Wall Street indices were lower amid a risk-off start to the week which also saw the VIX (volatility index) rise nearly 18% on Monday. Google’s Alphabet fell -2.4% after an unfavourable court ruling said the company must lift restrictions that prevents developers from competing with the Google Play store. The S&P 500 was -1% lower and erased all of Friday’s NFP gains, as did the Nasdaq and Dow Jones which fell -1.2% and -0.9% respectively.

Crude oil prices rallied for a third day on concerns that of an Israeli retaliation attack on Iran’s oil infrastructure. WTI crude oil rose 4% and was up for a fourth day to close above $77, its highest daily close in six weeks. Brent crude oil closed above its 200-day average and $80 handle.

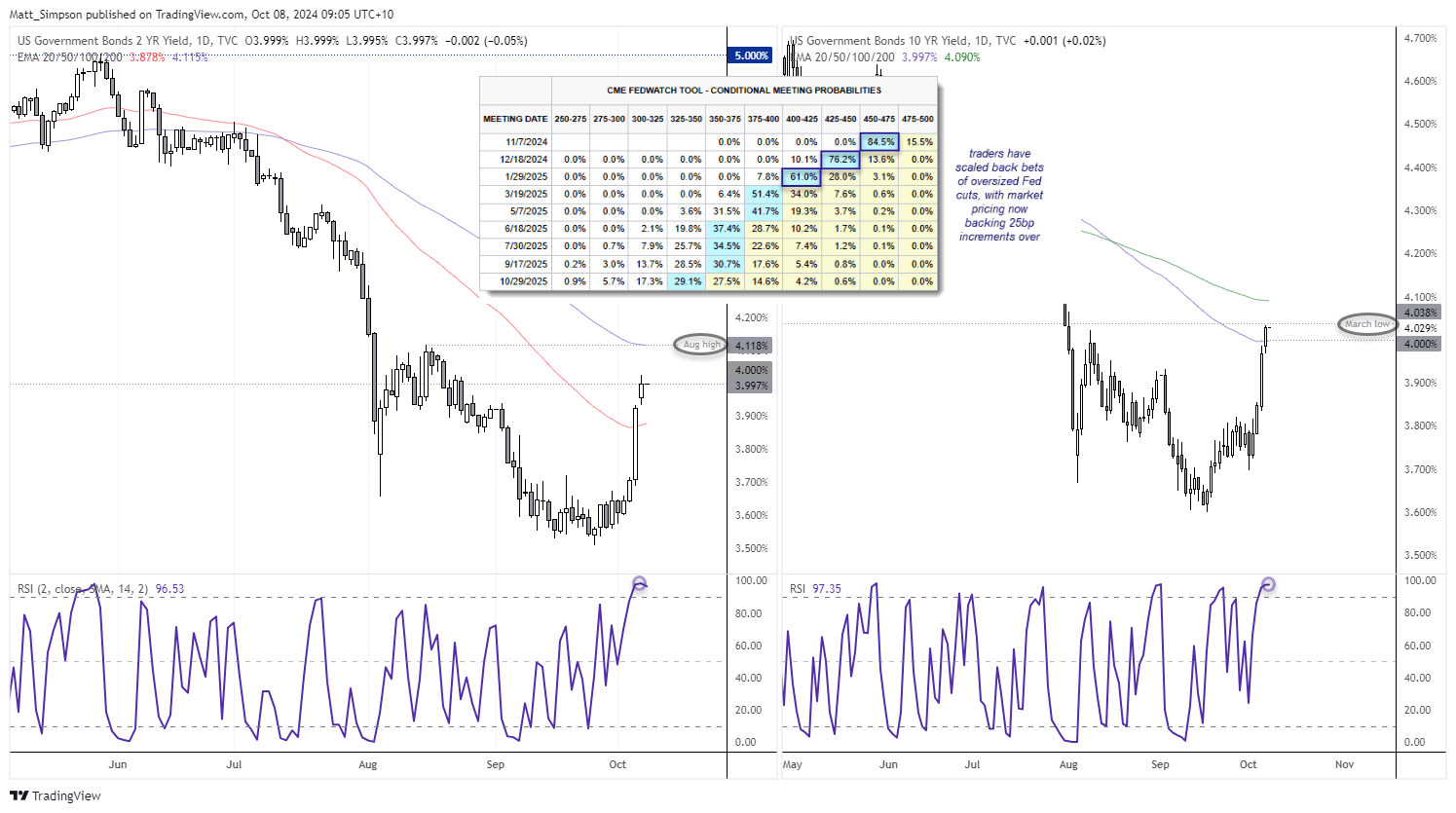

Bets of oversized Fed cuts continued to be scaled back following Friday’s bumper NFP report, sending the USD and yields higher. Fed fund futures now imply an 84% chance of a 25bp cut in November and 78.2% for another in December. The 10-year yield rose above 4% for the first time July, the 2-year saw an intraday break above 4% for the first time since mid-August before settling just beneath it. However, with their daily RSI 2’s heavily overbought, the March low’s nearby and a loss of bullish momentum on Monday, perhaps the upside potential for yields could be limited over the near term and that could provide a reprieve for currencies which have sold off against the USD.

NZD/USD and AUD/USD were the weakest FX majors and fell for a fifth consecutive day, although NZD/USD has fallen -4.2% since last week’s high on bets the RBNZ could cut rates by 50bp tomorrow and follow up with another 50bp in December. AUD/NZD rose for ab sixth day and trades just beneath its August high. The USD index formed a small bearish inside day to snap its 5-day run of around 2.5%.

Events in focus (AEDT):

- 10:30 – AU consumer sentiment (Westpac)

- 10:30 – JP wages, household spending

- 10:50 – JP current account

- 11:30 – RBA minutes, AU job advertisements, business confidence (NAB)

- 18:00 – FOMC Kugler speaks

- 21:00 – US small business optimism (NFIB)

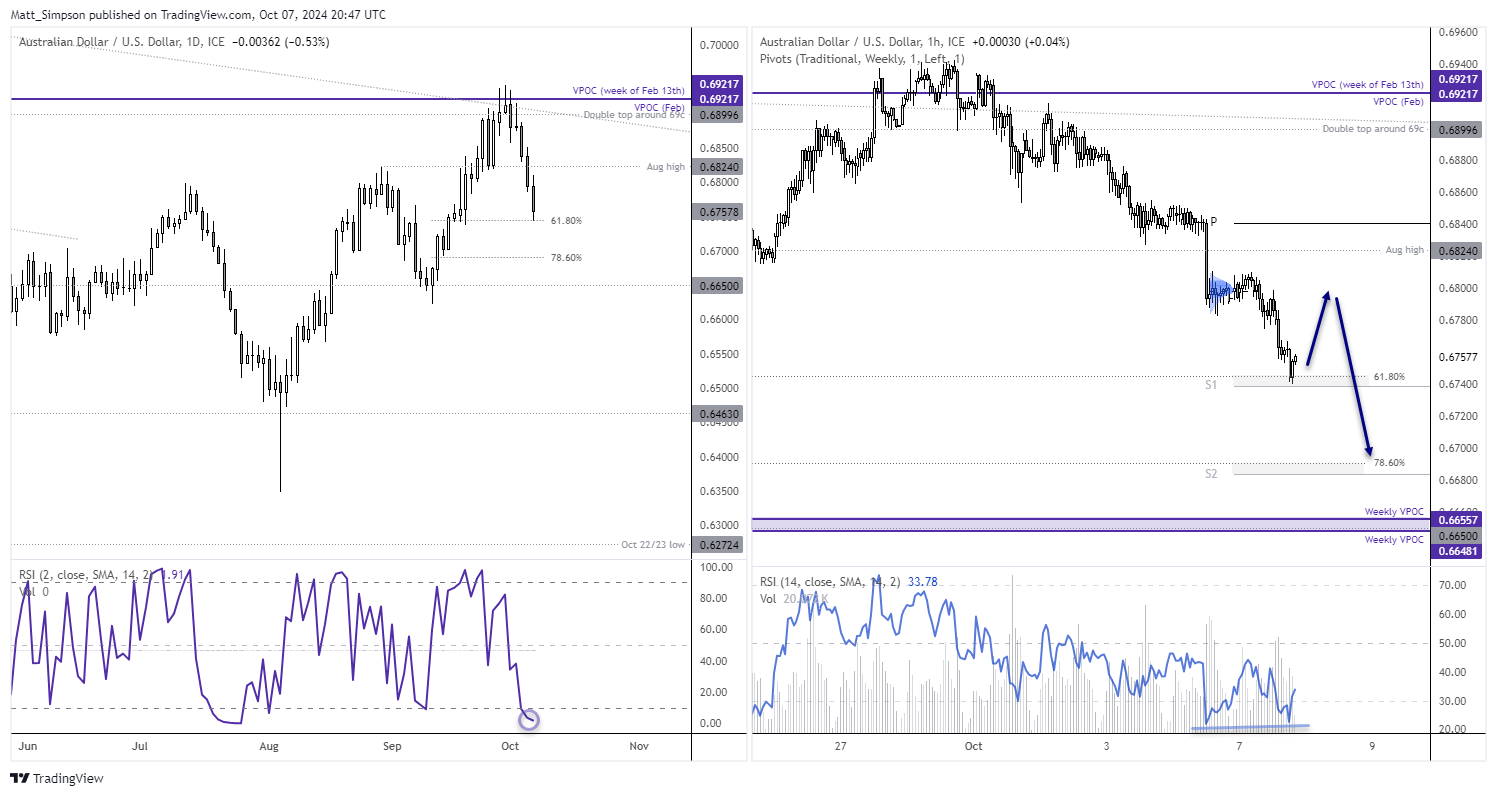

AUD/USD technical analysis:

The Australian dollar formed its fifth consecutive down day, its longest such bearish streak since the second half of July. Although bears tallied up nine down days back then. However, with the USD index failing to break to a new high, AUD/USD bears may want to tread with caution around current levels and instead seek to fade into minor rallies.

Monday’s low perfectly respected a 61.8% Fibonacci retracement level, the daily RSI (2) is oversold and a bullish divergence has formed on the 1-hour RSI (14). While the 1-hour chart is within an established downtrend, support was also found at the weekly S1 pivot point which points to a potential bounce higher before its next leg lower.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge