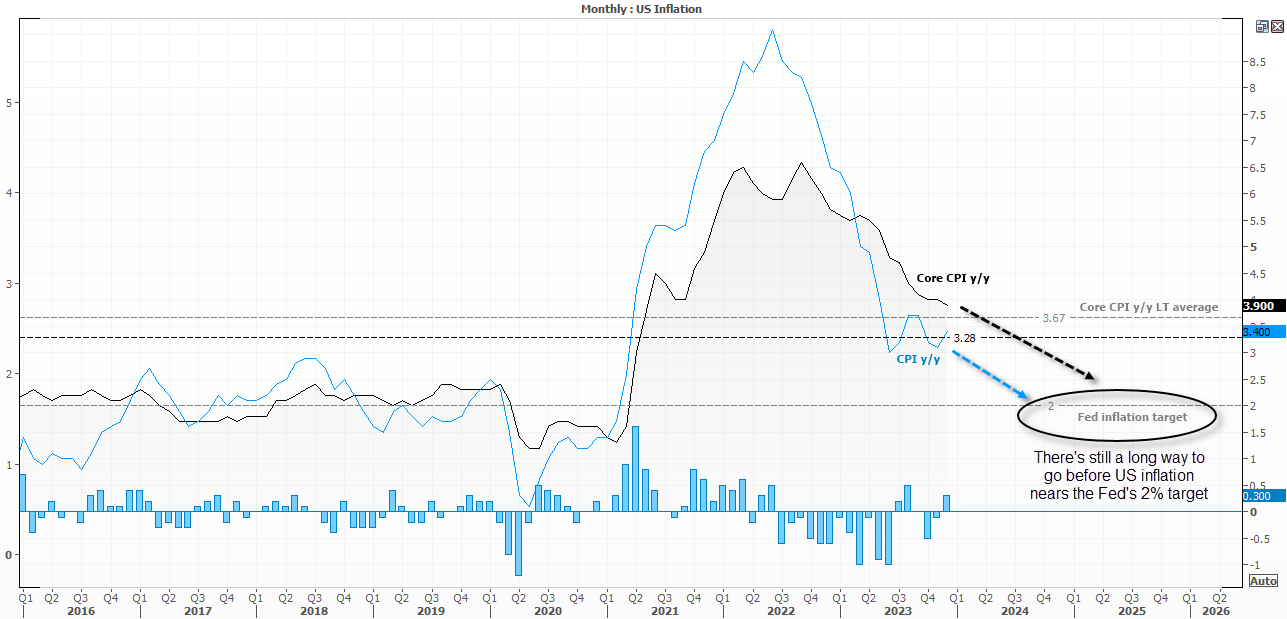

US inflation

Arguably the biggest event of next week, all traders and central bank watchers will be keeping an eye on the US inflation report. The Fed have continued to push back on multiple rate cuts, with Jerome Powell effectively ruling out a March hike and Bostic sticking to his ‘third quarter’ estimate for a first cut. Market pricing has been revised down from five or more cuts to just one or two, which has helped to push the US dollar higher and keep AUD/USD under pressure. And that downwards pressure could persist on AUD/USD unless US inflation falls at a faster rate, because there is a long way to go before CPI or core CPI reach the Fed’s 2% target.

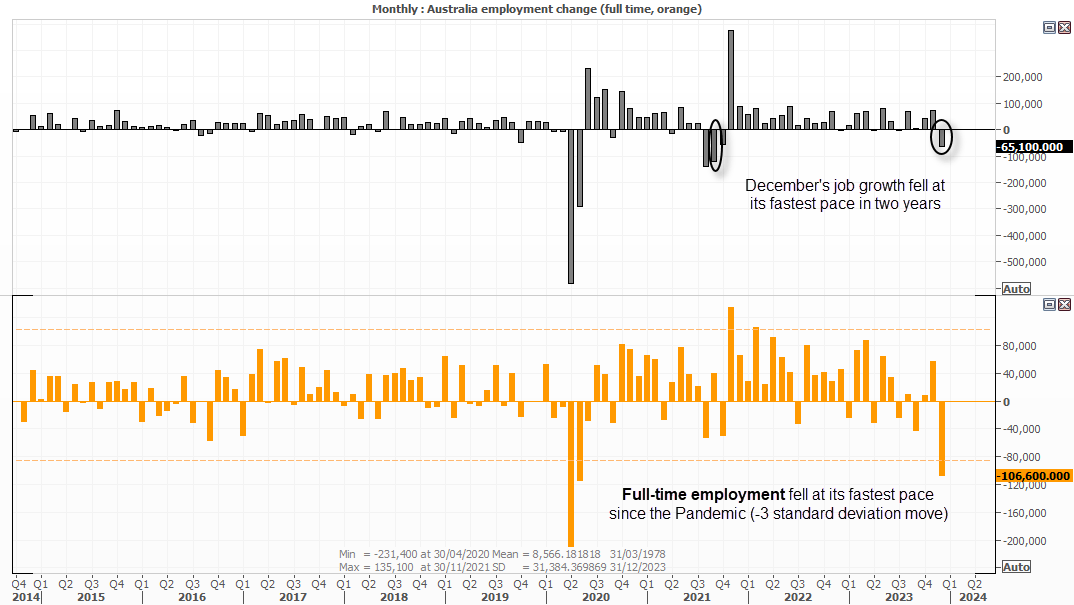

Australian labour force report

The RBA kept rates at 4.35% for a third meeting, retained their slight hawkish bias in their statement but slightly lowered their inflation forecast. Their cash rate estimate allows for at least one cut this year, and just less than two. Traders were expecting a bit more of a dovish tone given the general weakening of the economy and broadly softer inflation figures for Q4.

Australia’s relatively strong employment data has been a key reason for the RBA retaining a hawkish bias, although December’s figures revealed some cracks. Over 100k full-time jobs were culled, making it the worst month on record outside of recessionary time (it was only beaten by the pandemic). If full-time jobs are to be severed for a second month, recessionary alarm bells would surely ring. And they’d only ring louder if this is accompanied with a strong uptick of unemployment and a lower participation rate. In turn, traders could drive AUD/USD lower in anticipation of two or more RBA cuts to arrive this year and earlier than expected.

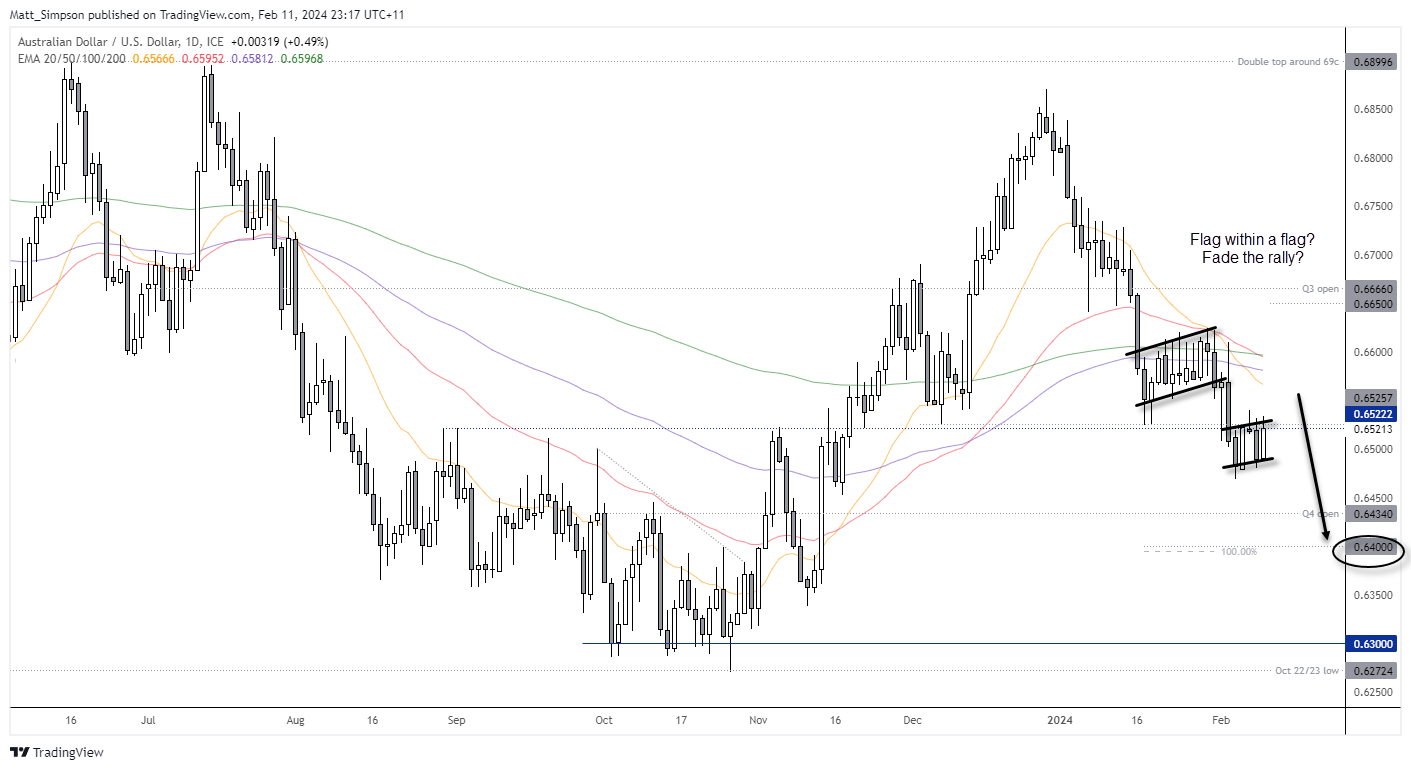

AUD/USD technical analysis

AUD/USD has just snapped a 5-week losing streak. It produced a spinning top candle for the week to show bears are losing enthusiasm and closed above 65c. Personally, I am wary of being ‘caught short’ around these levels. Even though I suspect it will eventually fall to 64c. My bias is to expect a bounce, and then to seek opportunities to fade (short) into the fake move higher.

On a fundamental level, we have the Fed with a higher base rate and lack of enthusiasm to signal easing, compared with an RBA with a lower cash rate pretending they might raise, with a lower cash rate and slowing economy. The RBA have to keep a ‘hawkish’ narrative to keep the Australian dollar elevated, as to avoid importing inflation, which is why they’re unlikely to drop the hawkish narrative even though there is little chance of them hiking again. In simple terms, fade the rallies.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge